True Price Recovery not expected until 2016

Refrac Opportunities a Factor in Current Market

“Weathering the storm” was the general theme of Halliburton’s (ticker: HAL) Q2’15 earnings call, highlighted by management explaining the widespread difficulties of the challenging commodity market. “Pressure” was a commonly used term when describing margins and revenue forecasts, but Halliburton, to its credit, has outpaced activity declines by utilizing its market presence and efficiencies.

The company’s Q2’15 revenue of $5.9 billion was 16% below Q1’15 numbers, but was impacted by a global rig count that declined by 26% overall. North America revenue dropped by 25% as a result of 40% slide in rig counts, but stage counts fell by only 10%. “We believe a customer flight to quality emerged in the quarter, and that gives us reason to believe that pricing dalliances may begin to decelerate,” said Dave Lesar, chief executive officer of Halliburton, in the call.

He added: “During the first quarter, Halliburton was one of just a few companies that posted profits in North America. We expect the second quarter has been even more challenging for those of us in the industry. As a result, we believe many of the smaller service companies are now operating below cash breakeven levels, which leads to the conclusion that pricing cannot stay at these levels for an extended period.”

Halliburton Q2’15 Snapshot

HAL reported net income of $53 million for Q2’15, amounting to $0.06 per share. The company reported a net loss of $643 million in the previous quarter due to an impairment charge of $1.2 billion. Net income for Q2’14 was $775 million on revenues exceeding $8 billion.

HAL reported net income of $53 million for Q2’15, amounting to $0.06 per share. The company reported a net loss of $643 million in the previous quarter due to an impairment charge of $1.2 billion. Net income for Q2’14 was $775 million on revenues exceeding $8 billion.

The oilservice giant’s two main elements of business are divided into completion and production, and drilling and evaluation. Completion and production revenue declined by 19% on a quarter-over-quarter basis, while operating income fell by 32% in the same time frame. The company realized reduced activity worldwide with the exception of increased tool sales in Algeria, Angola and Norway.

Drilling and evaluation revenue declined by 12% from Q1’15 numbers but its operating income actually increased by 31%, aided by depreciation cessation on assets held for sale. HAL is actively shopping its businesses involving Fixed Cutter and Roller Cone Drill Bits, Directional Drilling and Logging While Drilling/Measurement by Drilling as part of its pending merger with Baker Hughes (ticker: BHI). Management said it received “nearly 25 indications of interest for each of the businesses” in early July, and is narrowing down its bidders for the next step of the process. The auction is expected to be complete by the fall.

HAL management said it still believes synergies of nearly $2 billion are achievable regardless of market conditions.

Halliburton Forecasts: The Bigger Picture

HAL’s global, hands-on presence provides a glimpse into industry activity levels worldwide and, although company management believes rig counts have troughed, a price recovery is not on the immediate horizon.

Christian Garcia, acting chief financial officer, expects to see a low- to mid-single digit revenue decline in the eastern hemisphere for Q3’15. North America rig counts are also expected to fall by an additional 5%, which will place more pressure on margins. “This pattern is consistent with previous cycles where we typically see at least a one quarter lag when the market is positioning towards the bottom,” he said, adding that the pricing issues will carry over into Q4’15 but did not get into specifics.

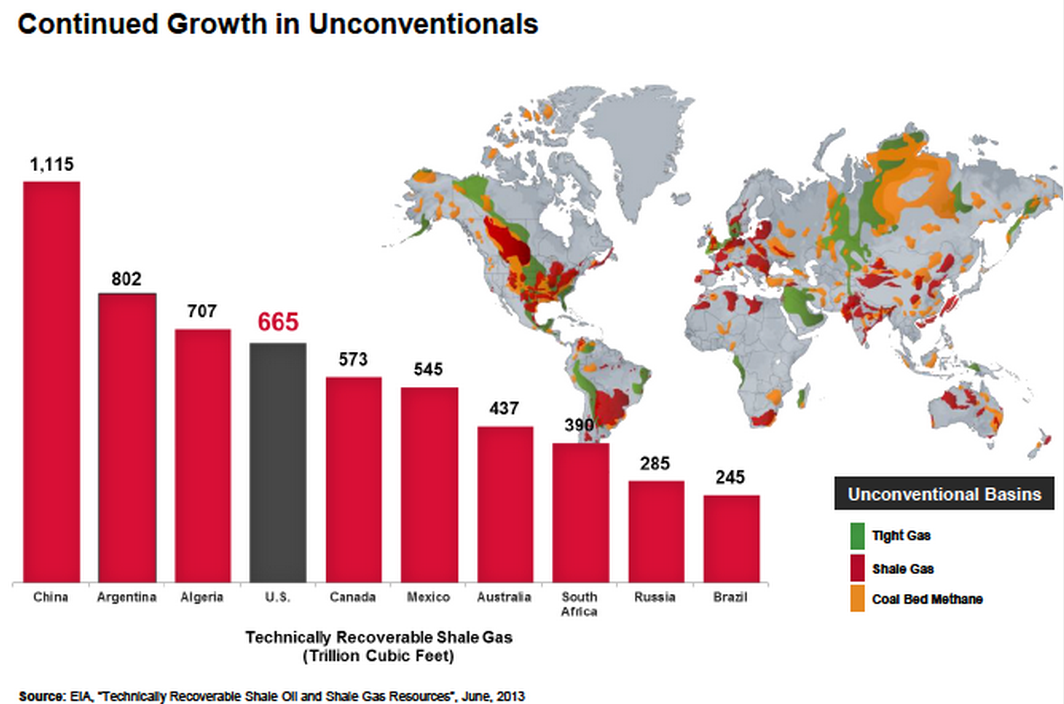

Improved profitability in Iraq, Kuwait and the UAE drove net income gains in Q2’15, and margins from Iraq reached double figures for the first time in HAL history. Despite the growth in the international markets, management believes North America’s ability to quickly ramp up operations will be the most beneficial to oilservice operators. “We’ve seen it before – our customers in unconventionals are highly adaptable and they are actively seeking service efficiencies, downhole technologies, and business arrangements that will make the economics work,” said Lesar. “When the recovery does come, it’s our belief that North America will respond the quickest and offer the greatest upside.”

Refracturing Market Set to Increase

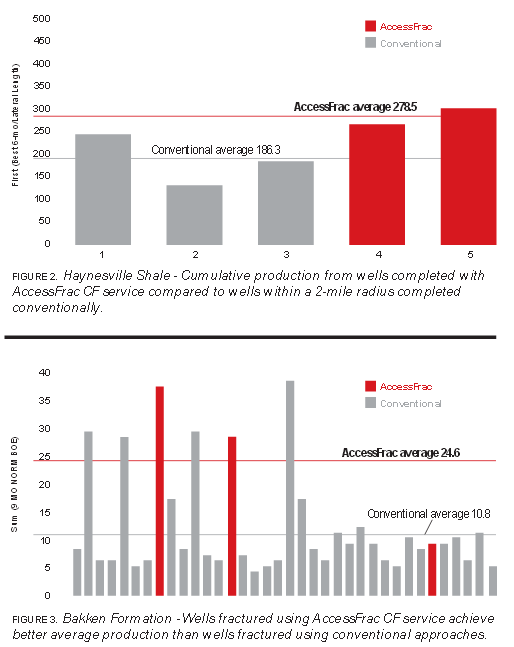

Lesar said HAL does not expect a “meaningful activity increase until sometime in 2016,” but a “modest uptick in activity in the second half of 2015” is certainly possible. Refracturing opportunities are apparent, according to Jeff Miller, president of HAL. “We’ve been involved in refrac operations for decades… Although relatively small today, we believe this market has significant potential in the coming years. Early horizontal wells were arguably under-stimulated, as stages per well are up more than 30% and proppant per well is up more than double since 2010.”

In an interesting move, HAL teamed up with BlackRock for $500 million in financing to fund its refrac project. Halliburton officials said the provided capital has a three year time frame and allows the flexibility to move quickly in a widely uncertain market.