Energy Transfer Partners, L.P. (ticker: ETP) said its Dakota Access, LLC has received an easement from the U.S. Army Corps of Engineers to construct a pipeline across land owned by the Army Corps on both sides of Lake Oahe in North Dakota.

The release of this easement by the Army Corps follows a directive from President Donald Trump to the Department of the Army and the Army Corps to take all necessary and appropriate steps that would permit construction and operation of the Dakota Access pipeline, including easements to cross federal lands, the company said in a statement.

With this action, Dakota Access now has received all federal authorizations necessary to proceed expeditiously to complete construction of the pipeline, the company said.

The Dakota Access pipeline consists of approximately 1,172 miles of new 30-inch diameter crude oil pipeline from North Dakota to Patoka, Illinois, and the Energy Transfer Crude Oil Pipeline consists of more than 700 miles of existing pipeline that has been converted to crude oil service from Patoka to Nederland, Texas. The two pipelines (together, the “Bakken Pipeline”) are expected to be in service in the second quarter of 2017.

With the receipt of the easement, ETP said it expects to complete approximately $2.6 billion of committed debt financing and equity transactions within the next several days, including access to the remaining $1.4 billion of the previously announced $2.5 billion project financing for Dakota Access and $1.2 billion from the closing of the previously announced sale by ETP of a minority interest in the Bakken Pipeline to MarEn Bakken Company LLC.

Meantime Ethan Belamy of R.W. Baird reports that the Cheyenne River Sioux have asked for a restraining order against DAPL on religious grounds. Bellamy’s comments appear in the accompanying analyst commentary box. Additionally, the Seattle city council has voted 9-0 to part ways with Wells Fargo because of the bank’s financial backing of the pipeline. The Seattle Times estimates the bank has approximately $3 billion in annual business with Seattle which the city will pull back at the end of its contract in 2018.

Analyst Commentary

From R.W. Baird

No change to positive outlook for ETP, ETE, SXL. As we expected, the Cheyenne River Sioux have filed suit in the DC Circuit Court of Appeals, this time with the law firm of Fredericks Peebles & Morgan replacing EarthJustice. Distilling the 56-page request for a restraining order, the Sioux contend that the Dakota Access pipeline is the "Black Snake" prophesied in the Lakota religion and that oil "slithering" under the lake will destroy the sacred nature of the Oahe waters.

• The legal argument has shifted from environmental to religious objections. Anything can happen in Court, but we believe the long record of U.S. Army Corps of Engineers attempts to engage the Tribe are likely sufficient to thwart any last ditch efforts in this suit or others.

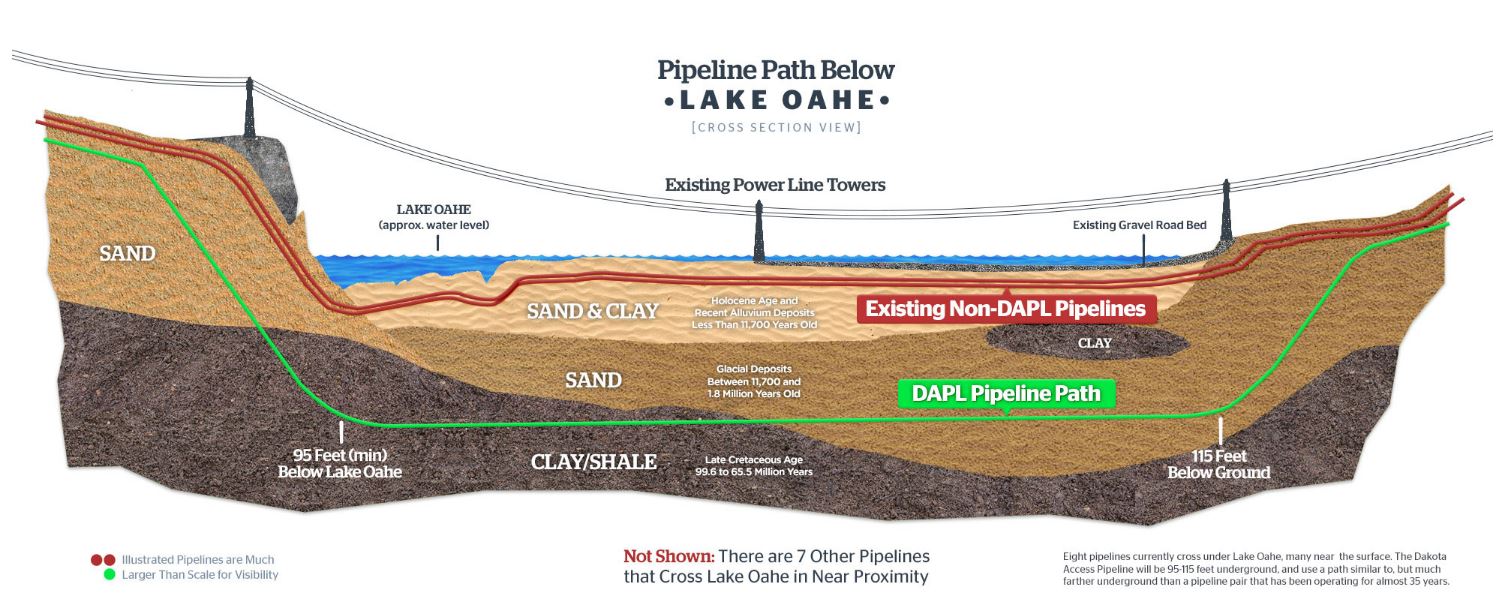

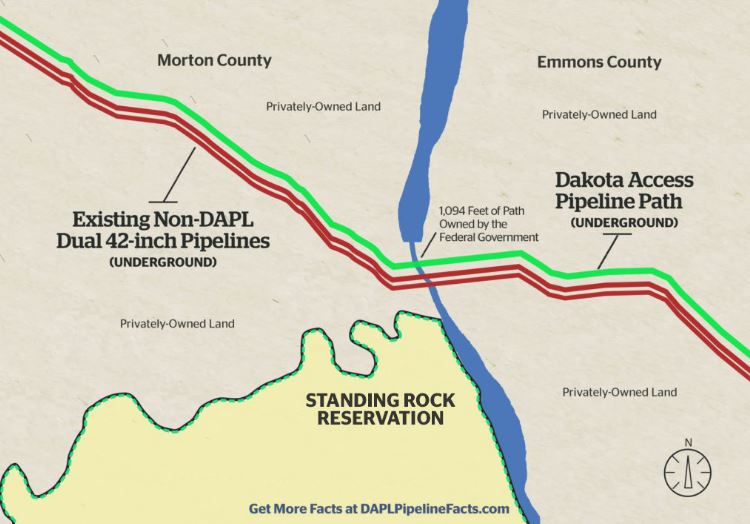

• No mention is made of other pipelines that cross the Missouri or crude-by-rail; however, the suit does concede the pre-existing Northern Border pipeline whose route DAPL would track under the lake. Page 43: "Indeed the Tribe has tolerated the construction and operation of natural gas pipelines under Lake Oahe because these natural gas pipelines are not the Black Snake of Lakota prophecy and do not burden Tribal religious practice." We were previously unaware that natural gas and crude oil had different levels of religious offense, which likely comes as a surprise to investors as well.

• Investment risk 1 - Court. The history of grievances that the Sioux and other Tribes have against the U.S. should not be dismissed cavalierly, regardless of the novelty of the legal arguments. There is always a possibility that such arguments could gain traction with a judge. The Sioux are overwhelmingly a sympathetic plaintiff given the long and well-documented history of territorial losses and Treaties abrogated or re-traded by the Federal government.

• Investment risk 2 - Press. Expect negative press coverage to dominate the final stage of construction. We view DAPL as a proxy issue for climate change advocates and a wedge issue for Native American rights advocacy. Hence, until oil starts flowing safely and legal arguments have been exhausted, we expect DAPL to remain a salient and potent headwind for ETE, ETP and SXL valuation.

• The case is Case No. 1:16-cv-1534-JEB in the United States District Court for the District of Columbia.