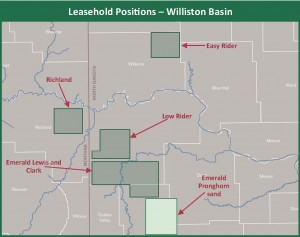

Emerald Oil (ticker: EOX) is an independent exploration and production operator that is dedicated to acquiring acreage and developing wells in the Williston Basin of North Dakota and Montana, targeting the Bakken and Three Forks shale oil formations. The company sold substantially all of its non-operated assets in 2013 to become a fully focused Williston operator.

In OAG360’s March 17, 2014, feature article covering Emerald Oil’s Q4’13 results, the two main catalysts for the company were lowering well costs and continuing to outperform production rates. The company was successful in both in its Q1’14 report on May 5, 2014. Guidance rates for 2014 were increased for the third straight quarterly earnings period due to higher well estimated ultimate recovery and expediting its rig program. The company plans on downspacing its Low Rider program and will add a fourth rig in late Q3’14, with production expected to begin by Q1’15.

In a conference call with analysts and investors on May 7, 2014, McAndrew Rudisill, Chief Executive Officer and President of Emerald Oil, said, “Our number one goal is to increase working interest in units that we are currently drilling.”

Q1’14 Results

Source: EOX May 2014 Presentation

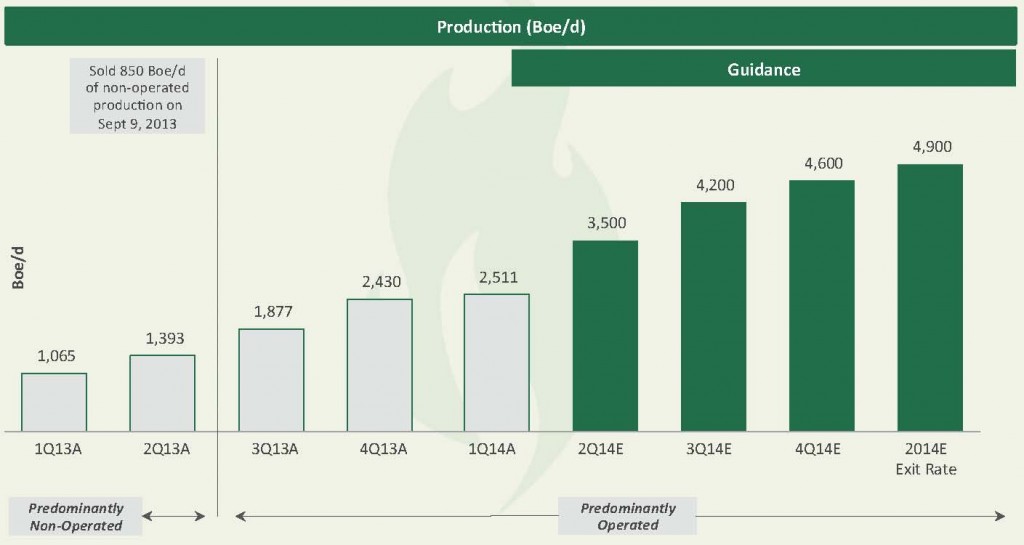

Production for the quarter averaged 2,511 BOEPD – increases of 3% and 136% compared to Q4’13 and Q1’13, respectively. In turn, sales revenues increased to $19.1 million for the quarter (133% higher than Q1’13) with crude oil accounting for 97% of income. Adjusted EBITDA was $9.0 million and adjusted income reached $2.5 million.

Emerald re-determined its borrowing base to $100 million from $75 million and is effective in October 2014. The company currently has nothing withdrawn from its credit facility. Approximately 60% of its production is hedged but the number may change following the redetermination in October. Management says the company’s current liquidity of $296 million will allow drilling operations to continue into 2015.

Overall, EOX posted a net loss of $1.7 million, or ($0.02) per share in the quarter. In comparison, the company reported losses of $10.9 million ($0.17 per share) in Q4’13 and $31.2 million ($0.75 per share) for fiscal 2013.

Revisions Boosting Inventory

EOX revised its 2014 production guidance to a yearly average of 3,700 BOEPD and an exit rate of 4,900 BOEPD – roughly 47% and 95% higher than Q1’14’s average, respectively. Year end reserves for 2013 were also revised to 13.2 MMBOE, and EURs for its two main project areas in the Low Rider and Easy Rider both increased. The company holds approximately 91,000 net acres in the play with more than 700 potential drilling opportunities resulting from downspacing initiatives. Although roughly 75% of its properties are currently being operated, EOX management believes 100% of the acreage will be held by production by year-end 2014.

Rudisill said, “Our plan is simple: focus on drilling, production growth and cost control for the remainder of 2014.”

Click here for the results of 20 wells drilled by Emerald Oil.

Source: EOX May 2014

Low Rider Operations

Low Rider EURs were revised up to 600 MBOE from 550 MBOE. Emerald is backing up its estimate by placing another rig in the play in 2H’14. Guidance rates have been revised to a yearly average of 3,700 BOEPD (4% higher) and a 2014 exit rate of 4,900 BOEPD (15% higher). The extra rig will assist in downspacing efforts, which are now focused on drilling 12 wells (eight Bakken and four Three Forks) per drilling spacing unit. Well costs have dropped to $9.5 million per well and lease operating expenses declined by 33% compared to the previous quarter. Well EURs in the nearby Easy Rider also climbed to 550 MBOE from 450 MBOE and downspacing plans consist of eight wells (five Bakken, three Three Forks).

EOX expects the drilling efficiencies to continue as the company gains more experience. Ryan Smith, Vice President of Capital Markets and Strategy, said: “The decreased expense is primarily due to the completion of replacing our diesel compression and generation equipment with natural gas powered equipment along with continued careful monitoring of weather-related effects on surface equipment. The next phase of this is going to be moving from natural gas fired generation to just straight electrical power at each of the wells.”

Smith added: “The other thing that’s going to impact us positively is once we get centralized gas compression built, which should be built over the course of the summer, we’ll be able to centrally distribute the gas to re-circulate into all the wells.”

Emerald will continue its 2014 operations with $400 million in capital expenditures, with $250 dedicated to drilling and the remaining $150 for leasehold acquisition. Approximately 25.5 net wells are forecasted to be completed within the fiscal year. EOX, under a full-year four rig program in 2015, expects to drill 38 net wells on expenditures of $350 million to $375 million.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.