MCF will present at EnerCom’s The Oil & Gas Conference® on Mon. Aug. 15, 2016

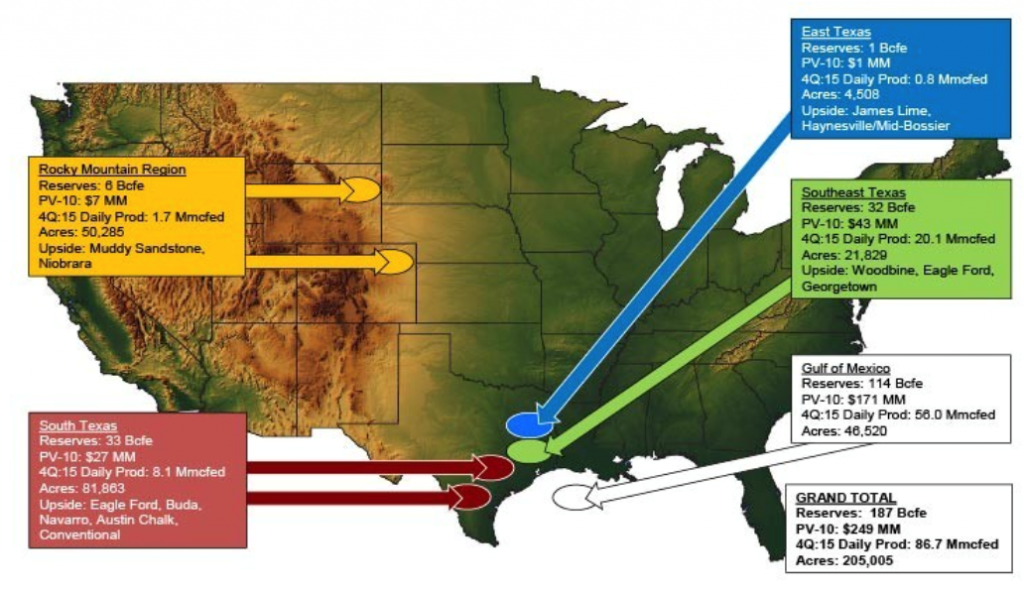

Contango Oil & Gas Company (ticker: MCF) is an exploration and production company headquartered in Houston, TX, with operations in the Gulf of Mexico, onshore Texas Gulf Coast, East and Southeast Texas, and the Rocky Mountains. In 2015, the company reported estimated proved reserves of 187,238 MMcfe (61% offshore and 67% natural gas), excluding reserves attributable to its investment in Exaro Energy III LLC. Production for Contango in the first quarter of 2016 was 7,226 MMcfe (67% offshore and 68% natural gas).

Contango also holds a 37% ownership interest in Exaro Energy III LLC, which as of March 31st 2016, operates 645 wells over 5,760 gross acres in the Jonah Field in Sublette County, Wyoming. Daily production for Q1 2016 averaged 33,000 Mcfe/d.

MCF Outlook

In 2015, capital expenditure of $55.6 million (down 71% from 2014) was allocated mainly to exploratory drilling in the Muddy Sandstone formation in Weston County, Wyoming, as well as developmental and leasehold drilling in Texas. In Weston County, the company drilled and completed two successful delineation wells, the Elliot #1H (80% WI) and the Popham #1H (80% WI), producing at initial 24 hour peak rates of 907 and 970 BOEPD (98% oil), respectively.

In Q1 2016, Contango brought production online from its third delineation well, the Christensen #1H (80% WI), in Weston County, Wyoming. The company now holds approximately 49,000 gross acres in the Muddy Sandstone formation. Capital expenditure guidance for 2016 is budgeted at less than $10 million, of which $3.4 million was incurred in Q1, including $2.9 million for the completion of the Christensen #1H well and $0.5 million for additional lease acquisitions. Further drilling activities have not been planned during 2016. Capital expenditures in 2016 will be entirely funded from internally generated cash flow.

Financial Overview

Contango Oil & Gas Company reported an adjusted EBITDAX of $7,264 for Q1 2016, down from $14,040 in QA1 2015. The decline in EBITDAX were driven mainly by a decrease in oil and gas sales revenues, dropping from $30.6 million in Q1 2015 to $17.6 million in Q1 2016. This decrease is attributed to falling commodity prices and lower production due to reduced drilling activity.

Contango has provided guidance for the second quarter for production volumes of 74 MMcfe/d to 79 MMcfe/d, with 57 % of projected production hedged at $2.53 per MMBtu. The company has hedges in place through the rest of 2016 for natural gas. Hedges are already in place for 2017, with natural gas volumes hedged with costless collars at a put price of $2.65/MMBtu and a call price of $3.00/MMBtu.

EnerCom’s The Oil & Gas Conference® Denver – August 14-18, 2016

Contango Oil & Gas Company (ticker: MCF) will be presenting at EnerCom’s The Oil & Gas Conference® 21 in Denver on Monday, August 15, 2016. Conference information and registration for this year’s EnerCom conference may be accessed here.