While TransCanada’s $8 billion project hangs in the balance, Canadian oil is already moving south

The landslide Republican victory in this month’s midterm elections will prompt changes in the business of politics and in the U.S. economy, but will they include the Keystone XL pipeline?

The House of Representatives approved the Keystone pipeline earlier today by a count of 252-161, with all 221 Republicans and 31 of 192 Democrats pushing for approval of the landmark pipeline. The measure now lands in the Senate, which may issue votes as early as Tuesday. House lawmakers were confident the Senate would follow suit and pass its version of the bill, but supporters were still one vote shy of the 60 needed to overcome a filibuster.

The House of Representatives approved the Keystone pipeline earlier today by a count of 252-161, with all 221 Republicans and 31 of 192 Democrats pushing for approval of the landmark pipeline. The measure now lands in the Senate, which may issue votes as early as Tuesday. House lawmakers were confident the Senate would follow suit and pass its version of the bill, but supporters were still one vote shy of the 60 needed to overcome a filibuster.

The current makeup of the Senate includes 53 Democrats, 45 Republicans and two independents who have typically sided with the Democrat majority. If the Keystone XL bill makes it through the Senate, it will land on the desk of President Obama to sign into law or veto. The Obama administration has been studying the project for more than six years.

Speaking at a news conference in Yangon, Myanmar, President Obama said that his position on the pipeline has not changed. Obama cited pending legal action in Nebraska and said it was hard to evaluate the pipeline proposal until the actual route was known. The president has vetoed only two bills in his tenure as chief executive.

“I have to constantly push back against this idea that somehow the Keystone pipeline is either this massive jobs bill for the United States or is somehow lowering gas prices. Understand what this project is: It is providing the ability of Canada to pump their oil, send it through our land down to the Gulf where it will be sold everywhere else. It doesn’t have an impact on U.S. gas prices,” the president was quoted by Bloomberg.

The Senate would need a two-thirds majority to override a presidential veto.

Booming Oil Production Sending Oil across North America

The United States shale boom, combined with increased oil imports from Canada, have reduced the need to import oil from traditional powerhouse producers like OPEC. The Energy Information Administration (EIA) reports United States imports have declined every year since 2005’s total of approximately 5,000 MMBO. The total from 2013 is roughly 28% less, at approximately 3,600 MMBO. In the meantime, reliance from OPEC has dropped from 2,039 MMBO to 1,358 MMBO (33%) while imports from Canada have increased from 796 MMBO to 1,147 MMBO (44%). On a share basis, OPEC dropped from 41% of the U.S.A.’s 2005 imported total to 38% of 2013’s total, while Canada’s share has doubled from 16% to 32% in the same time period.

The Market Has Moved Beyond Keystone

“The market has moved beyond Keystone,” Bloomberg BusinessWeek reporter Matt Phillips commented in a television interview this week. “In the past four years the amount of Canadian crude that’s made it to the U.S. Gulf Coast is up 80%. … Some of it goes into Chicago and what we’re going to get in the next couple of days is the opening of a pipeline that [takes the oil] from Chicago to Cushing [Oklahoma oil storage terminal] and from there [it moves] to the Gulf Coast.” Phillips was referring to the Flanagan South Pipeline.

Flanagan South Pipeline to Open Soon

Enbridge Pipelines L.L.C. (ticker: ENB) is nearing completion of construction of its Flanagan South pipeline, a nearly 600-mile, 36-inch diameter interstate crude oil pipeline that originates in Pontiac, Ill. and terminates in Cushing, Okla., crossing Illinois, Missouri, Kansas, and Oklahoma.

Enbridge is installing seven pump stations along the pipeline route which will help take initial capacity from 600,000 BOPD to ultimate design capacity of about 880,000 BOPD. The Flanagan South Pipeline will provide the additional capacity needed to bring increased North American crude oil production to refinery hubs on the U.S. Gulf Coast.

By comparison, the Keystone XL pipeline is designed at peak capacity to carry 830,000 BOPD to Gulf Coast and Midwest U.S. refineries.

Canada’s Crude is Moving across the U.S. with or without Keystone XL

Despite the increased U.S. reliance on Canadian crude oil, Bart Demosky, Chief Financial Officer of Canadian Pacific Railway Ltd. (ticker: CP), told the Financial Post that there is “no way” the Keystone pipeline, or any other key pipelines, will be completed in the near future. “There are far too many roadblocks to be overcome any time soon for that to be an outlet for crude,” he said. “Rail will fill the space.”

Despite the increased U.S. reliance on Canadian crude oil, Bart Demosky, Chief Financial Officer of Canadian Pacific Railway Ltd. (ticker: CP), told the Financial Post that there is “no way” the Keystone pipeline, or any other key pipelines, will be completed in the near future. “There are far too many roadblocks to be overcome any time soon for that to be an outlet for crude,” he said. “Rail will fill the space.”

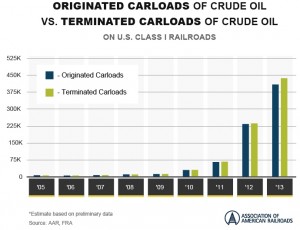

As evidenced by the EIA stats, the feet-dragging involved with Keystone has not prevented oil north of the border from reaching U.S. soil. While the KXL remains in limbo, the current pipelines have reached near capacity and the rail industry has increased capacity to meet crude oil transportation needs. Demosky expects his company to haul 200,000 carloads in 2015 – up from 120,000 this year. CP’s Chief Operating Officer, Keith Creel, said one-third of expected revenue gains through 2018 will result from crude oil shipments, aided by future infrastructure build-out.

Canadian Pacific Railway operates about 40% of its business in the Bakken Shale – the target of the majority of its future construction plans.

The EIA reported rail carloads of crude increased by 13% relative to last year in a brief released on November 13. A report from Michael Bourque, President and Chief Executive Officer of the Railway Association of Canada, said total carloads from Canada amount to roughly 230 MBOPD – more than four times the volume from 2009. He expects the growth rate to continue in the near future. “Energy customers appreciate the fact that they don’t have to enter into a long-term contract with railways to move their product,” he said. “At the same time, if they want to add more volume, they can. The energy by rail model is flexible in that it can be tailored to meet the changing needs of the customer in a dynamic marketplace.”

BNSF Railway has seen an increase in rail traffic out of North Dakota of 194% since 2009. The company’s energy-related commodities—primarily crude oil and frac sand—have grown their shipping volumes by 12% over last year. Approximately 65,000 units of crude oil have been handled by BNSF through Oct. 31, 2014, compared to the number handled in same 10 months of 2013.

BNSF Railway has seen an increase in rail traffic out of North Dakota of 194% since 2009. The company’s energy-related commodities—primarily crude oil and frac sand—have grown their shipping volumes by 12% over last year. Approximately 65,000 units of crude oil have been handled by BNSF through Oct. 31, 2014, compared to the number handled in same 10 months of 2013.

The rapid growth of crude oil production in the U.S. mixed with a deficit of oil pipeline infrastructure has led to increased crude-by-rail shipments across the nation and has fueled a safety debate to the side of the Keystone XL political wrangling.

“Oil trains in the U.S. and Canada were involved in at least 10 major accidents during the last 18 months, including an explosion in Lac-Mégantic, Quebec, that killed 47 people,” according to a report by the AP on CBC News.

As a result of the safety concerns about shipping oil by rail, North Dakota announced Thursday that new rules would require the volatility of crude to be reduced before it can be shipped by rail. “State Mineral Resources Director Lynn Helms told the state Industrial Commission that all crude from North Dakota’s oil patch would have to be treated to remove certain liquids and gases to ‘ensure it’s in a stable state’ before being loaded onto rail cars,” the AP reported.

Oil and gas industry officials said stripping liquids and gases from Bakken crude oil “would result in even more volatile products that would still have to be shipped by rail … [and cause] additional emissions due to heating the oil to remove gases,” Ron Ness, president of North Dakota Petroleum Council, told the AP. Other safety initiatives are already underway, including moving to new-design oil tank cars with additional safety features.

Not Waiting for Washington

Regardless if the Keystone passes both houses and is signed into law, the oil and gas industry will find other ways to get its products to market. “If we just sat around and waited for Washington, we’d never get anything done,” Valero spokesman Bill Day said to The Wall Street Journal last year.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.