Enterprise Products Partners announces strong Q1 on petrochemicals and refined products

Enterprise Products Partners (ticker: EPD) reported its first quarter 2015 earnings and increased its distribution for the 51st time since its initial public offering, backed by strong performances from its petrochemical and refined products divisions. For Q1’15, the company reported cash distribution of $0.375 per unit, distributable cash flow of $1.0 billion and net income of $651 million, according to the company press release.

Net income decreased by 19% compared to Q1’14, but the company’s petrochemical and refined products services showed strong growth in the first quarter of this year. Gross operating margins for the petrochemical and refined products services segment reached $175 million in Q1’15, an increase of 34%, or $44 million, compared to the same quarter last year.

The TE Products Pipeline system and related terminals reported a $26 million increase in gross operating margin for Q1’15 compared to Q1’14. Gross operating margins from refined products terminaling services at the company’s Beaumont Marine West Terminal and Houston Ship Channel Terminal, which were acquired in the $6 billion purchase of Oiltanking Partners, were $13 million, while the Beaumont refined products export terminal contributed $6 million of gross operating margin.

EPD’s propylene business reported gross operating margin of $64 million for Q1’15 compared to $49 million in Q1’14. The 31% increase was due to higher sales margins and volumes, according to the company. Propylene fractionation volumes grew by 1 MBOPD year-over-year.

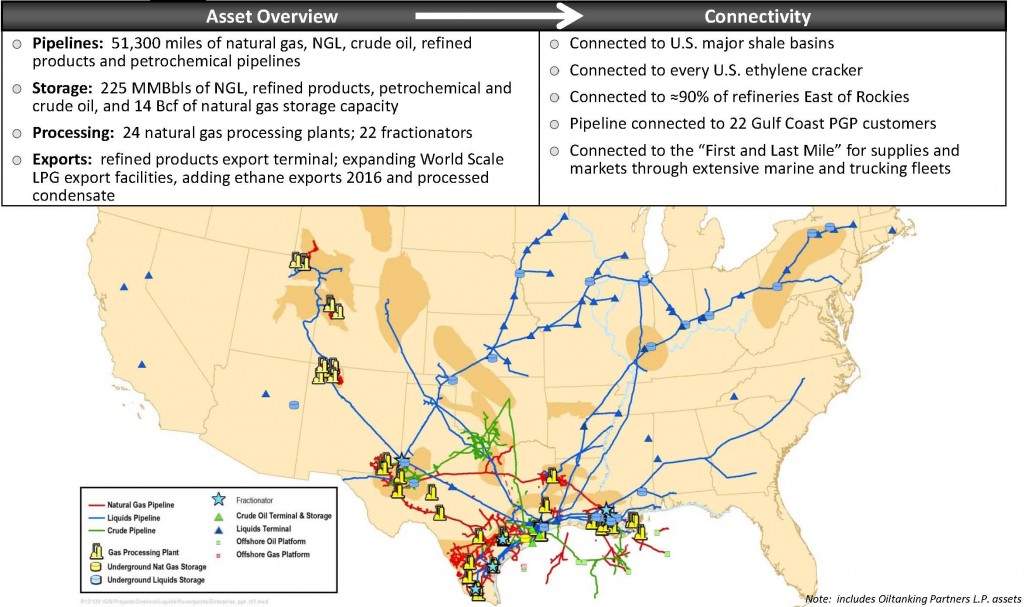

Enterprise Snapshot

Enterprise is the largest MLP in EnerCom’s MLP Weekly, with a market capitalization of $64 billion for the week ended May 1, 2015. The company’s debt to market cap ratio of 33% is below the median of 40%, while its ROIC and ROA of 11.9% and 10.4% respectively are above the group medians of 9.5% and 8.5%.

EPD’s sprawling network includes approximately 51,000 miles of onshore and offshore pipelines; 225 MMBO of liquids storage capacity and 14 Bcfe of natural gas storage capacity. Following the announcement of a 416-mile Texas pipeline earlier this week, the midstream provider now has $7.5 billion of capital growth projects under construction.

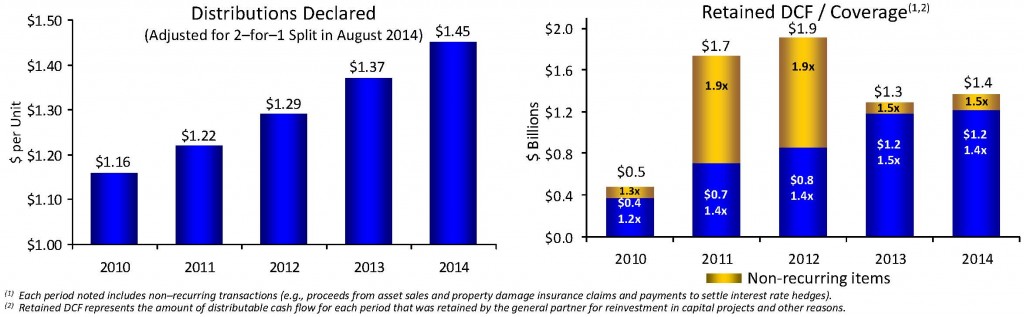

EPD increases distribution for 43rd consecutive time

During the first quarter conference call, Mike Creel, Chief Executive Officer of Enterprise, said the company increased its quarterly cash distribution to $0.375 per unit, a 5.6% increase from Q1’14, marking the 43rd consecutive distribution increase.

“Enterprise generated $1 billion of distributable cash flow for the quarter, providing 1.4x coverage of the cash distribution, and retained $295 million of distributable cash flow to reinvest in the growth of the partnership and reduce our reliance on the capital markets,” said Creel. The company has retained more than $7 billion of distributable cash flow since 2010 and used more than $500 million to purchase EPD units. Approximately 35% of all EPD units are held by Enterprise insiders.

James Teague, Chief Operating Officer of Enterprise Products Partners, said that the company’s coverage ratio should give hope that this down cycle is not as cataclysmic as some fear. “Without a doubt, 1.4x coverage in this environment should be proof that the sky isn’t falling, at least not for Enterprise.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.