The EIA’s weekly coal report shows production has fallen 14%

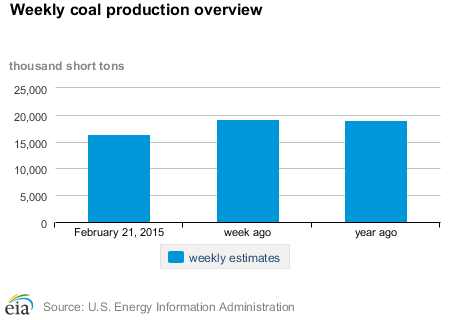

The Energy Information Administration’s (EIA) weekly coal production report for the week ended February 21, 2015, shows continued declines in coal production in the United States. According to the report, estimated U.S. coal production totaled approximately 16.5 million short tons (mmst), about 14% lower than last week’s estimate and 13.3% lower than production estimates in the comparable week in 2014.

Lower coal production taking a toll on states like Colorado

States around the country have been feeling the pain from falling coal production. In Colorado, coal production fell to a 20-year low in 2014, reports the Denver Post. The state’s eight mines produced 22,982,237 tons of coal in 2014, a 5% drop from 2013 and down 39% over the past decade, according to information from the Colorado Division of Reclamation Mining & Safety.

This decline in production has also meant fewer jobs in the communities around the mines. “These are well-paying jobs – an average of $80,000 – in places where good jobs are scarce,” said Martin Shields, director of the Regional Economics Institute at Colorado State University. There was a nearly 20% cut in mining jobs in Colorado in 2014.

The reason for the nationwide decline in coal production is low prices of natural gas, according to Brandon Blossman, a managing director at the energy investment bank Tudor, Pickering, Holt & Co. “It is pure economics, pure pricing,” he said. With natural gas prices holding below $3/mmbtu for the first time since late 2012, natural gas is becoming a cheap and clean alternative to coal-powered electricity generation.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.