Exxon Mobil will start developing Delaware basin assets in 2017

Exxon Mobil (ticker: XOM) reported fourth quarter results today, showing lower earnings than expected. Net fourth quarter earnings were $1.680 billion, or $0.405 per share. Overall 2016 earnings are $7.840 billion, or $1.877 per share.

This quarter’s earnings missed the Zacks consensus of $0.72 per share, primarily due to an impairment charge of $2.027 billion. This impairment was assessed due to sustained lower prices necessitating a reevaluation of Exxon’s assets, the company said. The asset groups subject to this impairment charge are primarily dry gas operations in the Rocky Mountains region of the United States with large undeveloped acreage positions, the company reported.

Without this charge, Exxon’s fourth quarter earnings were $3.707 billion, or $0.894 per share, and yearly earnings were $9.867 billion, or $2.363 per share.

Drilling on newly acquired Permian acreage expected to begin in 2017

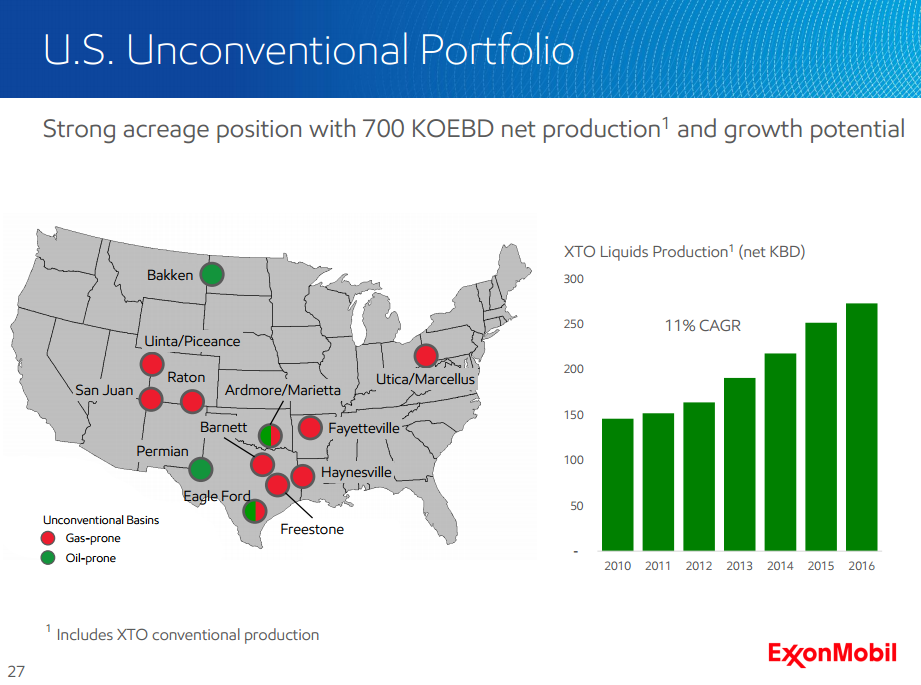

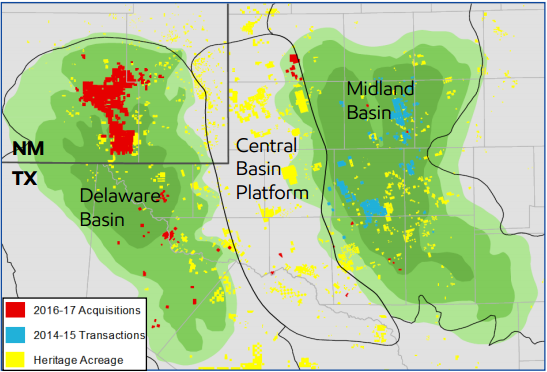

Earlier this month Exxon announced the acquisition of 250,000 acres in the Delaware Basin, more than doubling the company’s resources in the Permian to more than 6 billion BOE. According to Jeffrey J. Woodbury, VP of investor relations, less than 5% of the acreage has already been developed. The Delaware acreage addition gives Exxon a significant opportunity for growth in the most popular and active U.S. shale basin.

Exxon is planning to take advantage of such a large amount of contiguous acreage with plans to drill lateral lengths of two miles or longer, with activity on this acreage expected to begin in 2017.

Several other projects owned by the company are expected to start up in 2017-2018 including:

- The Hebron Field, a heavy oil field in offshore Newfoundland,

- The Odoptu field, an oil field on the Eastern coast of Russia,

- The Upper Zakum 750, an upgrade to the production capacity of the Upper Zakum field, a massive 50 billion barrel offshore field in the UAE,

- The Kaombo Split Hub project, developing an oil field in offshore Angola,

- The Barzan project, developing the massive North Dome field in Qatar, the largest non-associated gas field in the world with an estimated 1.8 trillion Mscf.

Q&A from XOM Q4 conference call

Q: As you think about [the Delaware] deal, is it indicative of the view that Exxon has that you see more value in, let’s say, the private market than the public market? And can you just talk a bit more about the opportunity you see in U.S. unconventional to do deals.

XOM IR Director Jeffrey J. Woodbury: I would tell you that I would not view it as being exclusive to one type of transaction. As we have talked in the past, we keep a full view on what may be out there that could be competitive with our existing resource base and accretive to overall long-term financial performance. These things don’t happen overnight. Several of these take many, many months to go ahead and put in place. And not all of them transpire into an executed deal. But what’s important is that it is a key aspect of our overall asset management program in order to high grade our portfolio with the view of our underlying mission of growing shareholder value.

Q: [Regarding] CapEx. The $22 billion that you outlined is in line with what you talked about earlier this year but up from 2016. Can you at least speak to high level to what’s driving the growth in 2017 versus 2016 in terms of CapEx? Is that cost inflation or is that higher growth? And then bigger picture, can you talk about what you’re seeing in terms of cost inflation across your portfolio?

Jeffrey J. Woodbury: The $22 billion that I mentioned is fairly consistent with our forward-looking plan that we provided a year ago. I would tell you that it does not reflect a year-on-year increase associated with the cost inflation. And in fact, the inverse is true, is that the organization continues to look for high-impact capital efficiencies to drive the costs down. And it is by and large a function of activity level.

Certainly as activity continues to build, we will all experience some market pressures, but that doesn’t relieve us of our fundamental objective of maximizing the value proposition. And rest assured that the organization will continue to keep focused on what new solution are there for us to get to a lower cost outcome? And the organization’s very committed to make sure that we’re capturing those and really leading the cost curve.

Q: Any outlook on future project returns – conventional versus your acquired Permian? I ask the question in the context that you make a significant acquisition one of the tighter energy asset markets in the world, the Permian, you discuss a relatively healthy plateau, future plateau level of production. Others distress in asset markets globally in regions in which Exxon operates. So, I don’t know, just given the assets in these laterals, these longer laterals you discussed, any – can you talk about how you think the future returns compete within your portfolio and how advantaged they may be?

Jeffrey J. Woodbury: Well, from a general perspective Evan, I would tell you that clearly the recent acquisition predominantly in the Delaware basin is very competitive. It really goes back to the fundamental objective that we’re trying to achieve through acquisitions or through exploration or our investment program. That is to make sure that we’re maintaining a focus on value accretive performance. We’re looking for investments that are going to continue to maintain our industry-leading return on capital employed. So certainly very attractive. We’ve given you a sense from the – for the economics where I think back in the second quarter we showed you some of the progress we’ve made in unit development costs, operating cost. We gave you a sense for the portfolio then, which with the Bakken and Permian together we had over 2,000 wells that achieved greater than a 10% return. Money forward economics. Full in, fully loaded on a $40 per barrel price. You add these – this acquisition into this, it takes us up to about 4,500 wells. So a very robust inventory.

The long-term objective, thinking about the short cycle versus long cycle is one in making sure that the pace maximizes the learnings that we’re integrating and captures the technology application that we want to apply in order to achieve these outcomes like the length of the laterals. I’d say that these – this acquisition and investments that we planned under it are going be very competitive to our existing inventory of opportunities.

Q: I mean, can you just mention how much of your expected CapEx, the 22 million CapEx is in shorter cycle, however you define that whether offshore or onshore? And related, I mean, how do you consider the value of capital flexibility or cycle times in your gating process? Either it’s a plus or a minus for a longer cycle project?

Jeffrey J. Woodbury: Yeah. On the first question I tell you that we are going provide some more color in about a month’s time at the Analyst Meeting. So if I ask you just to hold that thought we’ll give you a little bit more perspective at that time. On the second one, the balance, the overall balance of short cycle versus long cycle, obviously we’ve got a very large resource inventory with over 90 billion barrels. We’re trying to move that resource inventory at the same time maintaining a robust level of short cycle investments. Now of course that short cycle inventory continues to grow all these acquisitions that we’ve been picking up. So that’s done through our annual planning process. We look at the execution capability of the organization, the service sector and then we look at the fundamental cash management objectives to make sure that we’ve got that flexibility.

And a key element of when we share a CapEx objective, we’ve got – we’ve built in flexibility in the upside as well as flexibility to the downside. We know how to flex that program depending on what commodity prices do.

Analyst Commentary

From Wells Fargo:

OPINION. XOM posted an in-line quarter from an operational and cash flow standpoint assuming a normalized corporate and financing charge and excluding the $2 billion asset impairment charge. Given that the adjusted beat was driven by non-recurring items, we do not expect a meaningful reaction in the share price. Focus of the call should be on production and cash flow guidance, but we expect most detailed answers to be deferred to next month's Analyst Day.

EARNINGS REVIEW. XOM delivered a headline EPS miss with 4Q16 results of $0.41 versus our and consensus estimate of $0.71. Excluding a $2 billion impairment charge, XOM posted EPS beat of $0.89. Assuming a normalized corporate and financing expense, we estimate EPS of just over $0.70 - in line with our and consensus estimates. Global production of 4.12 million barrels oil equivalent per day (mmboed) was higher than our forecast of 4.07mmboed and increased versus 3.81mmboed in the prior quarter but declined versus 4.23mmbopd a year ago. Liquids production of 2.38 million barrels per day (mmbopd) increased versus 2.23mmbopd in the prior quarter, while gas production of 10.42 billion cubic feet per day (bcfpd) declined versus 10.60bcfpd in the prior quarter. Oil/liquids made up 58% of volumes versus 58% in the prior quarter and a year ago.

SEGMENTAL OVERVIEW. Excluding the impairment charge, both U.S. and international Upstream fell short of expectations. U.S. earnings missed on higher costs, while the miss within international upstream was driven by both weaker realizations and higher costs. Downstream beat expectations driven by international, while Chemicals missed our estimates. Corporate expense was well below expectations.

Total capex of $4.9 billion fell by 34% YoY but increased 15% QoQ and exceeded our $4.3 billion forecast. Upstream capex of $3.6 billion decreased by 39% YoY but increased 16% QoQ.

In line with 2016, XOM plans to continue to acquire shares to offset dilution but does not have plans to repurchase shares to reduce shares outstanding.

From UBS:

2017 capex up ~14% YoY, above expectations

XOM expects 2017 capex to be "about $22bn," above consensus of ~$18.2bn and UBSe of $20.3bn and a ~14% increase from 2016 spending of $19.3bn. However, we'd note the guidance is right in line with XOM's $22 billion outlined at its Analyst Day last March. XOM repurchased just 12MM shares of its common stock in 2016 to offset dilution which it will continue to do so but does not currently plan on making purchases to reduce shares outstanding. At this level of spending and assuming current futures strip prices, we forecast XOM will generate a FCF deficit (after dividends) this year of ~$2bn (compared to last year's ~$8.3bn FCF deficit). We expect XOM to update its long term capex outlook and production guidance at its March Analyst Day.

4Q EPS beats on R&M asset sale gain & favorable tax items; CFPS in line

4Q clean EPS (which excludes a $2bn writedown related to Rockies dry gas assets) rose 34% YoY to $0.89, above consensus & UBSe of $0.70 & $0.71, respectively. Upstream earnings increased ~62% YoY to ~$1.39bn, just below consensus of ~$1.43bn. R&M earnings fell 8% YoY to ~$1.24 billion, well above UBSe $985MM & consensus $898MM aided by an asset sale gain. Chemical segment earnings of ~$872MM were down ~9% YoY & ~20% below expectations. Corporate & financing earnings of $209MM were much better than consensus & UBSe of an expense of ~$456MM & ~$364MM, respectively, on favorable non-US tax items positively impacting EPS vs consensus by $0.16/share. 4Q cash flow from ops of $7.4bn was near both UBSe of ~$7.2bn & consensus of ~$7.8bn.

Volumes fell 3% YoY, below expectations; 2017 guidance at Analyst Day

4Q upstream production slipped 3% YoY to 4.121 MMBoed, 3% below UBSe & in line with consensus' ~4.142 MMBoed. Notably, worldwide liquids volumes fell ~4% YoY while natural gas volumes decreased ~2% YoY. We expect XOM to provide its 2017 production guidance at its March 1st Analyst Day; we forecast volumes will increase ~2.5% YoY this year to ~4.158 MMBoed, near consensus of ~4.140 MMBoed.

Valuation: material premium to peers and historical multiples

Our $77 PT is based on a normalized relative PE of 0.95x (in line with its 5-year avg).