Energy Companies Discussed their Colorado Operations at EnerCom’s The Oil & Gas Conference 19®

Weld County, Colorado, is home to the Wattenberg Field, where horizontal drilling and hydraulic fracturing and complex well completion techniques are creating Colorado’s shale boom. Operators are going after oil and gas trapped in layers of shale about 7,000 feet beneath Weld County’s rich farmland and growing towns.

At EnerCom’s 19th Oil & Gas Conference®, several of the active drillers in the Niobrara-Codell shale play conducted investor presentations and answered analysts’ questions about horizontal drilling, completion strategies, and their present and future development plans for the oil-rich Niobrara. The key formations the companies are targeting include the Niobrara A, B and C benches and the Codell shale.

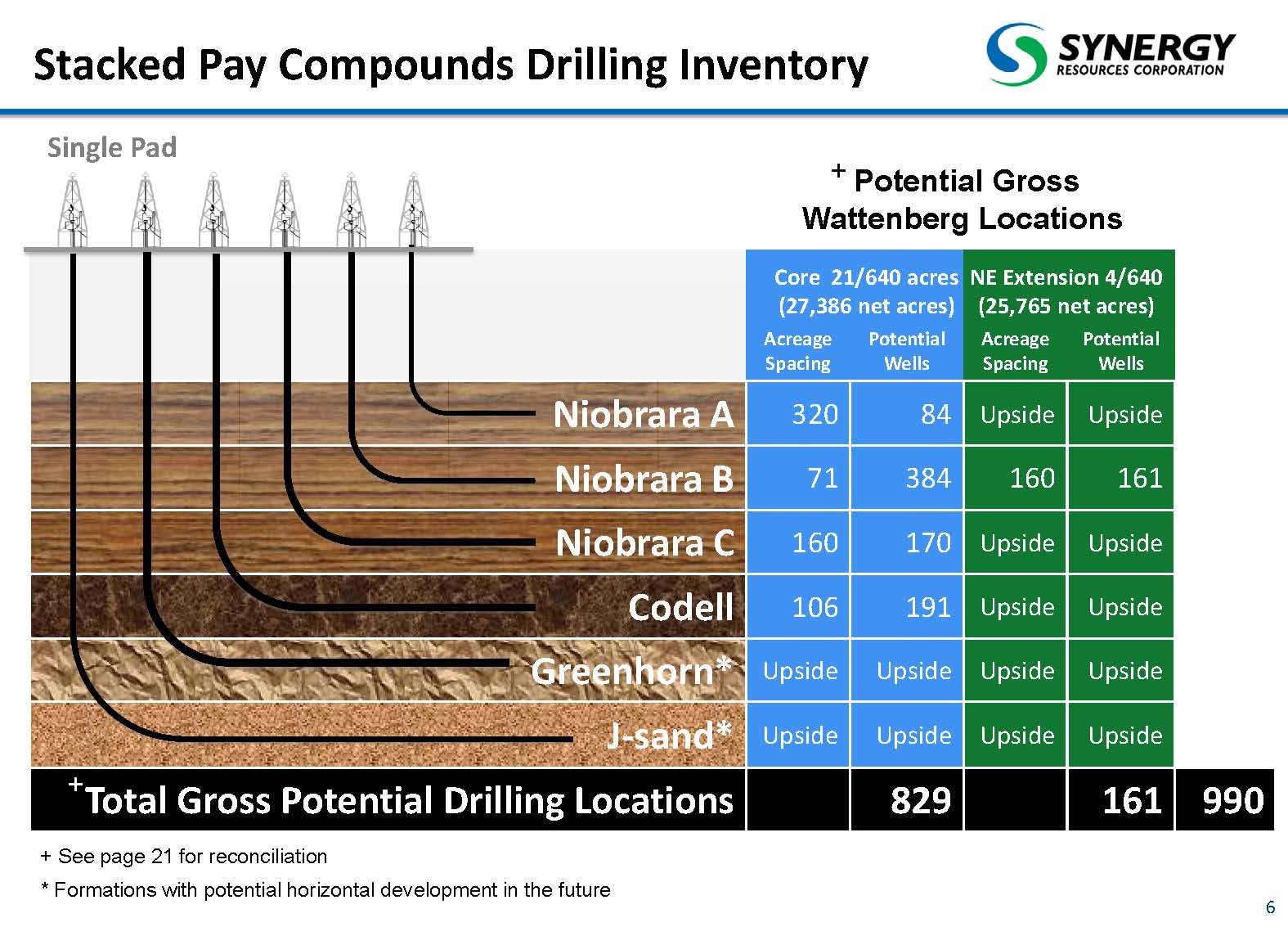

Synergy Resources (ticker: SYRG) has been actively drilling horizontal wells in Weld County not far from its corporate headquarters in Platteville, Colorado. Synergy reports it has 53,151 net Wattenberg acres, and its “stacked pay” drilling inventory includes almost 1,000 drill sites, where planned wells target different layers of the formation—Niobrara A, B, C, and Codell, as well as prospective formations like the Greenhorn and J-sand, which lie two layers below the Codell.

Source: SYRG Presentation 08.15.14

Synergy says it has a 100% success rate drilling 32 horizontal wells on its acreage, and nine horizontal pads are currently producing, in completion or being drilled. The company expects to have three rigs operating by the end of August.

At the EnerCom conference, a securities analyst asked Synergy to “talk about how your production has been affected by line pressures,” in reference to the need for increased takeaway capacity in the Wattenberg field. Craig Rasmuson, Synergy’s Chief Operating Officer, responded: “It took over 30 years to build out the 250 to 275 million cubic foot take away capacity per day. In three years, the field has tripled that. Our drill time is coming down dramatically, so we are completing more wells before line capacity is there.” He said with so much production coming on line, he projects takeaway capacity will just be able to keep pace and he expects takeaway capacity in the Wattenberg to remain “status quo until the end of 2016.”

A question was asked about operating “in this regulatory environment—what are your concerns and thoughts about it?” Jon Kruljac, Synergy’s VP of Capital Markets & Investor Relations, said, “We work within 12 different communities; we ask each of them ‘what are their concerns?’ and we go way over and above the state regulations.” Another question was posed: “Have all your efforts to educate the public made an impact?” Kruljac responded, “Just because those initiatives are off the ballot doesn’t mean we can stop educating. We started looking at our own methane emissions 12 months ahead of the regulators.”

Synergy is targeting a capital expenditure budget of $200 million to $225 million for FY 2015, of which it plans to use 89% for development drilling in the Wattenberg.

Source: BCEI Presentation 08.08.14

Bonanza Creek Energy (ticker: BCEI) is forecasting 24.2 MBOEPD (midpoint) of production for 2014, 70% liquids, from its operations in the Wattenberg Field’s Niobrara and Codell shale, where the company has drilled 180+ horizontal operated wells. In its investor presentation, the company says it has about 25 years of Wattenberg 3P inventory (~3,500 gross drilling locations) at its current drilling pace.

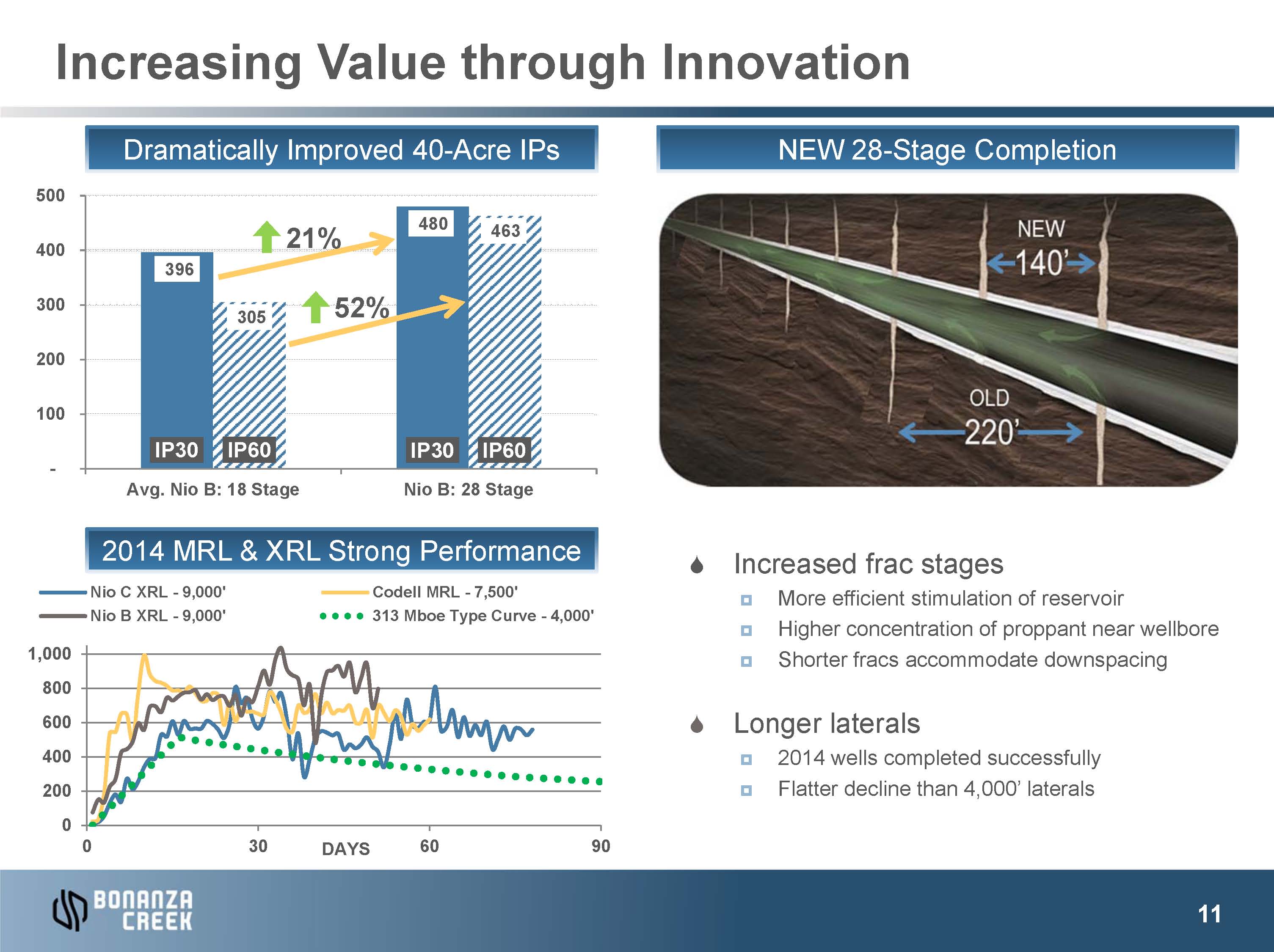

Bonanza Creek said it is using increased frac stages, more efficient stimulation of the reservoir, higher concentrations of proppant near the wellbore, shorter fracs to accommodate downspacing, and longer extended reach laterals that have a flatter decline curve than 4,000’ laterals.

The company said 80% of its CapEx budget is targeting the Niobrara B and C benches of the Wattenberg, with an eye towards expansion to the thinner Codell zones. Tony Buchanon, Bonanza Creek’s EVP and Chief Operating Officer, summed up the program as follows: “More fracs, more frac stages and shorter frac lengths.” In the breakout session, Buchanon said, “Extended reach laterals—that’s the future, that’s where we’re headed.”

Whiting Petroleum (ticker: WLL), which is now the largest operator of North Dakota’s Bakken shale formation, is targeting Niobrara properties northeast of the Wattenberg field called the Redtail prospect. Whiting says its objective is the Niobrara “A” and “B” benches. The company plans a mix of 960 and 640‐acre spacing units, respectively, with eight wells per spacing unit in each bench. Whiting says it has 3,300+ potential drilling locations on approximately 128,000 net acres in the Redtail prospect. Horizontal wells are being budgeted at $5.5 million each.

Whiting’s first 8‐well pad, the Razor 27I (4 Niobrara“A”; 4 Niobrara “B”), came online April 15, 2014. The pad was producing 4,699 BOE/d as of July 21, 2014 . The company said it has spud the Horsetail 30F super pad that will test 32‐well spacing in the Niobrara “A”, “B” and “C” zones and results are expected in early 2015.

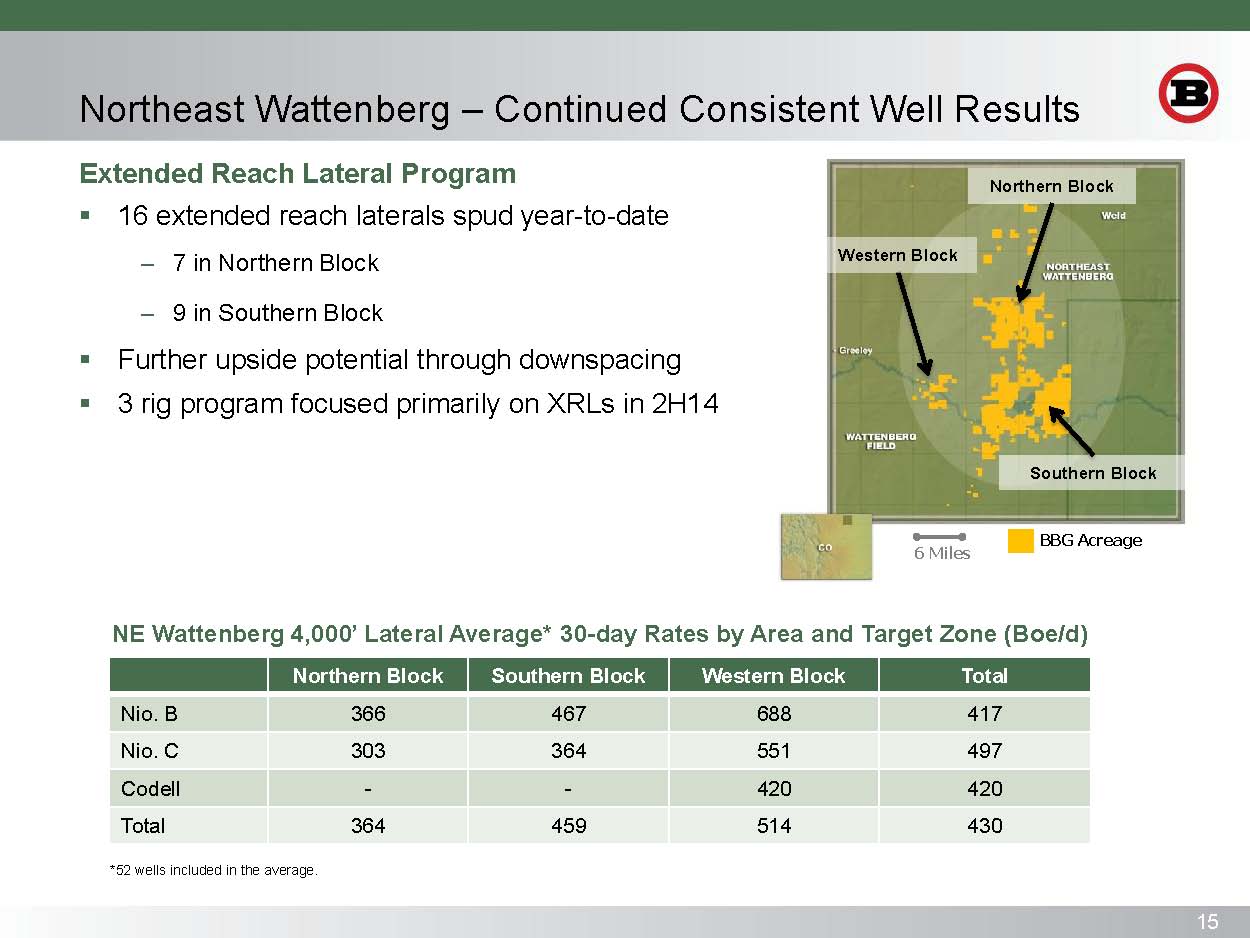

Source: BBG Presentation 08.17.14

Bill Barrett Corporation’s (ticker: BBG) 2014 CapEx budget is weighted heavily toward development of its assets in the Denver Julesburg Basin, which it calculates is 75% oil. Of its projected $500 million – $550 million capital budget, 75% is slated for the D-J. Of the company’s approximate 76,000 acres in the D-J, more than 53,000 acres are in the Wattenberg, where it has 750 net undeveloped drilling locations targeting the Niobrara and Codell.

With respect to its standard reach lateral wells, the company said it has cut its drilling cost per foot in half since 2012 and reduced drilling days per well to 10.1 from 17.1 in the same period.

On the horizontal wells, Scot Woodall, Bill Barrett Corporation’s President and Chief Executive Officer, said the company was testing five pilot projects in the Wattenberg and that drilling days from spud to rig release have been shortened to 16 days. In response to a question about completion design evolution, he said they were testing completion techniques in extended reach laterals. Techniques for 25 stages included varying the amount of sand from 4 million pounds to 6 million pounds, and in the 40 stage completions varying the sand from 9 million pounds to 12 million pounds. Testing is also underway for plug ‘n’ perf vs. sliding sleeve completions as well as different fluid designs.

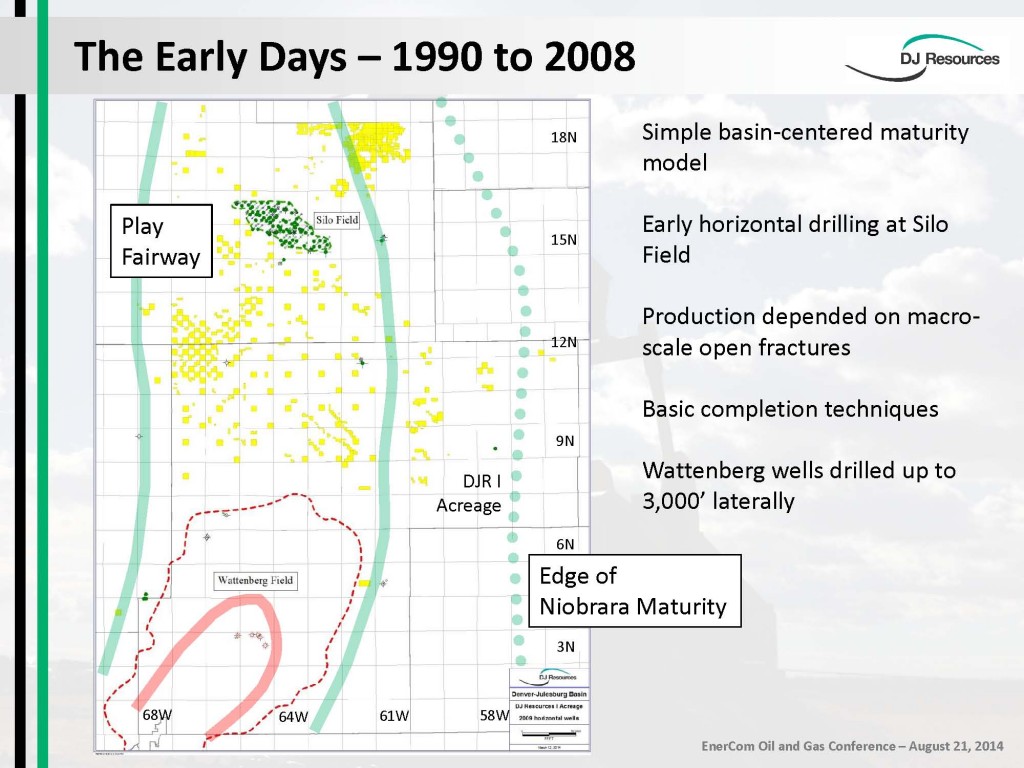

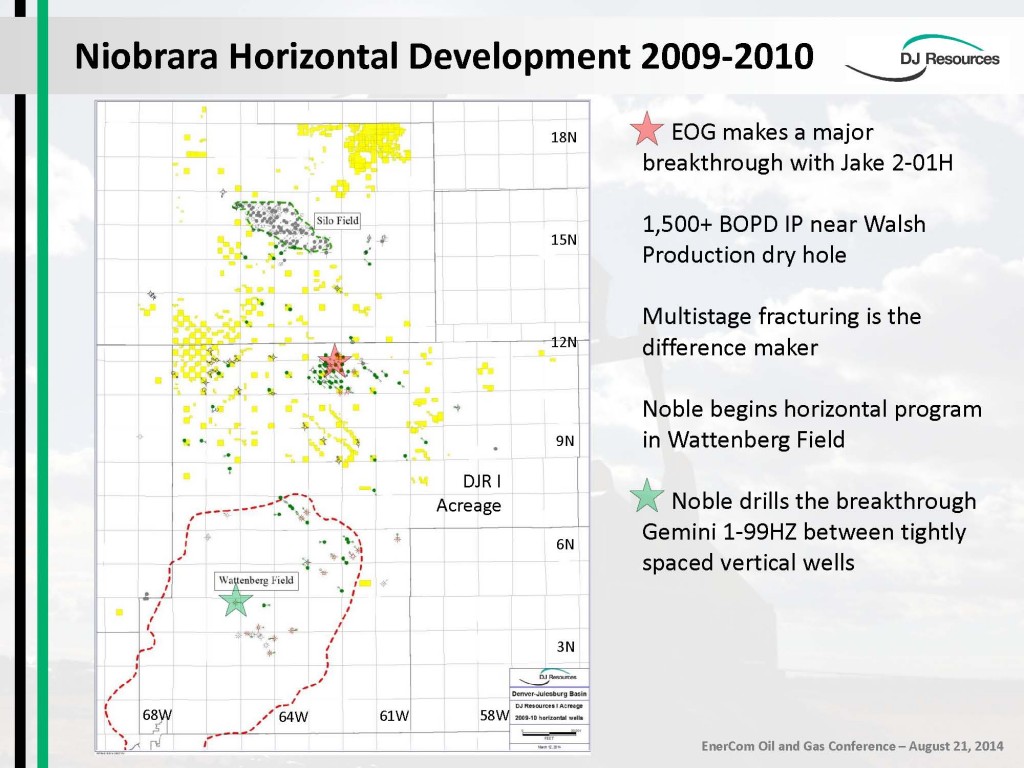

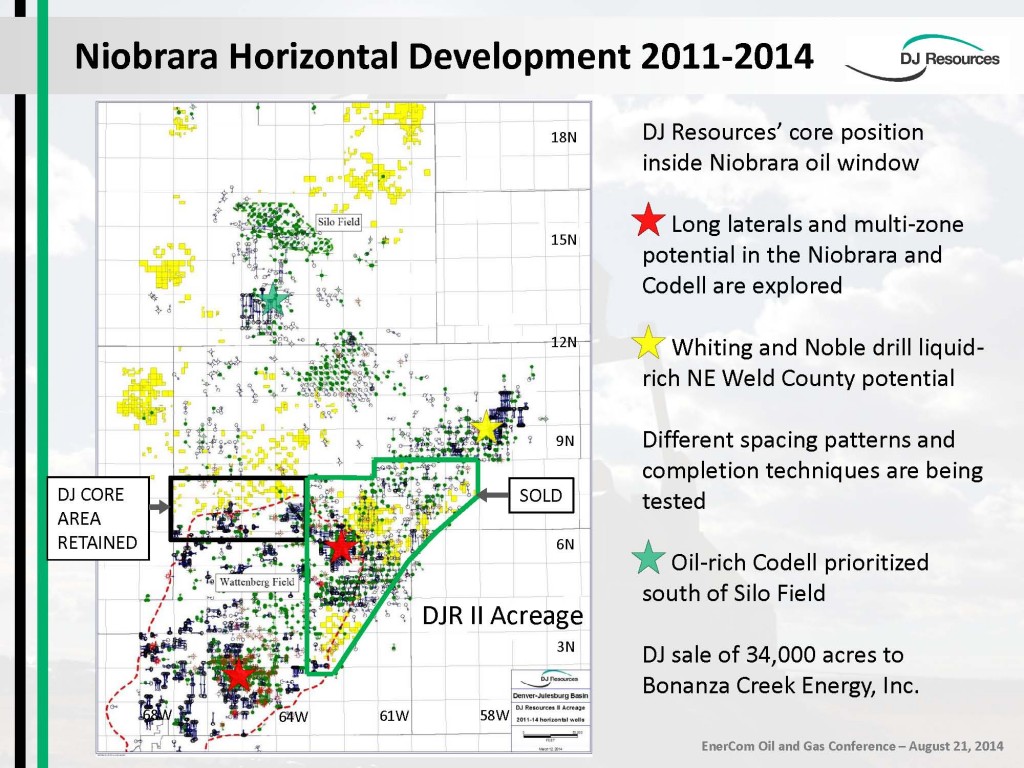

DJ Resources highlighted the evolution of the D-J Niobrara playduring a “Private E&P Company Panel Discussion” at the EnerCom conference..

DJ Resources’ President David Lehman said that they liked the D-J Basin for a number of reasons. “We saw it as an oily play. If the mechanics of horizontal drilling worked as well here as in the Bakken, we thought the play in the D-J would be much more economic, that costs would come down to the $50 – $60 per barrel range.”

DJ Resources has 10,000 acres in the North Wattenberg and is targeting development drilling in Q1’15.

What Economic Impact Does the Oil & Gas Business Have on Colorado?

Colorado Governor John Hickenlooper addressed the EnerCom conference, saying that Colorado was recently named the nation’s fastest growing economy, and that “our job is to create a regulation environment that allows businesses to succeed.” The governor noted that oil and gas is a $30 billion industry in the state that delivers 120,000 jobs with an average wage 30% above the state’s median wage. The governor pointed out that “horizontal drilling and hydraulic fracturing have brought oil and gas production to places where it’s never been.”

The introduction page to the University of Colorado’s Leeds School of Business’ 2012 Assessment of Oil and Gas Industry: Industry Economic and Fiscal Contributions in Colorado delivers a clear picture of what the billions spent by Niobrara-focused companies mean to Colorado, in terms of economic impact:

“Much of Colorado’s oil and gas is sold outside of the state, contributing wealth to owners, employees, governments, and schools, all of which are beneficiaries of oil and gas revenues. In 2012, Colorado’s oil and gas industry recorded $9.3 billion in production value, accounting for some 29,300 direct drilling, extraction, and support jobs with average annual wages in excess of $101,000. Coupled with the oil and gas supply chain within Colorado—transportation, refining, wholesalers, parts manufacturers, and gasoline stations—direct employment totaled more than 51,200 jobs, with average wages over $74,800, which are 49% higher than the state average for all industries. Collectively, this industry contributed slightly more than $3.8 billion in employee income to Colorado households in 2012, or 2.8% of total Colorado salary and wages. In addition, $614 million went to private land owners in 2012, assuming private land owners capture royalty and lease terms similar to those of the government.

“The oil and gas industry contributed substantial public revenues in 2012—totaling nearly $1.6 billion, of which $1 billion was derived directly from severance taxes, public leases, public royalties, and property taxes. This industry is subject to taxes and assessments beyond what other industries contribute. Ad valorem taxes, for instance, are 3 times higher for oil and gas production than for commercial property within the state and 11 times higher than residential property. Oil and gas property taxes exceeded an estimated $600 million in 2012.

“Severance taxes paid by the industry totaled $163 million in 2012. The industry also paid $275 million in royalties to state and federal governments in 2012, of which $160 million stayed within Colorado. The State of Colorado received almost $80.7 million in state lease revenue from oil and gas in 2012, a record high. Oil and gas prices tended to be relatively volatile from 2000−2012, causing government revenue driven by production value to fluctuate year to year. Prices have demonstrated greater stability since 2010, and price stability is expected moving forward, primarily due to greater reserve estimates and technological improvements in drilling and extraction.

“While this industry has substantial operations on state and federal lands, a vast majority—more than 69%—transpires on private lands. As oil production ramps up in Colorado, oil and gas in the state is no longer dominated by gas production. In 2012, gas accounted for 51% of total sales-based value of production, followed by oil at 45.6%.”

To view the presentations and webcasts of these and other companies that presented at EnerCom’s The Oil & Gas Conference 19®, please click here.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.