While the United States is garnering global attention for its shale boom, its prominence in the renewable energy field is far above that of any of its international competitors. The United States has been the world’s greatest producer of renewable energy since 2006. According to BP’s 2014 Statistical Review of World Energy, the U.S. accounted for 43.5% of the world’s renewable energy production in 2013.

Major energy companies traditionally known for oil production are expanding their reach in alternative power solutions. ExxonMobil (ticker: XOM) and Shell (ticker: RDS.B), in particular, are building up wind power farms across the globe. Shell runs ten farms worldwide (eight in the United States), including an offshore farm in the North Sea that was developed from its experience with offshore oil and gas platforms. The company has an offshore oil and gas platform powered entirely by wind and solar.

A New Use for Old Wells: Geothermal Energy

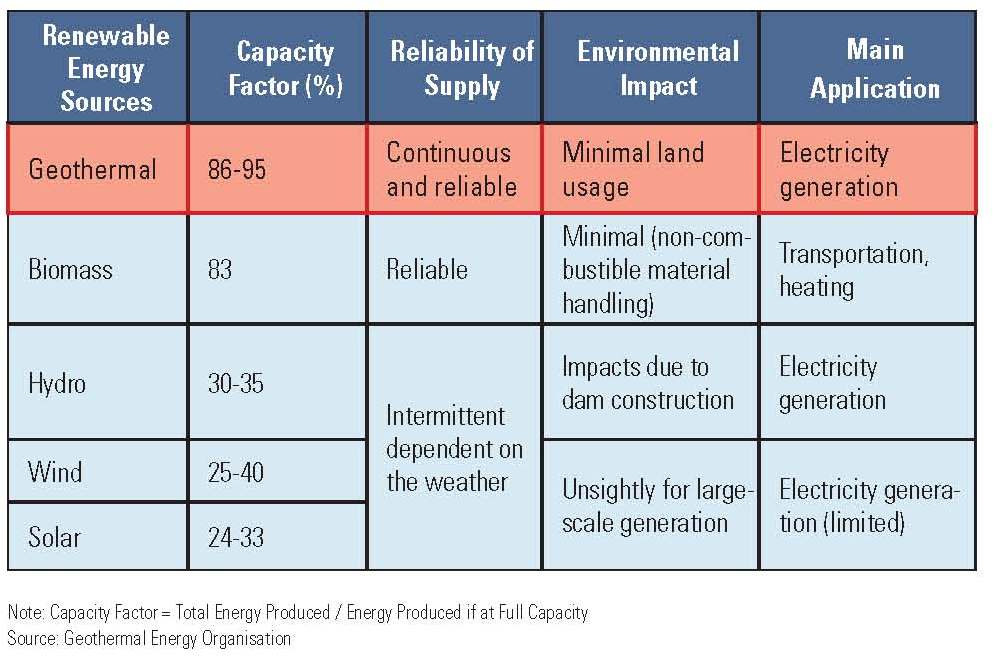

According to The New York Times, geothermal energy (generated from heat deep in the earth) is making strides, and oil and gas operations deserve credit. Although geothermal energy is only a fraction of the renewable energy market, the Energy Information Administration expects it to grow at an annual compound rate of 5.4% through the year 2040 – ultimately more than quadrupling its current output. A major benefit is dependability, which is a factor that solar and wind technologies are not able to provide.

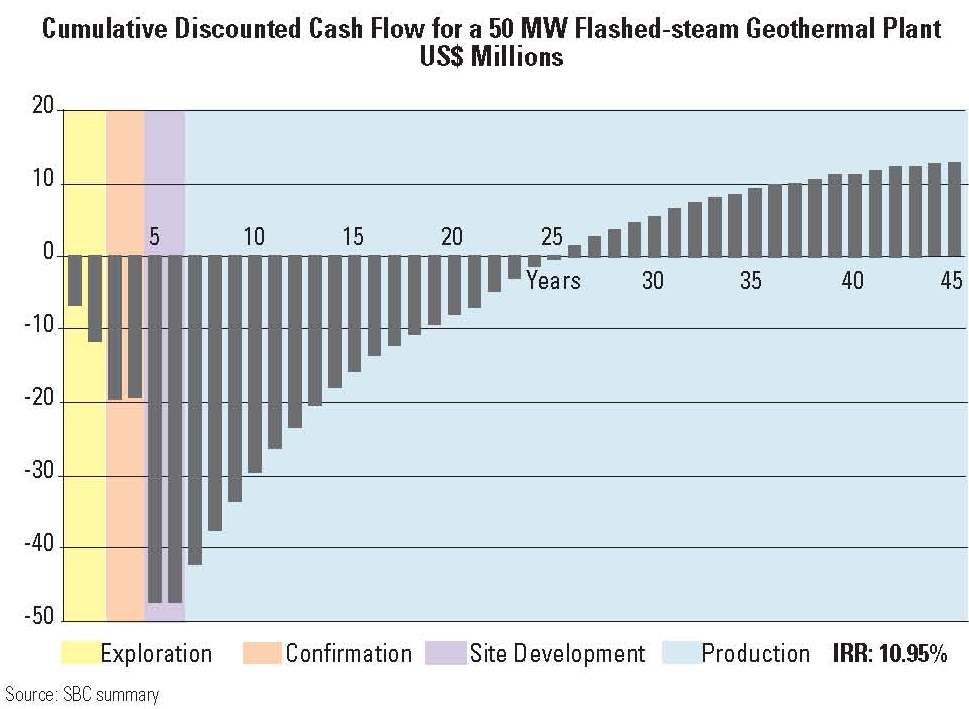

However, geothermal power has historically suffered the chief shortcoming of other renewable energy programs: returns. A review from Schlumberger (ticker: SLB) Consulting determined operating expenditures are low, but high initial costs can deter investors. The Times reports drilling a geothermal well can devour more than half of the project’s budget, and even then the possibility of drilling a “dry well” can range from 10% to 30%. Even if operations went according to plan, a Goldman Sachs report placed a profit-to-investment ratio at 0.8 for a hydrothermal project. A typical oil and gas project has a profit-to-investment ratio nearly twice that amount.

Source: Schlumberger Consulting

However, the geothermal landscape has changed due to hydraulic fracturing utilization. The new techniques have unlocked information that was previously unavailable and led to the debut of the National Geothermal Data System just months ago. Data provided by the oil and gas industry played a significant role in its compilation and release. Researchers hope to someday use abandoned wells to generate the greatest and most economically feasible return for geothermal projects, as drilling has already been completed.

Can Geothermal Become More Viable?

The majority of worldwide geothermal projects are located around the Pacific Rim, which brims with the heat of volcanic activity. The Ring of Fire runs along the West Coast of the United States. Therefore, geothermal opportunities exist for most of the states in the Pacific Time Zone. California, for example, currently has more than 650 active, high temperature geothermal wells and 280 injection wells. The state generated 78% of the U.S.’ total geothermal output in 2013.

However, geothermal energy contributed only 0.4% of total U.S. production in 2013. Oil and gas, on the other hand, accounted for more than half of all U.S. energy production. Even California, despite being a national leader in renewable energy sources, produced 64% more oil and gas than its combined output of total electric power, biofuels and other forms of renewable energy (1,420 trillion BTUs compared to 912 trillion BTUs).

Source: Schlumberger Consulting

Even though renewable energy is certainly a secondary source in terms of overall power utilization, its investment levels and levels of power generated are both growing. Production for fiscal 2013 was approximately 9.3 quadrillion BTUs – 43% higher than 2007’s total. Renewables also consist of 11% of overall U.S. energy production, which is above 2007’s mark of 9%. Oil and gas, in the meantime, has increased to 54% from 46%.

Is There Incentive for Geothermal Oil & Gas Wells?

Testing is materially inconclusive to date, but the United States is drilling wells at record rates while shutting in conventional natural gas wells due to price differentials. Texas alone had more than 66,000 shut-in wells in February 2014, according to the Texas Railroad Commission. Studies from Southern Methodist University in Texas say “thousands” of the wells are viable for geothermal development.

The process can also benefit from the wastewater of drilling operations. The Department of Energy says 25 billion barrels of hot water are disposed of on an annual basis, but the first geothermal energy converter was developed in 2008 in an attempt to recycle the resource. The converter produces more than 200 kilowatts per hour. A 2013 study by a university in China concluded geothermal energy can be used to heat the wellbore and conserve energy, and a correlation was identified with higher wellhead temperatures equating to higher production rates.

In turn, a Schlumberger report believes geothermal wells can be mutually beneficial with oil and gas wells. It reads: “The key to increasing the use of geothermal ironically involves greater co-operation with the oil and gas industry. Through joint collaboration on technology research and co-siting of pilot projects, the geothermal industry has the potential to change the structure of its economics and the trajectory of its development.”

Eliminating drilling costs would make a big difference in cost effectiveness for geothermal wells. However, as previously evidenced by data, geothermal benefits would just be icing on the cake. Oil and gas operations, for the time being, would be the overwhelming focus.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom, Inc. has a long only position in Shell.