In its Q3’15 results, management of Halliburton (ticker: HAL) was more upbeat about a market recovery than its competitor Schlumberger (ticker: SLB), but warned market difficulties are likely to continue through at least the remainder of 2015.

“Looking ahead to the fourth quarter, visibility is murky at best,” said Dave Lesar, Chief Executive Officer of Halliburton, in a conference call following the release. “Based on current feedback, we believe most operators have exhausted their 2015 budgets and will take extended breaks starting as early as Thanksgiving. Therefore, activity levels could drop substantially in the last five weeks of the year.”

Lesar did offer some signs of optimism, but stressed that the lack of near-term visibility is unlike anything he has seen in his 22 years of business experience. He explained current prices are “clearly unsustainable, but, as we have been saying all along, pricing cannot stabilize until activity stabilizes.” Although he stopped shy of calling the exact shape of the recovery, Lesar and the HAL board believes an upswing is in the cards. “The longer [the recovery] takes, the sharper it will be,” said Lesar, adding that the dynamics of the North American market position itself to offer the greatest upside in a renewed oil price environment.

Lesar’s Recovery Scenario: Slow Ramp-Up Beginning in January, Picking Up Speed in 2H2016

Lesar believes the market reaction following OPEC’s status quo decision last November could generate an opposite reaction this year, as the drilling slowdown may overcorrect itself. He explains: “The first quarter could end up being a mirror-image of the fourth quarter. So, just as the fourth quarter is facing a steep drop-off post-Thanksgiving, we expect to see a slow ramp-up beginning in January and improving from there, suggesting that the first quarter could be the bottom of this cycle. If you pull back and look at the full year 2016 and compare it to 2015, you could envision a similar mirror-image, directionally a slow start and then perhaps picking up speed in the second half of the year.”

Rig counts are at five year lows and HAL believes there is further room to fall. Q4’15 horizontal rig counts may be 15% to 20% lower than Q3’15 numbers, which would push active rigs to as low as nearly 700 overall. Raymond James & Associates believes U.S. rigs could fall below the 600 threshold by mid-2016.

Jeff Miller, President of Halliburton, believes profitability margins could reach high single margins in 2016 and 2017 as activity accelerates. The uncompleted well count, which he said is “arguably deferred revenue,” may become uncoupled from the rig count and can add additional fuel to a recovery market.

Market redeterminations could also impact the near-term recovery, as Lesar said some banks are reaffirming borrowing bases as a “kick the can down the road” approach. “That really just pushes the day of reckoning into sort of the first quarter of next year,” he said. “But the reality is that the strong customers are going to survive, they’re going to have money, and they’re going to drill at some point next year.”

Halliburton and Its Q4’15 Forecast

In relation to the market slowdown, HAL reduced its 2015 capital budget to $2.4 billion from $2.6 billion, marking an 8% decrease and a 27% decrease compared to 2014. Revenue and margins are expected to be relatively flat for the remainder of the year. Revenue for the first nine months of 2015 is 23% below 2014, and the company is currently operating at a loss for fiscal 2015 after returning profits of $4.11 per share in fiscal 2014.

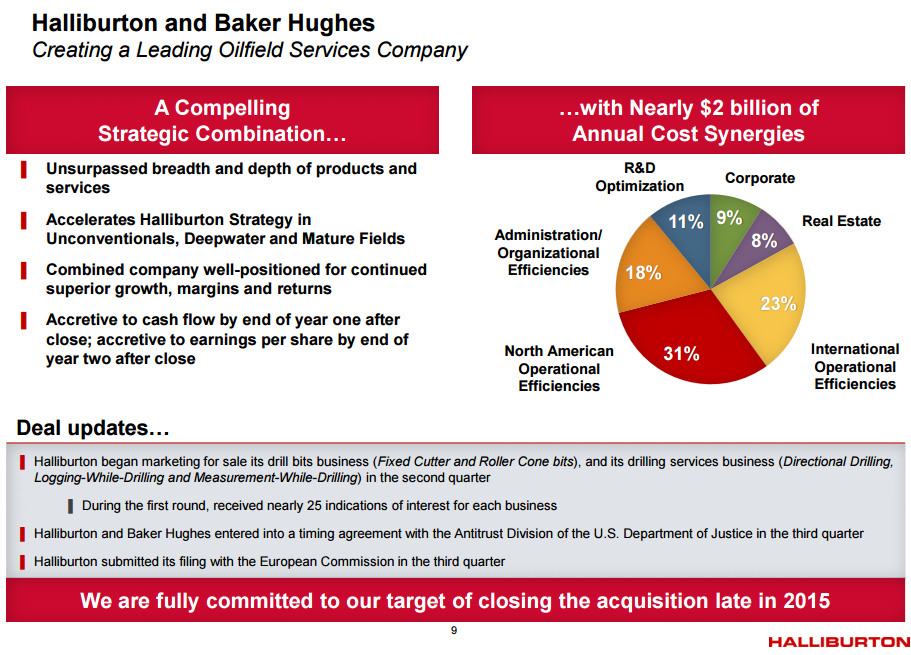

The company still targets closing its $34.6 billion acquisition of Baker Hughes (ticker: BHI) by year-end 2015, but moving into 2016 is a possibility allowed under the merger agreement. The combined company still expects to realize $2 billion in synergies and continues to market selected parts of the business that would pose antitrust barriers. In March, the entity believed it could end up selling as much as $10 billion in assets. About $3.5 billion has been sold to date, and several other businesses are up for sale, including expandable liner hangers and numerous other well completion, servicing and monitoring systems.

HAL continues to collaborate with its E&P counterparts, seeking ways to provide the best returns in the current environment. HAL has been forced to take extreme measures to cope with the new commodity playing field (it has laid off 21% of its workforce in the past year), but optimism remains that prices will recover sooner than later. “Even if I don’t like that service pricing, it is there,” said Lesar. “It’s a fact of the market, and this is a long-term game we’re in. These are long-term customers we have. We typically make good money from them in good times, and I’m not going to walk away from them in the kind of times we’re in today, because it’ll pay off in the long run.”