Liquidity Pushing $1 Billion

Energy XXI (ticker: EXXI) announced its second asset sale in the last 10 days in a company press release on July 1, 2015. The Gulf Coast operator closed on its East Bay Field for $21 million and will retain a 5% overriding royalty interest for no more than five years, along with a 50% interest for the deep rights of the field. The buyer was not disclosed.

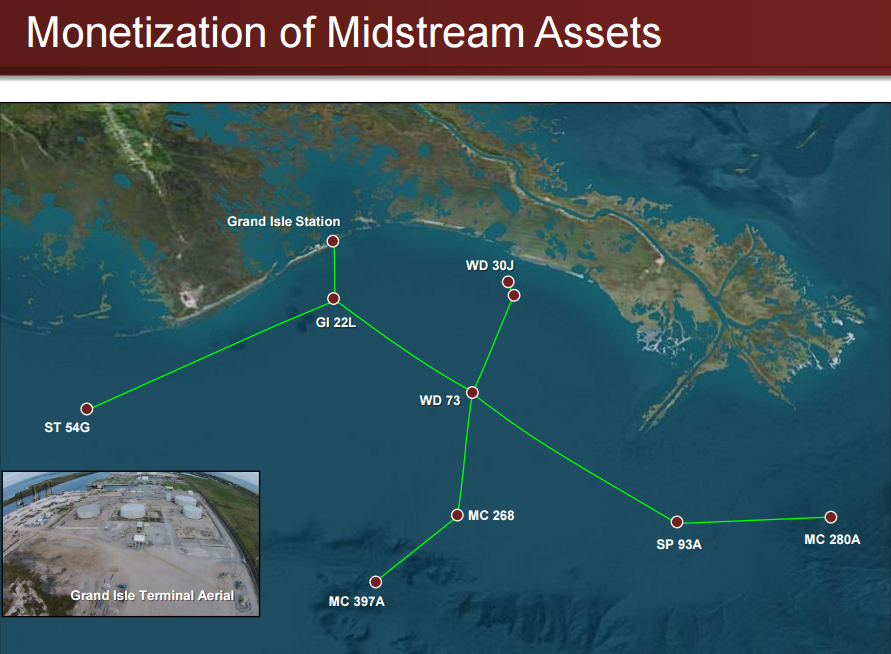

The company also announced the $245 million sale of its Grand Isle Gathering System has closed. As previously covered by OAG360, EXXI retains certain operatorship and the rights of certain interests in association with the sale of the midstream asset.

The two divestures total $266 million, which, combined with the $140 million on its revolver and $602 million in cash on hand as of last week, pushes the company’s total liquidity near the $1 billion mark.

Divesture Review

According to the EXXI release, East Bay produced 2,050 BOPD in fiscal 2015 and holds reserves of 9.4 MMBOE (94% liquids). All plugging and abandonment will be assumed by the buyer – a move welcomed by John Schiller, president and chief executive officer of Energy XXI.

“We continue to evaluate additional opportunities to sell non-core assets in the Gulf of Mexico,” Schiller said. “It is important to have these two transactions complete. We remain focused on delivering excellent operational results and continue our work to improve the balance sheet.”

The Grand Isle system has total capacity of 120 MBOPD and is currently running at about half of its availability.

Operations Update

EXXI is currently running two rigs. Its workover rig in South Pass 78 has completed eight wells to date and more than doubled production on a year-over-year basis. A developmental rig in West Delta 73 is expected to drill seven wells in fiscal 2016 (beginning July 1), with an additional seven being drilled in a neighboring field.

EXXI averaged volumes of 59 MBOEPD in Q4’15 (ending June 30), with oil production accounting for about 70% of the flow. Its 2016 program will focus on low-risk projects, and its 2015 program successfully maintained production rates through its recompletion program.