To say Houston’s Harvest Natural Resources (ticker: HNR) has been frustrated by the government of Venezuela is an understatement. On Jan. 15, Harvest submitted a request for international arbitration against the sovereign nation.

After years of fruitless negotiations with Venezuela for owed oil production revenue and past dividend payments, and more recently for apparently squashing the sale of Harvest’s interest in Petrodelta, its Venezuelan operating affiliate, for the second time, the company took the only path left open to protecting its investment in the OPEC nation. After years of getting nowhere with normal business to business communications, Harvest decided to take Harvest’s case to the World Bank’s International Centre for Settlement of Investment Disputes (ICSID) in Washington, D.C.

“Over the past decade, the Venezuelan Government has violated Harvest’s rights as an investor by systematically thwarting the development of Harvest’s investment in Venezuela as well as the company’s ability to sell its interests there,” Harvest President and CEO James Edmiston said in a company press release issued Jan. 16.

“Harvest’s two attempts to sell its remaining interests in Venezuela, both of which were fully vetted with the appropriate authorities prior to undertaking either transaction, ended in the imposition of wholly unreasonable and extra-contractual conditions on the sale by Venezuela authorities, directly leading to the failure of both transactions.”

“This is not the outcome of our 22 years in Venezuela that we envisioned or desired,” Edmiston said in the press release, “but it’s the only means left to Harvest to protect our investment.”

Despite the necessary public airing of grievances that accompanied the filing for arbitration, Harvest seemed to offer Venezuela an olive branch when he said, “As always, we remain receptive to an urgent solution, reached in good faith dialogue between the parties.”

James Edmiston is no stranger to international petroleum deals with foreign governments or country-to-country management of oil and gas operations. His past positions include vice president and general manager of Conoco Russia and president of Dubai Petroleum Company, a ConocoPhillips affiliate company in the United Arab Emirates. Edmiston spent 22 years with ConocoPhillips. He joined Harvest as chief operating officer in 2004 and has served as its president and CEO since 2005.

Edmiston hosted a conference call today to carefully explain the ramifications of the company’s decision to pursue international arbitration in a final attempt to resolve the outstanding issues between Harvest and the nation credited with the world’s largest proved oil reserves at 298.3 billion barrels, or 17.7% of the world’s total (source: BP Statistical Review 2014). By comparison, the next largest holder of proved oil reserves is estimated to be Saudi Arabia with 265.9 billion barrels, or 15.8% of the world’s total, according to EIA stats.

Harvest to Venezuela: The Window is Closing

“We are clear that pursuing arbitration will require the company to make strategic shifts that soon become irreversible,” Edmiston told the collected audience via phone and simultaneous webcast.

“So, I want to communicate clearly and I hope that Venezuela will understand that there remains a very short window of opportunity to urgently set things right before both parties march down the arbitration path. “To that point, I don’t want to use this call to ‘vent’ about how Harvest has been treated in Venezuela nor do I think it serves our purpose at this stage.”

List of Grievances

On Jan. 15, in a Form 8k that Harvest filed with the United States Securities and Exchange Commission, Harvest’s Vice President and General Counsel Keith L. Head outlined the reasons that the company is seeking arbitration against the nation of Venezuela:

- “[T]he Company believes that the Venezuelan government has violated the Company’s rights as an investor by systematically thwarting the development of the Company’s investment in Venezuela, as well as the Company’s ability to sell its interests there. The Request for Arbitration sets forth numerous claims, including:

- the failure of the Venezuelan government to approve the Company’s negotiated sale of its 51% interest in Petrodelta to Petroandina on any reasonable grounds in 2013-2014, resulting in the termination of the Petroandina Purchase Agreement (see “Background” above);

- the failure of the Venezuelan government to approve the Company’s previously negotiated sale of its interest in Petrodelta to PT Pertamina (Persero) on any reasonable grounds in 2012-2013, resulting in the termination of a purchase agreement entered into between HNR Energia and PT Pertamina (Persero);

- the failure of the Venezuelan government to allow Petrodelta to pay approved and declared dividends for 2009;

- the failure of the Venezuelan government to allow Petrodelta to approve and declare dividends since 2010, in violation of Petrodelta’s bylaws and despite Petrodelta’s positive financial results between 2010 and 2013;

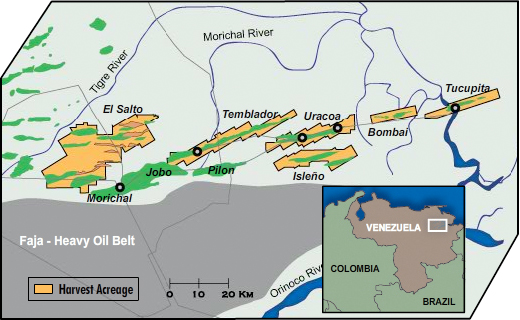

- the denial of Petrodelta’s right to fully explore the reserves within its designated areas;

- the failure of the Venezuelan government to pay Petrodelta for all hydrocarbons sales since Petrodelta’s incorporation, recording them instead as an ongoing balance in the accounts of Petroleos de Venezuela S.A. (“PDVSA”), the Venezuelan government-owned oil company that controls Venezuela’s 60% interest in Petrodelta, and as a result disregarding Petrodelta’s managerial and financial autonomy;

- the failure of the Venezuelan government to pay Petrodelta in US dollars for the hydrocarbons sold to PDVSA, as required under the mixed company contract;

- interference with Petrodelta’s operations, including PDVSA’s insistence that PDVSA and its affiliates act as a supplier of materials and equipment and provider of services to Petrodelta;

- interference with Petrodelta’s financial management, including the use of low Bolivares/US dollars exchange rates to the detriment of the Company and to the benefit of the Venezuelan government, PDVSA and its affiliates;

- the forced migration of the Company’s investment in Venezuela from an operating services agreement to a mixed company structure in 2007.”

“We believe that in the arbitration Harvest’s investment will receive fair treatment and any award in favor of the Company will ultimately be enforceable against the Venezuelan Government,” Edmiston said during today’s call.

Arbitration Timeline

Describing the timeline for the arbitration process as ‘merely estimates’, Edmiston said that a specific timeline is difficult to project “but under a best case scenario, we could be looking at a hearing of the merits in late 2016 with a decision from the panel in mid to late 2017. As those of you who have followed the arbitration proceedings involving Conoco and Exxon-Mobil know, the process can, however, be lengthy.”

A Brief History of Venezuela’s March to Oil Nationalization

Reuters reported on the 2012 re-election of Hugo Chavez and his propensity to nationalize private industry in Venezuela. Below are the main oil-related nationalizations under Chavez, according to the 2012 Reuters report:

- “In 2007, Chavez’s government took a majority stake in four oil projects in the vast Orinoco heavy crude belt worth an estimated $30 billion in total. Exxon Mobil Corp and ConocoPhillips quit the country as a result and filed arbitration claims. Late last year, an arbitration panel ordered Venezuela to pay Exxon $908 million, though a larger case is still ongoing in 2012. France’s Total SA and Norway’s StatoilHydro ASA received about $1 billion in compensation after reducing their holdings. Britain’s BP Plc and America’s Chevron Corp remained as minority partners.

- *In 2008, Chavez’s administration implemented a windfall tax of 50 percent for prices over $70 per barrel, and 60 percent on oil over $100. Oil reached $147 that year, but soon slumped.

- *In 2009, Chavez seized a major gas injection project belonging to Williams Cos Inc and a range of assets from local service companies. This year, the energy minister said the government would pay $420 million to Williams and one of its U.S. partners, Exterran Holdings, for the takeover.

- *In June 2010, the government seized 11 oil rigs from Oklahoma-based Helmerich & Payne Inc.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Jan 20 Harvest Natural Resources Conference Call Transcript

Venezuela Arbitration Conference Call

January, 20, 2015

Thank you for joining us today. I am going to try to add a bit more color to the recent press release and 8-K where we announced our request for arbitration against Venezuela. I will try to summarize what such a proceeding looks like in terms of steps and timing as well as what this action means for the Company in strategic terms.

Let me state up front that while our decision to transit this route shouldn’t be surprising to most observers, it was not our preferred outcome. We simply had no other option to preserve our rights in this case. We are clear that pursuing arbitration will require the Company to make strategic shifts that soon become irreversible. So, I want to communicate clearly and I hope that Venezuela will understand that there remains a very short window of opportunity to urgently set things right before both parties march down the arbitration path. To that point, I don’t want to use this call to “vent” about how Harvest has been treated in Venezuela nor do I think it serves our purpose at this stage. As a result, I do not plan to hold a Q&A session on this call. As always, you are free to contact the Company directly with your questions in the coming days and weeks.

Let’s start with our Request for Arbitration and discuss some of the legal background, timing and issues related to the Request. Harvest filed the Request with ICSID, the International Centre for Settlement of Investment Disputes, an institution sponsored by the World Bank in Washington, D.C. For nearly 50 years, ICSID has served as a neutral arbitration forum for international investment disputes. Specifically, Harvest’s claims relate to the Government of Venezuela’s violations under the Netherlands – Venezuela Bilateral Investment Treaty, or BIT which the two countries signed back in 1991.

Harvest’s investment in Venezuela is entitled to protection under the Netherlands BIT since, through the years, the investment has been held by Dutch affiliates of Harvest. Although Venezuela terminated the Netherlands BIT in 2008, the Treaty contains a sunset provision under which investors continue to be protected until 2023.

Further, the Netherlands BIT provides for the resolution of investment disputes to be held before ICSID. ICSID has two sets of rules that determine how arbitration cases will be conducted: the ICSID Convention and ICSID’s Additional Facility. As many of you know, Venezuela denounced the ICSID Convention in 2012 and it has taken the position that it is no longer bound to arbitrate disputes under the ICSID Convention. I’m not going to get into the legal details, but Harvest believes this proceeding should be conducted under the ICSID Convention for several reasons, including the fact that as early as 2005 our Dutch affiliate party to the arbitration provided a notice of dispute letter under the BIT specifically consenting to arbitration under the ICSID Convention.

We believe that in the arbitration Harvest’s investment will receive fair treatment and any award in favor of the Company will ultimately be enforceable against the Venezuelan Government.

Our Form 8-K fiIed Friday contains a description of some of the conduct by the Venezuelan Government which we believe violates the Netherlands BIT. I can’t - and won’t - elaborate or go into further details with respect to the claims set forth in the Request, but the claims include:

-- the failure of the Government to approve two separate transactions the Company entered into to sell its interests in Petrodelta, transactions which had each been fully vetted with the appropriate authorities prior to undertaking either transaction. As you will recall, Harvest had entered into a transaction with Pertamina in 2012 to sell its 32% stake in Petrodelta for $725 million. And as we recently announced, the transaction to sell our remaining 20.4% interest in Petrodelta to Pluspetrol for $275 million terminated because of the failure to receive Venezuelan Government approval. As we noted in our announcement, in each of these transaction, the Government conditioned its approval on wholly unreasonable and extra-contractual conditions.

-- the failure of the Government to allow Petrodelta to pay approved and declared dividends of $12.2 million, as well as the failure to allow Petrodelta to approve and declare dividends since 2010.

-- the denial of Petrodelta’s right to fully explore and develop the reserves within its designated area.

-- the failure of the Government to make payment to Petrodelta for all hydrocarbons sales, recording them instead as an ongoing balance in the accounts of PDVSA, as well as the failure to pay Petrodelta for these hydrocarbons in U.S. Dollars.

-- interference with Petrodelta’s operations, including PDVSA’s insistence that PDVSA and its affiliates act as a supplier of materials and equipment and provider of services to Petrodelta.

-- interference with Petrodelta’s financial management, including the use of low Bolivares/US dollars exchange rates to the detriment of Petrodelta and to the benefit of the Venezuelan Government, PDVSA and its affiliates.

-- the forced migration of the Company’s investment in Venezuela from an operating services agreement to a mixed company structure in 2007.

These actions incrementally, and in total, violated Harvest’s rights as an investor and systematically thwarted the development of our investment in Venezuela as well as our ability to sell our interests there.

Now let me turn to the anticipated timing of the arbitration process, absent any near-term, good faith resolution of our dispute. Keep in mind that these are merely estimates and there are many factors that could influence this timing. We expect ICSID to officially acknowledge the Request for Arbitration in the next week or so and ICSID would then screen and register the Request. After registration of the Request, the parties will each appoint an arbitrator and the chairman will be agreed to or appointed by ICSID. Altogether, this process could take approximately six months.

Within 60 days of the appointment of the arbitration panel, a scheduling hearing will be held to set forth procedural matters relevant to the timeline of the case, such as deadlines for briefs, exchange and production of documents, hearing dates, etc. A specific timeline beyond this point is difficult to project but under a best case scenario, we could be looking at a hearing of the merits in late 2016 with a decision from the panel in mid to late 2017 As those of you who have followed the arbitration proceedings involving Conoco and Exxon-Mobil know, the process can, however, be lengthy.

Now let’s move on and discuss what this action means in terms of strategic plans and near term changes for the Company.

You will recall that the intended use of proceeds from the terminated Pluspetrol transaction was to present the Board of Directors the option of moving forward with further development, appraisal and exploration of our Gabonese Dussafu block where we have had outstanding success to date in our exploration program and where we are putting the finishing touches on our interpretation of the outboard 3-D seismic where we continue to believe order of magnitude potential exists relative to our current discoveries. On the other hand, even in the case of the Venezuelan sale having been consummated, the Board would also consider the option of a follow-on outright sale of Gabon and return of capital to the shareholders. So those were the range of options to be considered post-closing of the Venezuela sale. Management’s focus over the past several months has been to fully develop these options for the Board’s consideration. To that end, we have shut down all offices but Headquarters and Venezuela and cut our run rate to minimal G&A and technical and front-end engineering activities on Gabon. In parallel with those activities, we have been engaged over the past several months with a select group of interested parties in discussing commercial opportunities for our Gabon block including farm-ins as well as partial or outright sale. We continue to be very active in this regard.

As I mentioned before, Venezuela’s actions regarding the failed sale carry significant strategic consequences for our Company. Absent an urgent resolution of our dispute with Venezuela which provides the proceeds expected from the sale of our interests in Petrodelta, our strategic options are now more restricted to say the least. Accordingly, and given both the equity and debt markets at this point, a large recapitalization which would allow Harvest to move forward with our Gabon activities has become more challenging and seems unlikely. Rather, without a near-term resolution with Venezuela or a large recapitalization, the most likely outcomes would include shoring up near term liquidity in order to definitively market our Gabon interests and use the Gabon sale proceeds to a) fully fund the arbitration, b) extinguish any liabilities and finally, c) distribute the remainder to shareholders, effectively winding down the Company with the exception of the arbitration claim.

In the coming days, we will address near-term liquidity to get us through the above process. We expect our run rate to be in the $1.3 million per month range inclusive of our near term legal expense increase. Our preference is to place a bridge loan to a Gabon sale and/or we may tap the equity market to fund near term expenses only. We hope to have news on that front in the coming weeks.

Although I remain hopeful and open to a solution between the parties, we are not in a position to delay the actions described beforehand without a firm and urgent resolve on the part of the Venezuelan authorities to address the problem. And just to be clear, at this point no such discussions are taking place.

I hope this call has been helpful and you’re encouraged to follow up with us should you have any questions. Thank you again for joining us.