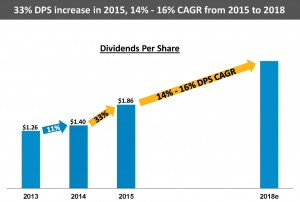

Enbridge Inc. (ticker: ENB), the operator of the world’s longest crude oil transportation system, today announced a 33% increase to its next quarterly common share dividend, as well as a Canadian restructuring plan and corresponding new dividend payout policy range. These actions are intended to enhance the value to investors of the company’s organic growth capital program and enhance the competitiveness of its funding costs for new organic growth opportunities and asset acquisitions. The company’s quarterly common share dividend will increase by 33% to $0.465 per share from $0.35 per share with the next dividend payable March 1, 2015, to shareholders of record on February 16, 2015.

Enbridge’s Board of Directors has approved a revised dividend payout policy range of 75% to 85% of adjusted earnings. The previous payout policy range was 60% to 70%. The payout rate is expected to rise from the lower end of the new range in 2015 to the higher end by 2018 as the funding of Enbridge’s current record organic growth capital program progresses. Enbridge also announced 2015 adjusted earnings per share (EPS) guidance of $2.05 to $2.35. Enbridge’s resulting annual dividend growth rate is expected, based on Enbridge’s current planning assumptions, to average between 14% and 16% from 2015 to 2018.

The Details of the Transfer

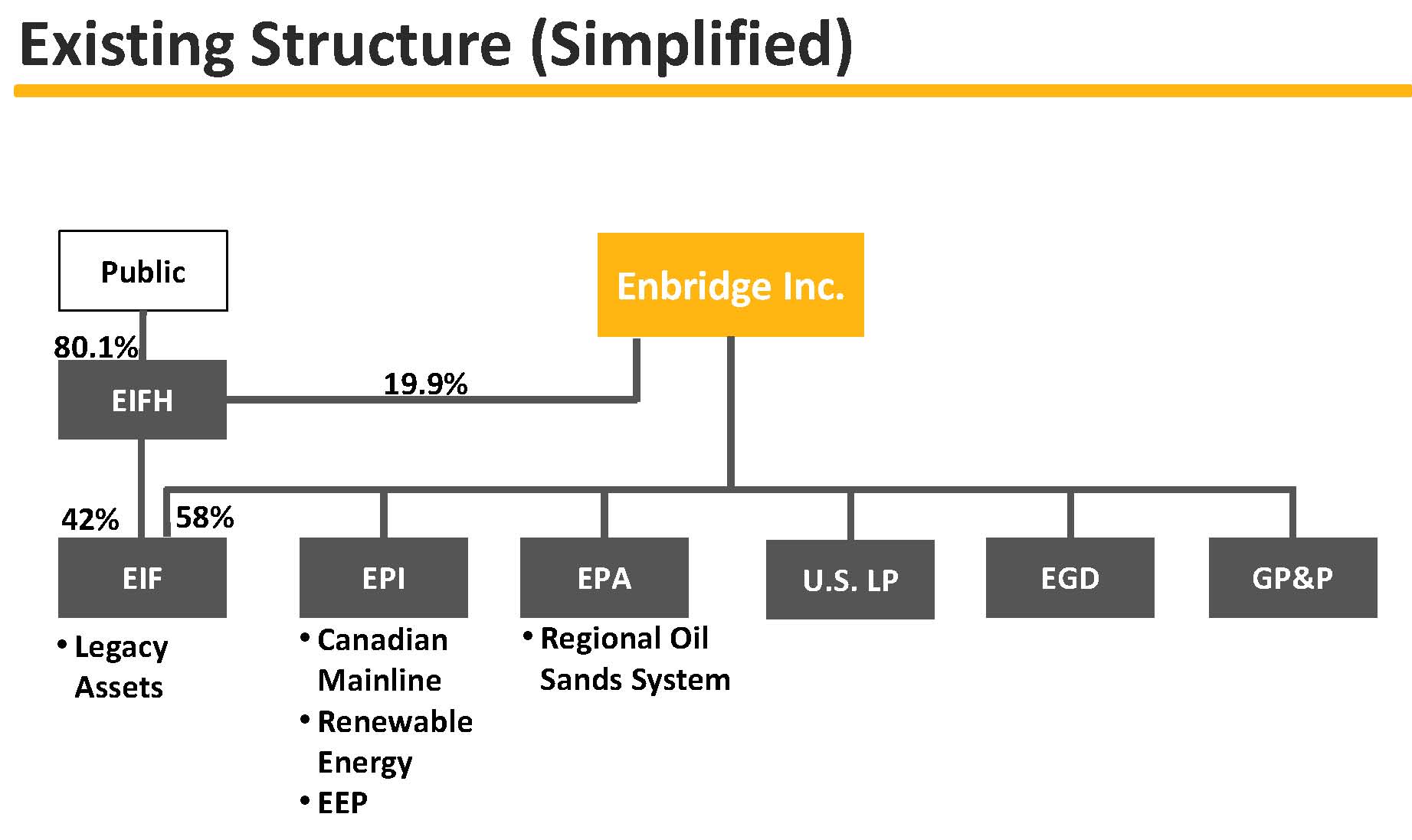

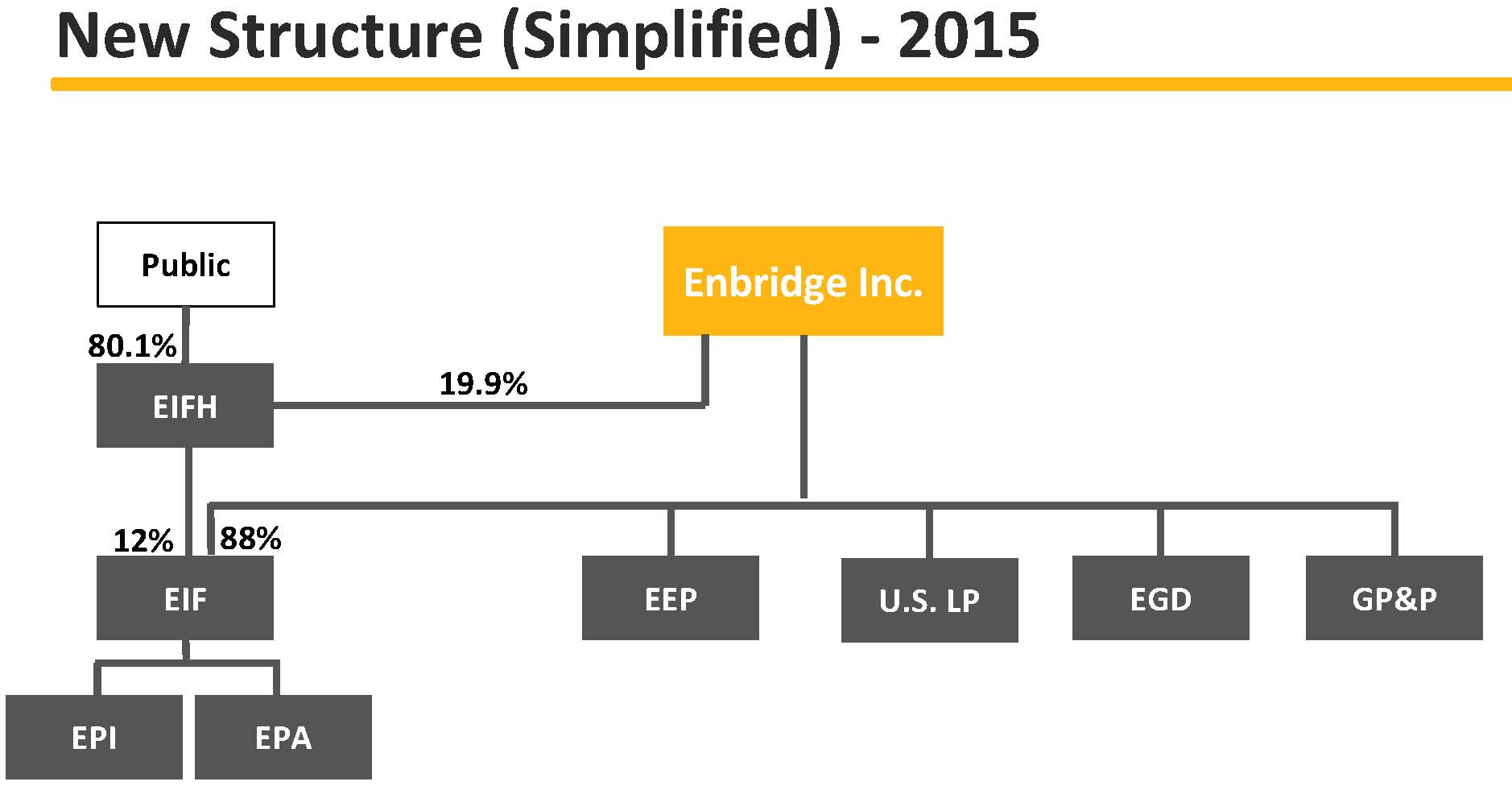

Enbridge plans to transfer its Canadian Liquids Pipelines business, comprised of Enbridge Pipelines Inc. (EPI) and Enbridge Pipelines (Athabasca) Inc. (EPA), and including certain renewable energy assets, to its privately held Canadian affiliate, Enbridge Income Fund (EIF). Enbridge Income Fund Holdings Inc. (ticker: ENF) is expected to acquire an increasing interest in the assets through investments in the equity of EIF over a period of several years in amounts consistent with its equity funding capability. Based on Enbridge’s current planning and financing assumptions, EIF’s resulting dividend growth rate is expected to average about 10% per year from 2015 through 2018 through a combination of organic growth of assets and its increasing interest in the assets.

The Reasoning, in a Nutshell

Enbridge management noted the importance on return to shareholders both in the release and in its subsequent 2015 Guidance conference call, conducted on December 4, 2014.

By dropping down its Canadian pipeline business to its private subsidiary, Enbridge frees up available capital and reduces future commitments for expenditures. The company announced an aggressive five-year growth program in its Q3’14 release that included $44 billion of investments ($33 billion commercially secured). The shift of its Canadian pipeline business moves $15 billion in capital growth projects from Enbridge’s balance sheet to its private fund, leaving ENB with fewer capital commitments in the future and allowing a clearer path for growth.

Enbridge has a market capitalization of approximately $45 billion but has accumulated nearly $30 billion in debt, with more than $7 billion added in 2014 to date. In the call, Al Monaco, President and Chief Executive Officer, said the plans for a shareholder return has been in the works as ENB has grown. “With respect to the dividend payout itself, as we’ve said, we’ve been pretty conservative in our approach,” he said. “We’ve been waiting through the last couple of years to ensure that we’ve got a lot of the funding locked down.”

Enbridge and its New Alignment

In total, an aggregate of $17 billion of combined carrying value of assets are to be transferred to EIF under the planned restructuring.

Enbridge will retain operating responsibility for the Liquids Pipelines business, as it does for the assets currently held through EIF and those held through its U.S. affiliate, Enbridge Energy Partners, L.P. (EEP); as well as business development and project construction responsibility.

Enbridge’s Canadian Liquids Pipelines business consists of its Canadian mainline system held through EPI and its Regional Oil Sands system held through EPA, both of which would be transferred from direct ownership by Enbridge to ownership by EIF.

To fund the transaction, the plan contemplates the issuance by ENF of $600 million to $800 million of public equity per year from 2015 through 2018 in one or more tranches to fund its increasing investment in the Canadian Liquids Pipelines assets through EIF. Enbridge will retain an obligation to ensure EIF has sufficient equity funding to undertake the growth program associated with the transferred assets, and the amount of public equity to be issued by ENF would be adjusted as necessary to match its capacity to raise equity funding on favorable terms. Enbridge will contribute additional equity to ENF to maintain its 19.9% interest. Enbridge would also take back a significant portion of the proceeds of the asset transfer to EIF in the form of additional equity in a subsidiary of EIF.

As a result, Enbridge’s aggregate economic interest in EIF is expected to increase from its current level of approximately 66% to approximately 90% initially, and then decline to approximately 80% by 2018 as ENF increases its investment in EIF.

Enbridge also has under review a potential parallel U.S. restructuring plan which would involve transfer of its directly held U.S. Liquids Pipelines assets to EEP. The review has not yet progressed to a conclusion.

The Canadian restructuring plan has been approved in principle by Enbridge’s Board of Directors but remains subject to finalization of preliminary internal reorganization steps and a number of internal and external consents and approvals, including final approval of definitive transfer terms by the Enbridge Board and by the Boards of ENF and EIF. Assuming all necessary consents and approvals are obtained, the transfer and initial investment by ENF are targeted for completion mid-2015.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.