Henry Hub Transfers Ownership

The EnLink Midstream companies, EnLink Midstream Partners, LP (ticker:ENLK) and EnLink Midstream, LLC (ticker:ENLC) completed a $235 million deal agreement with Chevron Pipe Line Company and Chevron Midstream Pipelines LLC (ticker:CVX) for three different natural gas pipeline assets totaling nearly 1,400 miles, 11 billion cubic feet of working natural gas storage capacity, and ownership and management of the Henry Hub.

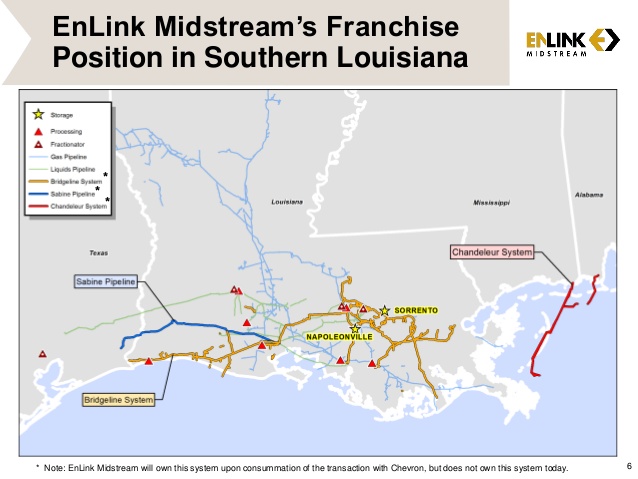

According to a company presentation the deal included the Bridgeline system, which is approximately 985 miles of gas pipeline located in Southern Louisiana, with a capacity of 920,000 MMcf/d, and interconnections with over 50 end-users. The other two systems that were included in the deal were the Sabine system, a 150 mile pipeline with a capacity of 235,000 MMcf/d and 23 interconnects in Texas and Southern Louisiana, and the Chandeleur system, with 215 miles of offshore Mississippi and Alabama pipeline and a capacity of 330,000 MMcf/d. EnLink’s new storage assets will include two caverns with 4Bcf total of active natural gas storage capacity at Sorrento, LA, and one cavern with 7Bcf of inactive storage capacity at Napoleonville, LA.

According to a company presentation the deal included the Bridgeline system, which is approximately 985 miles of gas pipeline located in Southern Louisiana, with a capacity of 920,000 MMcf/d, and interconnections with over 50 end-users. The other two systems that were included in the deal were the Sabine system, a 150 mile pipeline with a capacity of 235,000 MMcf/d and 23 interconnects in Texas and Southern Louisiana, and the Chandeleur system, with 215 miles of offshore Mississippi and Alabama pipeline and a capacity of 330,000 MMcf/d. EnLink’s new storage assets will include two caverns with 4Bcf total of active natural gas storage capacity at Sorrento, LA, and one cavern with 7Bcf of inactive storage capacity at Napoleonville, LA.

In addition to the natural gas pipelines, the acquisition includes ownership and management of the title tracking services offered at the Henry Hub, the delivery location for NYMEX natural gas futures contracts. The hub is connected to 13 major interstate and intrastate natural gas pipeline and storage systems.

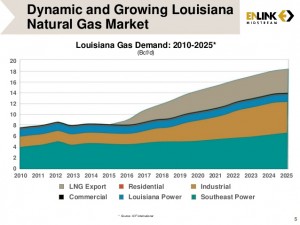

These new acquisitions will allow EnLink to serve a wider range of customers in the Louisiana Gulf Coast, where EnLink expects natural gas demand to increase over 10 Bcf/d over the next 10 years. Barry E. Davis, EnLink Midstream President and Chief Executive Officer said, “The acquisition of these highly strategic assets builds upon our franchise position in the Louisiana market and provides a substantial platform for growth in an area we know well.”

EnLink Midstream’s assets now include approximately 7,300 miles of gathering and transportation pipelines, 12 processing plants with 3.3 Bcf/day of net processing capacity, six fractionators with 180,000 BOPD of net fractionation capacity, as well as barge and rail terminals, product storage facilities, brine disposal wells, and an extensive crude oil trucking fleet. EnLink Midstream Partners, LP currently has a market cap of $6,909MM, and a yield of 4.6%. More information on EnLink Midstream Partners and other MLPs is available from EnerCom’s weekly MLP Scorecard.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results.