Calling the move “transitional,” Encana Corp. (ticker: ECA), Canada’s largest natural gas company, has announced it will acquire all shares and assume the senior notes of Fort Worth’s Athlon Energy (ticker: ATHL) in a US$7.1 billion cash offer, which Encana says is immediately accretive to cash flow per share.

Under the terms of the merger agreement, Athlon shareholders will receive cash consideration of US$58.50 per share, which represents a premium of 28% over the average trading price of Athlon stock for the last 20 days and a 25% premium over the trading price of Athlon stock at market close on Friday, September 26. Athlon’s board has unanimously recommended that its shareholders approve the offer.

The acquisition, which Encana expects will become self-funding in 2016, positions the Canadian E&P in the heart of the liquids-rich Permian Basin and adds 30,000 barrels of oil equivalent per day (BOEPD). Encana says the deal will deliver 5,000 horizontal well drilling locations along with a potential recoverable resource of approximately 3 billion BOE. Athlon’s proved reserves are 173 MMBOE pro forma year-to-date its acquisitions.

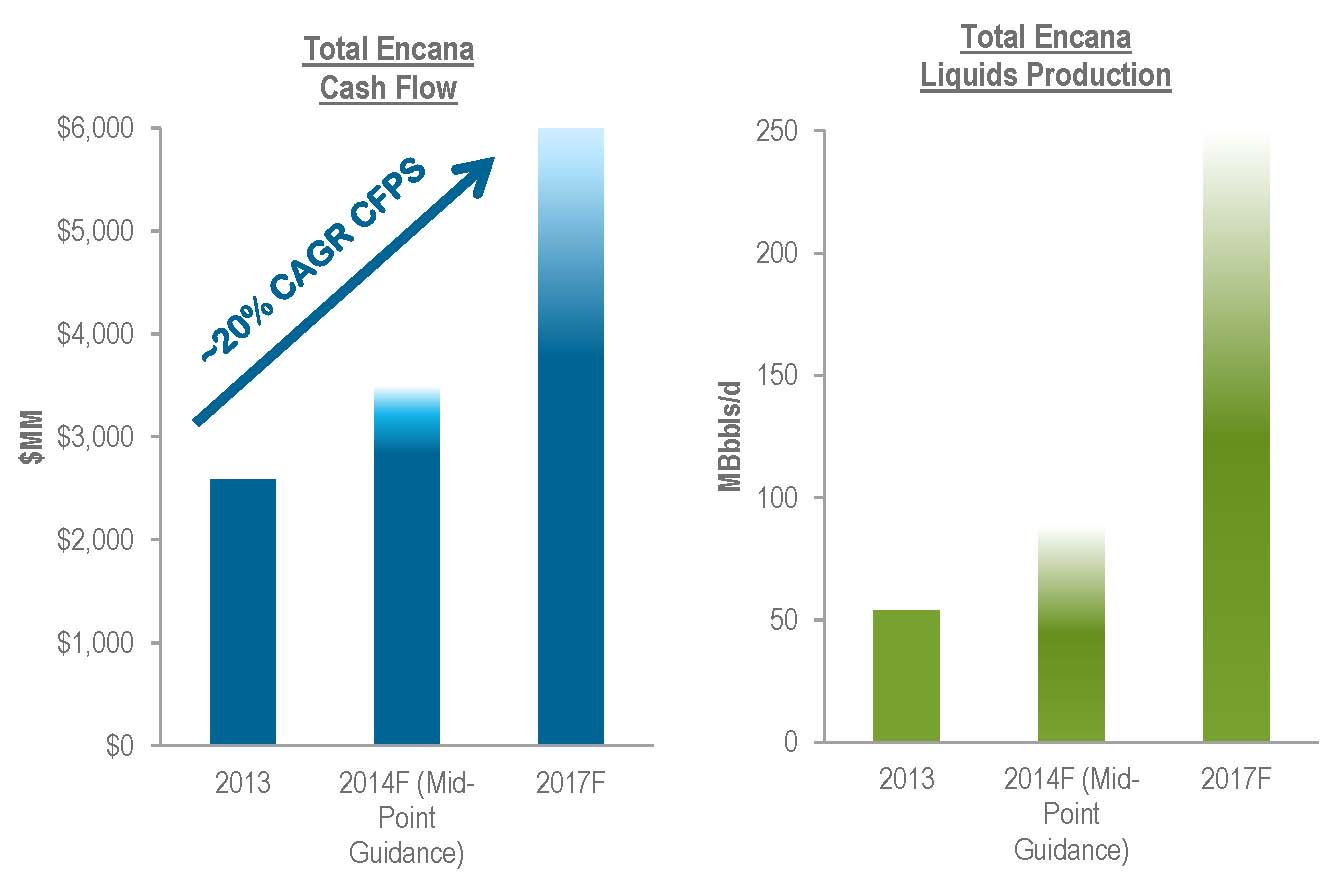

Athlon’s 30,000 BOEPD Permian production breaks down as approximately 60% oil, 20% natural gas liquids (NGL) and 20% natural gas. Encana’s liquids production target is 250,000 barrels per day by 2017. Athlon’s 30,000 BOEPD helps move Encana toward the goal, but the real prize lies in the future development value of Athlon’s Permian assets.

Encana said it believes the Permian has the potential to be bigger than the Bakken and Eagle Ford combined, citing stacked oil resource spanning over 5,000 feet of stratigraphy. “Our growth areas now include the top two resource plays in Canada, the Montney and Duvernay, and the top two resource plays in the United States, the Eagle Ford and the Permian,” Encana President & CEO Doug Suttles said in today’s press release.

Turning the Ship

Back in 2013, Suttles announced that Canada’s largest gas producer was revamping itself, transitioning away from natural gas and steering toward more profitable oil and liquids resource opportunities.

“My original view, and it was probably shared by much of the market, was that Encana was this beast of a gas-focused company and it was going to be hard to turn that ship around,” Kyle Preston, an analyst at National Bank Financial in Calgary, told the Dallas Morning News in May, reflecting on Suttles’ plans.

But Suttles has stayed the course during the past year, and today’s announcement is significant to pushing the gas giant toward the higher margin liquids sector. For the six months ended June 30, 2014, Encana reported Cash Flow of $1,750 million, Operating Earnings of $686 million and Net Earnings Attributable to Common Shareholders of $387 million. The balance sheet showed $2.658 billion in cash and equivalents at the end of the second quarter. The company’s market cap is $15.5 billion.

Drill Baby Drill

Encana says it will invest at least $1 billion of capital in the Permian in 2015 and utilize seven horizontal rigs. Plans prior to the acquisition called for the use of three rigs by year-end 2015. Pad drilling will be used to boost downspacing. Athlon’s number of producing wells was 1,121 vertical, 17 horizontal as of Q2 2014, putting Encana at the early stage of horizontal development of the asset.

Analysts discussed the growth potential of Athlon’s Permian assets in a BNN segment that aired this morning. While Encana estimated in its announcement that it was acquiring a 10-year horizontal drilling inventory and 5,000 horizontal drilling locations, KLR Group’s Gail Nicholson said her company’s assessment estimated a 25-year horizontal inventory using a six rig program on Athlon’s 1,842 identified gross horizontal locations in seven horizons. “Encana throughout the day in their press releases believes they have about 5,000 locations, so if that’s actually true then you have a plethora of opportunity to throw capital and rig count and increase activity,” Nicholson said.

The offer is expected to commence within 10 business days, and shareholders will have 20 business days to tender their shares to the offer following its commencement, according to Encana’s press release today.

Liquids-Driven A&D Moves

In June the company announced an agreement to sell its Bighorn assets to Jupiter Resources for $1.8 billion and it closed a $3.1 billion, 45,000 acre Eagle Ford acquisition with Freeport McMoRan. Pro forma for recently announced acquisitions, Encana is operating in the Montney and Duvernay in Canada, and in the Denver Julesburg Basin, San Juan, Permian, Eagle Ford and Tuscaloosa Marine Shale, all known for liquids production. The company expects liquids production to reach 250 MBOEPD by 2017, with oil consisting of 75% of the volume.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.