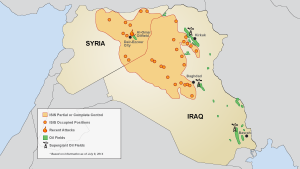

It is no coincidence that ISIS is using the oil fields and pipelines it captured in Iraq and Syria to sell crude oil for the purpose of funding its activities, according to a report in Istanbul’s Daily Sabah, dated July 10, 2014.

In the report, Erdal Tanas Karagöl, economy director at the Ankara-based non-profit SETA Foundation for Political, Economic and Social Research, says the group’s intention is clearly to capture oil resources in order to pay for the creation of its own state in Iraq.

Dr. Fahrettin Sümer, from the American University of Iraq based in the Kurdish city of Sulaimaniyah, believes ISIS is moving towards establishing a system “with state-like functions in the territories that they control.” He said that in order to fulfill such functions the militants need revenues, and oil and gas in Iraq are the easiest source. “ISIS will try to take control of as many more oil fields as possible before they are stopped,” he added.

An article published on www.iraqoilreport.com asserts that ISIS has been smuggling increasing amounts of crude oil that it scavenged from Iraq’s stricken oil infrastructure to buyers in the Kurdistan region, earning an estimated $1 million per day.

An article published on www.iraqoilreport.com asserts that ISIS has been smuggling increasing amounts of crude oil that it scavenged from Iraq’s stricken oil infrastructure to buyers in the Kurdistan region, earning an estimated $1 million per day.

Tugce Varol Sevim, an associate professor at Istanbul’s Uskudar University, said ISIS has specialists in Iraq’s and Syria’s energy sources and possess intelligence as to the location of the oil fields. “ISIS had moved into Mosul because it had failed to hold oil fields in Syria due to the presence of Russian companies, she said, pointing out that Iraqi oil fields were easier targets,” the report explained.

“If we suppose that Iraq will be divided into three among the Kurdish region, Shia-dominated central government and ISIS-led Sunni state, all three will face battles to own more energy sources in the future,” Karagöl said, adding that ISIS’s steady march towards the south proves that it is seeking to play a greater role in energy affairs.

In a June 17 telephone conversation with Oil & Gas 360®, Raymond James Managing Director Marshall Adkins commented that he believed Brent crude prices could go as high as $130-$150 per barrel if hostilities in Iraq lead to supply interruptions, but impact on world oil prices would be limited if Iraq’s oil changes hands but continues flowing.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.