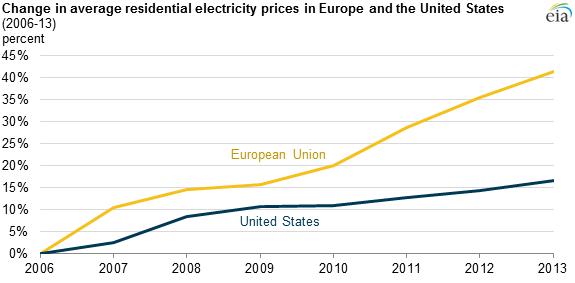

With their residential electricity prices climbing 43% from 2006 to 2013, European citizens are paying through the nose for electricity, especially when compared to U.S. residential electricity prices, which have climbed just 17% in the same time period.

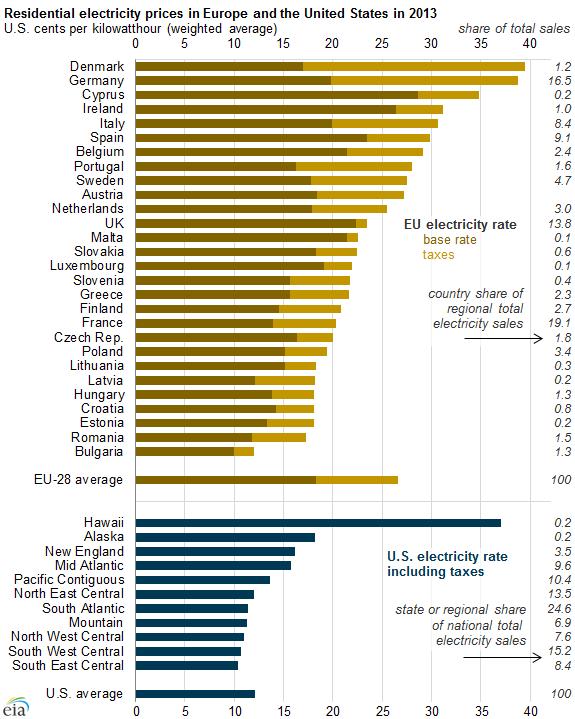

Average residential electricity prices in Europe are more than double prices in the U.S. “Regulatory structures—including taxes and other user fees, investment in renewable energy technologies, and the mix and cost of fuels—all influence electricity prices,” the EIA said in a report out today.

Average residential electricity prices in Europe are more than double prices in the U.S. “Regulatory structures—including taxes and other user fees, investment in renewable energy technologies, and the mix and cost of fuels—all influence electricity prices,” the EIA said in a report out today.

In the U.S., Hawaii residential electricity prices are triple the U.S. average because of the high cost of transporting generation fuel to the islands. Hawaii’s cost for electricity is almost on par with Germany and Denmark, the EU’s two highest. Bulgaria is the only country in the EU-28 with residential prices lower than the U.S. average in 2013.

Recipe for High Prices in Europe: 30% Taxes, Renewable Energy Levies, Saying Goodbye to Nuclear and Coal

Taxes and levies account for high prices in some European countries. EU countries taxed residential electricity rates at an average of 31% in 2013, up from an average of 23% in 2006. These values vary greatly with 2013 taxes on electricity as low as 5% in the United Kingdom (UK) and as high as 57% in Denmark. In Germany, where taxes and levies account for about half of retail electricity prices, transmission system operators charge residential consumers a renewable energy levy that is used to subsidize certain renewable generation facilities.

Although about 18% of 2012 EU generation came from natural gas, most EU countries consume more natural gas than they produce and thus rely on pipeline or liquefied natural gas (LNG) imports, the EIA reported. “From 2006 to 2013, prices for natural gas at the main trading hubs in the UK and Germany increased by more than a third, while prices at the U.S. benchmark Henry Hub decreased by 45%.”

Although about 18% of 2012 EU generation came from natural gas, most EU countries consume more natural gas than they produce and thus rely on pipeline or liquefied natural gas (LNG) imports, the EIA reported. “From 2006 to 2013, prices for natural gas at the main trading hubs in the UK and Germany increased by more than a third, while prices at the U.S. benchmark Henry Hub decreased by 45%.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.