March Madness may be recognized as the most exhilarating tournament in sports, but spectators simultaneously viewing the stock market with the Federal Reserve news conference on March 19, 2014, were treated to a roller coaster ride of their own. The market hung on every word spoken during Fed Chairwoman Janet Yellen’s debut until the organization insisted it will maintain the status quo, quelling fears for the moment. Tapering of the third round of Quantitative Easing (QE3) remains in place and will dip to $55 billion a month from $65 billion a month beginning in April, down from the original $85 billion per month when the program was initiated. Yellen indicated the QE3 bond buying program may end in roughly six months, signaling the probable start to a rise in interest rates – typically a cause for concern in the market.

“Rising interest rates by themselves are not a disaster,” said Tom Petrie, Chief Executive Officer of Petrie Partners, in an exclusive interview with OAG360. “However, the rate of rise is what really matters. If we get into a fairly sharp escalation then we have to worry about it effecting concerns of economic growth and therefore demand growth for oil.”

Bank Credit Ratings

Market stability was strengthened when Fitch ratings reaffirmed the United States credit ratings at a Triple-A level (its highest) coupled with a stable outlook. The firm had previously placed America’s credit ratings on notice, marking it with a “rating watch negative” in October 2013, and anticipating a possible downgrade in Q1’14. The estimates have now been absolved on what the firm believes has become a low-risk financial sector. Triple-A ratings were re-established for the country’s ceiling and default ratings, and the firm commended the Fed’s proper timing on suspending the debt limit to next year.

The news is a promising sign of what could have conversely happened. A downgrade may have resulted in the selling of Treasury bonds, since some institutions are limited to investing in securities rated triple-A by at least two major firms. Standard & Poor removed its Triple-A badge from the United States in 2011. Moody’s had said a downgrade was unlikely.

Tom Byargeon, Managing Director at PNC Financial Services, explains differentials in credit ratings can affect the capital of companies on a grand scale. Larger companies, particularly those involved in bond issuances will see prices increase as new issuances will require greater capital. Similarly, smaller companies are also affected due to the higher cost of borrowing and/or greater difficulty to engage in the borrowing process.

However, the ratings had virtually no effect on the oil markets following Standard & Poor’s downgrade in 2011. “This means,” Byargeon said, “The market knows how to evaluate the risk associated with the United States treasuries and can usually see through the ratings agencies.”

The yield curve following S&P’s downgrade in August 2011 indicated a stern reaction from the United States market. The 30-year to 3-month treasury spread decreased by as much as 17% over a two-week period and even dipped below the 3% threshold late in the year despite being as high as 4.38% the month before the announcement. The oil and gas market tipped downward but has since not reflected the Treasury rates.

Public Reacts to New Leader of the Fed

Inevitably, a changing of the guard from Ben Bernanke to Janet Yellen resulted in new dialogue and ideas. A March 31, 2014, article by the Wall Street Journal raised eyebrows at Yellen’s rhetoric and public appearances. In the past, the Fed’s benchmark for short-term interest rates would remain near zero as long as the unemployment rate was above 6.5% and inflation remained below 2.5%. Yellen strayed from specific numbers and was somewhat broad in her new approach, revealing official plans to keep rates very low for a prolonged period as the economy slowly rebuilds.

Charles Goodson, a member of the Energy Advisory Council of the New Orleans Branch of the Federal Reserve Bank of Atlanta, told OAG360 in an exclusive interview that the Fed has become more specific in recent weeks. “What I currently understand is that the Federal Reserve will likely be out of the bond market by October or November of 2014,” he said. “And we will probably see a quarter point rise in Fed rates probably by the second half of next year.”

Weaning the market off the bond buyback program can be a very delicate process, Goodson explains. He has experienced effects of the process firsthand as President and Chief Executive Officer of PetroQuest Energy, Inc. (ticker: PQ).

“When the Fed announced they would start pulling back on their bond buying in May, it literally crushed the market for debt issuance,” Goodson said. “It cost us to go from about an 8% interest rate on our bonds to 10%. It was very costly for us, but then it settled back down… I believe the Fed is clearly trying to get out of the bond market on a very managed basis. They do not want to shock the system in any way.”

Impact on the Oil & Gas Industry

According to former Chairman Bernanke, the same holds true on the Federal Reserve and the energy markets. In a Congressional hearing in February 2012, Bernanke said the Fed can only control the rate of inflation and the Reserve’s decisions hold minimal impact on the price of oil and gas. The only solution, Bernanke suggested, is for producers to guarantee a steady supply – a highly improbable task due to constant geopolitical crises that can disrupt markets.

“The Fed is almost always a follower and not a leader,” said Petrie. “They don’t have nearly the control over rates that people think they have.”

Thus, the current debate of exporting America’s crude oil and natural gas resources comes into play. A point of interest: since 2011, the U.S. annually exports an average of 116.9 metric tonnes of coal, 1.53 billion bushels of corn, 159.2 million gallons of finished gasoline and 47.3 million gallons of jet fuel. What is the debate about exporting crude oil and natural gas? Prices for commodities are not set by the producer. In fact, it can be argued that in some cases the marginal cost far exceeds the marginal benefit of each unit of production, e.g. Haynesville dry gas. The U.S. (and for that matter, North America if we factor in Canada and Mexico) can offer stability of supply to Europe and Asian markets who are long fuel demand and short hydrocarbon supply.

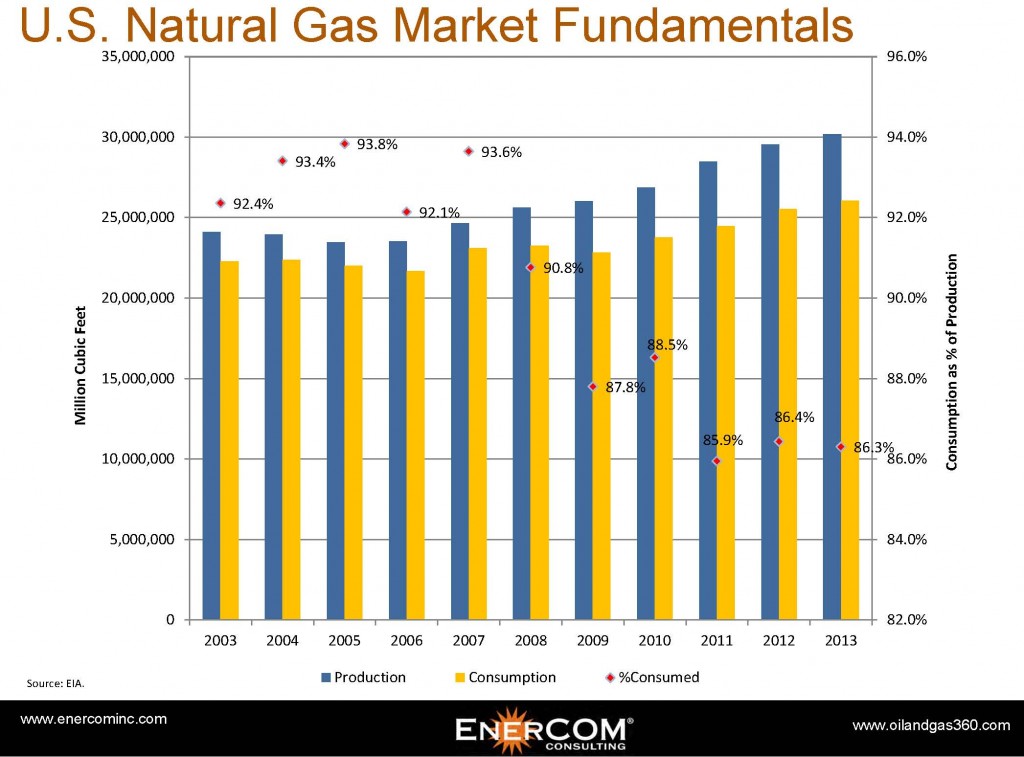

Mass exports of natural gas by the United States will undoubtedly help the market in the near term. The mutual dependence of Russian gas with the rest of Europe has left the entire region with “no sensible alternative,” says Germany’s Economy Minister. Spot prices, which are as much as three to five times higher internationally, provide the United States with a legitimate market expansion opportunity. The EIA estimates the U.S. could export as much as 12 Bcfe/d (15% of production) as early as 2018 if licensing for LNG plants is expedited.

However, a March 4, 2014 note from Goldman Sachs believes Europe’s chief natural gas producers can lower costs in order to undercut the America-based imports. In fact, the report believes the prices can be as much as 40% lower than what the United States could offer. As a result, American gas would likely head towards the Asian markets.

Gas Prices at Home Should Remain Constant

Even if mass exports are approved, an IHS study showed domestic gas prices will likely average between $4 and $5 annually for the next 20 years. Many experts, including Goodson, believe the United States’ massive resources will prevent prices from exceeding such a level and likely solidify a floor price.

Approving exports, on the other hand, is not as simple. The Obama administration has been dragging its feet for years on energy-related issues like exports and the Keystone Pipeline. “The rate at which the government is approving these exports is very slow compared to our ability to raise production levels,” Goodson said. “If you look at the consumption of natural gas, exporting natural gas is nowhere near the top of the growth rate in consumption. So it doesn’t appear that it will have a material effect on the price of natural gas.”

The Fed’s attention is currently elsewhere, as the organization maintains its focus on strengthening the dollar and bolstering the job market. Yellen acknowledged what she called a “considerable slack in the economy and the labor market” in a conference on March 31, 2014. As indicated by maintaining interest rates, the Chairwoman is convinced the economy is still in recovery mode.

It may be that Chairwoman Yellen and the FOMC is looking more at the labor participation rate, which was 63.9% in March 2014, well below the pre-recession average of 66% and the lowest since June 1978. The low labor participation rate is symbolic of the long-term weakness in the job market. Some attribute the weakness to structural issues, implying many jobs are simply not coming back (e.g., construction jobs lost from the overheated pre-recession housing market) versus transitional, implying that job growth will get back on track when the economy does. As the economy improves, it is likely more people will enter the labor market, which will make it difficult for the unemployment rate to decline substantially until the participation rate increases back to historical norms.

“I think (Yellen) recognizes there will come a time when they have to play catch up,” said Petrie. “I think she’s hopeful it’s not right away.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.