Range bound or not, ETFs invest capital into energy

An analysis of commodity markets from Bloomberg Intelligence today pointed to oil likely being in the $40-$60 per barrel range for the foreseeable future, but that hasn’t stopped ETFs from pumping more money into energy in November. Commodity market strategist Mike McGlone said it would take “a substantial development to get above $60 … or below $30, even as the market remains oversupplied.”

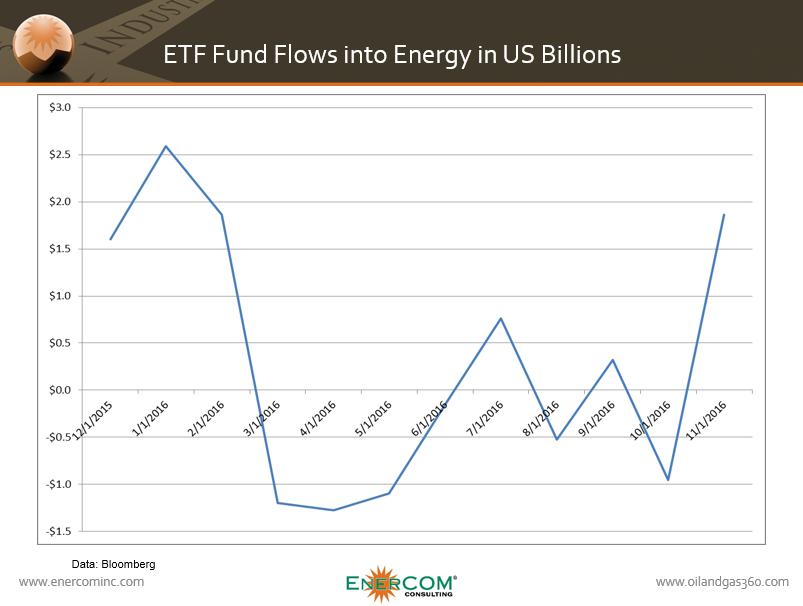

Even as WTI, Brent and natural gas trade within a range well below where they stood two years ago, ETF funds are beginning to put their money back into energy, McGlone pointed out. In the first half of November alone, ETF funds have put $1.9 billion into energy.

“There has been a substantial shift into energy. A pick-up in open interest, which implies new traders, and commitments are near record highs,” said McGlone. “That’s the highest inflow since February, and we’re only half-way through November.”

Prices will likely stay range-bound for the foreseeable future, however. “Anywhere near $55-$60 [per barrel], I think you’re going to see substantial responsive selling,” said McGlone. “It’s going to take something that isn’t currently in the markets to sustain crude above or below [a $30 to $60 per barrel price range.]”

In its tracking of the Sector SPDR ETFs, sectorspdr.com offers some tracking tools that allow investors to track the movement of the 11 Sector SPDRs as well as the 500 component stocks. Users may compare current and historical performance to see how the Sectors match up against one another and the S&P 500 Index. Energy (XLE) is presently leading the pack.