On a month-over-month comparison, few changes stood out in the Energy Information Administration’s (EIA) Short Term Energy Outlook (STEO) for July 2015. Oil price projections are relatively consistent, and 2015 production was even revised upward by 0.1 MMBOPD.

The declines in natural gas production, however, is projected to come to an end in June and will return to a growth stage in July. The recent monthly declines dating back to May were caused “largely due to maintenance and construction in the Marcellus producing area.” Caught up in the maintenance season shortage was the massive Transcontinental Pipeline. The 10,200 mile network, operated by Williams Companies (ticker: WPZ), is capable of delivering 10.2 Bcf/d to customers in 12 different states.

The expansion of the Leidy Line, a leg on the Southeast portion of the pipeline, is expected to be fully complete by December 2015 and will add 510 MMcf/d to the line.

The expansion of the Leidy Line, a leg on the Southeast portion of the pipeline, is expected to be fully complete by December 2015 and will add 510 MMcf/d to the line.

Inventories to Rise?

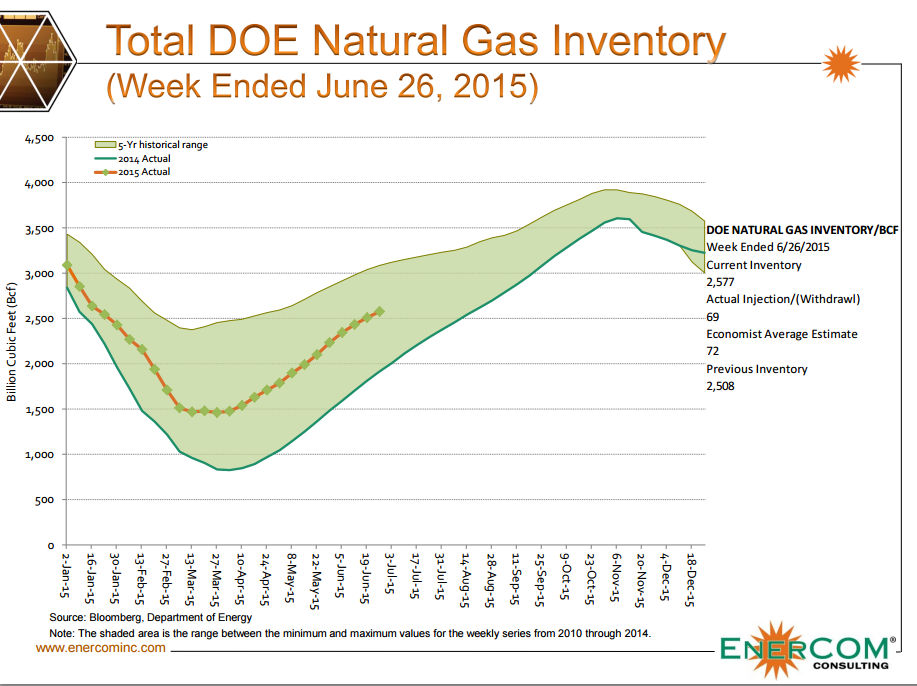

Natural gas inventories are currently slightly above the five year average, but the EIA believes a combination of incoming production and a mild summer will pad inventory levels as the year moves along. Stockpiles are expected to peak at 3,919 Bcf at the end of October, which would be 3.2% above the five year average and 8.7% higher than any point in 2014.

Hydrocarbon gas liquids reached record production in April and are expected to climb through 2016. The EIA expects that marketed natural gas production will increase by 4.3 Bcf/d (5.7%) and by 1.6 Bcf/d (2.0%) in 2015 and 2016, respectively.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.