SOG will present at EnerCom’s The Oil & Gas Conference® on Tues. Aug. 16, 2016

Strategic Oil & Gas Ltd. (ticker: SOG) is an exploration and production company headquartered in Calgary, Alberta, that is focused on developing its Marlowe Muskeg asset in Alberta. In the year ended 2015, the company reported production of 2,509 BOEPD (76% oil) and proved reserves of 5.6 MMBOE. SOG has 500,000 net acres in northern Canada.

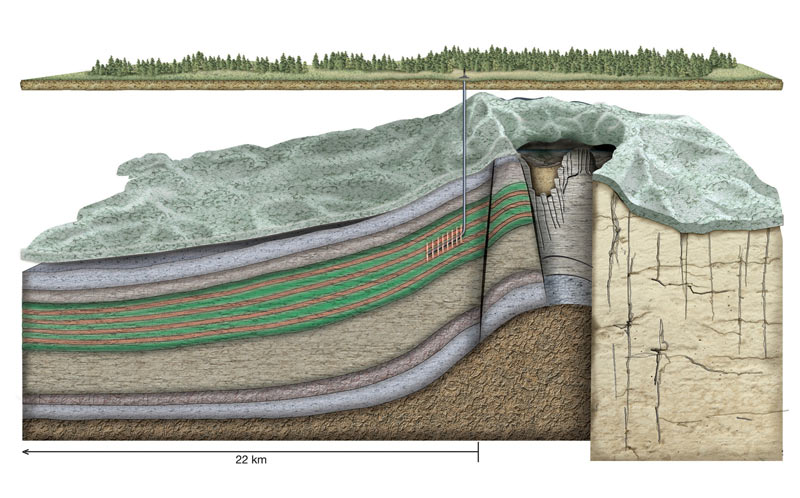

SOG Assets

Strategic’s sole growth focus is the Marlowe asset in far Northern Alberta. The asset is 100% owned by the company including all related infrastructure. SOG has drilled 19 wells to prove the economic viability of hydraulic fracturing on the acreage. During the first quarter 2016 Strategic acquired eight additional sections of undeveloped land to the south of its current prospect along the Muskeg trend.

On June 15, 2016, Strategic announced a C$21 million capital spending program for the second half of 2016. Capital will be spent on a four-well program and construction of associated development infrastructure.

The 2H 2016 drilling program, scheduled to begin in July, marks the beginning of pad development activity along the drilling corridor at west Marlowe, following the company’s successful delineation drilling program during first quarter of 2016. The first four-well pad is approximately 3 kilometers from the existing wells at West Marlowe, moving toward the Muskeg horizontal well 14-35 which was drilled in the first quarter of 2016. The well 14-35 tested at a rate of 1,060 BOE/day over the last 48 hours of a nine day production test.

SOG expects to achieve further drilling efficiencies with longer horizontal wells using a larger drilling rig, and intends to complete up to an additional five stages per well to increase production performance.

Other assets include gas assets in the Bistcho/Cameron Hill play. These wells have been shut in because of low commodities prices. The shut in has also allowed the company to reduce overhead to C$1.4 million in Q1 2016 (including G&A) from C$2.2 million for Q1 2015.

Financial Overview

Strategic showed a net loss for Q1 2016 of C$7.2M (C$0.01/share). The loss is largely driven by an operating loss of C$0.32/BOE. The company states that the expenses related to shutting in and maintaining the Bistcho/Cameron Hill play in Alberta/Northwest territories is the main drag on margin per barrel. The Marlowe asset has an operating profit of C$4.27, before the inclusion of overhead costs and DD&A, according to the company’s Q1 filings.

The company did not have any hedges in place as of Q1 2016. Strategic does not have bank debt. The primary liabilities associated with the company are C$55.8 million in decommissioning liabilities and C$79.4 million in convertible debentures.

The company’s investor presentation estimates that COG’s assets hold a billion barrels of light oil in place which can be produced profitably at US$40 WTI oil prices. Strategic stock is 63% owned by insiders.

Presenting at EnerCom’s The Oil & Gas Conference® Denver – August 14-18, 2016

Strategic Oil & Gas Ltd. (ticker: SOG) will be presenting at EnerCom’s The Oil & Gas Conference® 21 in Denver on Tuesday, August 16, 2016. Conference information and registration for this year’s EnerCom conference may be accessed here.