ExxonMobil executes two deals for Permian acreage

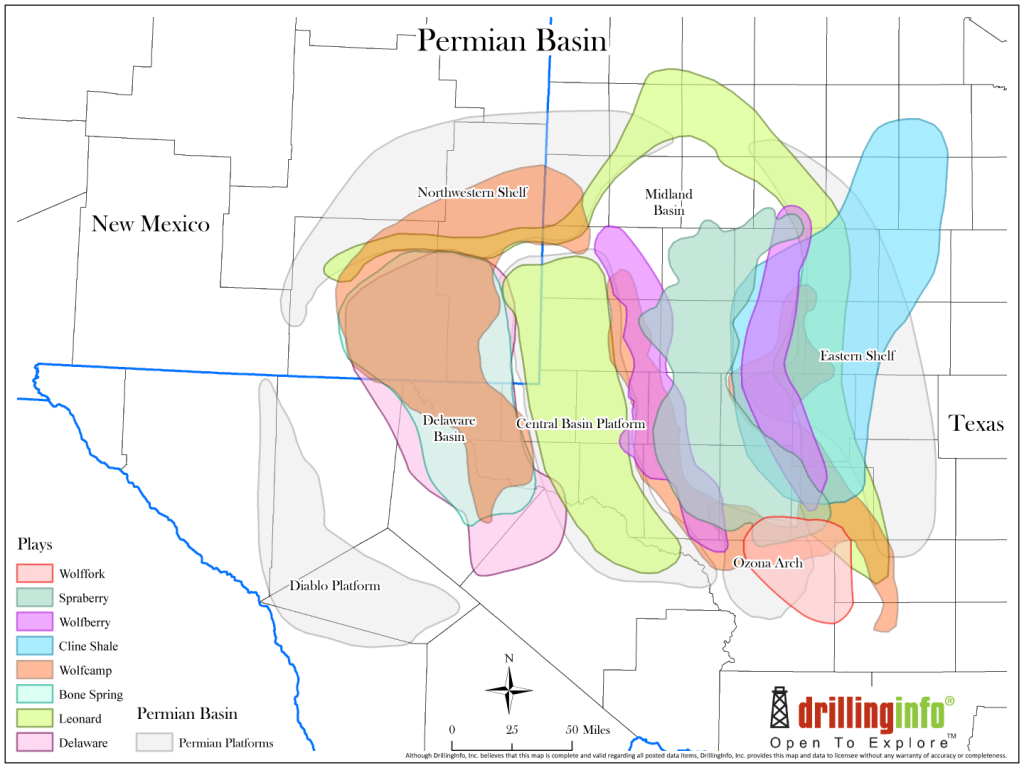

ExxonMobil (ticker: XOM) announced that it has acquired 48,000 acres in the core of the Midland Basin through the execution of two agreements. The agreements include an acquisition and farm-in adjoining XOM subsidiary XTO Energy’s existing acreage position in Martin and Midland Counties, providing rights to all intervals within the basin. The acreage will be operated by XTO.

“We are continuing to grow our position in a prolific area of the Permian Basin,” said Randy Cleveland, president, XTO Energy. “The recent emergence of strong Lower Spraberry results, combined with the established Wolfcamp intervals, demonstrates the significant potential of the stacked pays in the Midland Basin core.”

ExxonMobil has executed five agreements in the Midland Basin since January 2014, providing the company with over 135,000 operated net acres.

“We are encouraged by the horizontal well productivity and cost reductions we have achieved to date,” Cleveland said. “We expect to drive continued improvements in productivity and cost as we develop our substantial inventory of wells across the multiple stacked pays.”

XTO is currently operating 11 horizontal and four vertical rigs across its Permian Basin leasehold of more than 1.5 million net acres, with net oil-equivalent production exceeding 115,000 barrels per day.

Producers getting more from the Permian

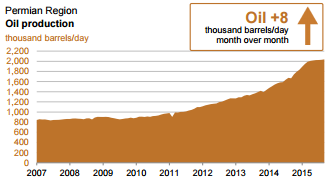

Yesterday, the Energy Information Administration (EIA) released its Drilling Productivity Report (DPR) predicting that the Permian Basin would continue to show increased levels of production, even as most other oil plays began to taper off.

The DPR, which uses current well data to predict production levels for the following month, estimates that the production in the Permian will increase by 8 MBOPD in September. Every other play tracked by the EIA in its DPR showed declines, with the exception of the Marcellus, which the EIA expects to increase production by 1 MBOPD, and the Haynesville, where the EIA expects production to remain flat.

Permian remains a target for companies looking to expand

In addition to the XOM acquisition, several other companies have been increasing operations in the Permian Basin over the last several months. WPX Energy (ticker: WPX) acquired privately held RKI Exploration & Production for $2.75 billion on July 14. In return, WPX picked up 92,000 net acres (98% held by production) in the Delaware Basin on the New Mexico-Texas border at approximately $50,000 per flowing barrel.

Rick Muncrief, WPX president and CEO, said the largely undeveloped acreage offered an attractive target for the company. “We believe the total net recoverable resource potential at more than 1.1 billion barrels of oil equivalent; less than 10% of that is currently developed thus far. Thus, this acquisition results in adding high quality assets at an attractive $2.50 per BOE.”

Energen Corporation (ticker: EGN) recently announced that it planned to tap equity markets in order to fund its drilling program in the Permian. According to the company, EGN will “slightly” increase Permian drilling activity in 2015 and then “begin a multi-year acceleration of development activities in the Permian Basin in 2016.” Energen expects to spend $1.0 billion on its drilling program in 2015, and “$1.0 billion or more” on its 2016 program.

EGN’s position in the Permian offers substantial returns, according to company Chairman and CEO James McManus. At $60/barrel, Energen says it can generate a 60% rate of return from its Lower Spraberry locations.

“Let’s just be conservative and say that the $7 million number is right,” said McManus, referring to the PV-10 value of a 7,500 foot Wolfcamp A well during the company’s recent conference call. “If we take our 414 locations in the North [Midland] and multiply by $7 million PV-10 value, that’s $2.898 billion or $2.9 billion of undiscounted value created in the Northern Lower Spraberrys alone.”