The Federal Reserve decided to stand pat following its two-day October meeting

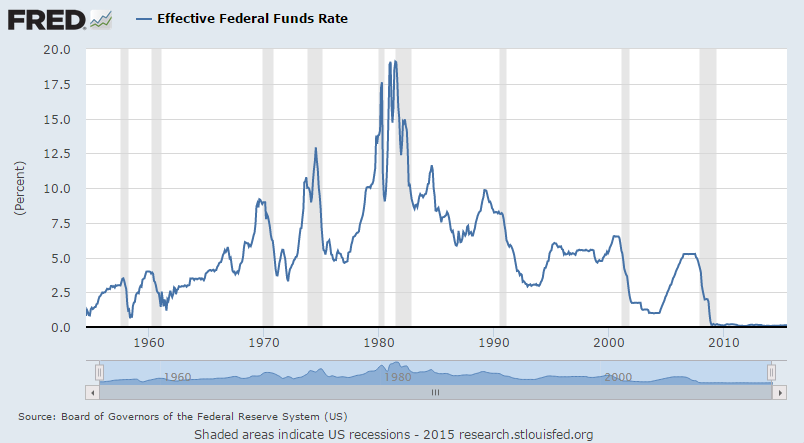

The U.S. Federal Reserve today decided to maintain rates near zero, leaving them unchanged since 2008. The Fed did announce that it is open to raising rates at the next meeting in December.

“In determining whether it will be appropriate to raise (interest rates) at its next meeting, the (Fed) will assess progress-both realized and expected-toward its objectives of maximum employment and 2 percent inflation,” the Board of Governors of the Federal Reserve System said in its statement.

Jeffrey Lacker, the Federal Reserve Bank of Richmond president, was the only vote in dissent of the decision to maintain rates today. Laker wanted to raise the federal funds rate, which affects everything from mortgage rates to bank savings interest rates, by 25 basis points.

In the Fed’s statement today, the Federal Open Market Committee (FOMC) dropped language about international markets, and listed concerns over slowing payrolls as a cause for further cautiousness.

After the FOMC’s September meeting, Wunderlich Securities Chief Market Strategist Art Hogan told Oil & Gas 360® he was concerned about the group’s focus on international events.

“You can pick your flavor of the month,” said Hogan about events that might cause market instability. “There’s always going to be something going on in the world that you can point to as a reason to not raise rates.”

The exclusion of language regarding concern over global economic and financial developments will remove another set of uncertainties from the Fed’s decision in the future. Hogan referred to the strong focus on global markets in the Fed’s previous statement as a third mandate for the FOMC to consider, in addition to the Federal Reserve’s official goals of zero unemployment and 2% inflation.

Soft jobs data

The U.S. economy added 142,000 jobs in September, but the release from the Fed today pointed out that the pace of job gains slowed since the FOMC’s previous meeting. Unemployment remained unchanged at 5.1%.

Employment in the mining sector continued to decline in September, shedding 10,000 jobs, with losses concentrated in support activities, which accounted for 70% of the jobs lost. Mining employment reached a peak in December, 2014, but has since declined by 102,000 jobs.

Oil up today

Both international benchmark Brent crude, and U.S. benchmark WTI crude were up today, despite the decision from the Fed to maintain rates and an inventory build in the United States. Brent is up 5.11% to $49.20 as of 5:05 pm EST, while WTI was up 6.90% at $46.18.

The Department of Energy announced a build in U.S. crude oil inventories today of 3.38 million barrels for the week ended October 23, 2015. The build did come in below economists’ average estimates of 3.56 million barrels. The DOE also reported an inventory drop of 785,000 barrels at Cushing, Oklahoma, and draw-downs in stockpiles of gasoline and distillates, which helped fuel oil’s gains.