Enhanced oil recovery (EOR) is being mentioned with more and more emphasis in the margin-tightened oil price environment, and Husky Energy (ticker: HSE) is employing methods to generate more from its oil sands projects in western Canada.

The Calgary-based company placed online its Rush Lake thermal project this week – nearly two months ahead of schedule. The use of thermal production techniques, which is a steam stimulated method and first began in the 1980s, is a staple of Husky’s near-term growth.

The company plans on placing three more projects online in 2016 as it accelerates its heavy oil segment. “Five years ago, we had two heavy oil thermal projects in production and by the end of 2016, we will have ten projects onstream,” said Asim Ghosh, Chief Executive Officer of Husky Energy. Projects generally take about two years to complete construction and then have an operating life of more than 15 years.

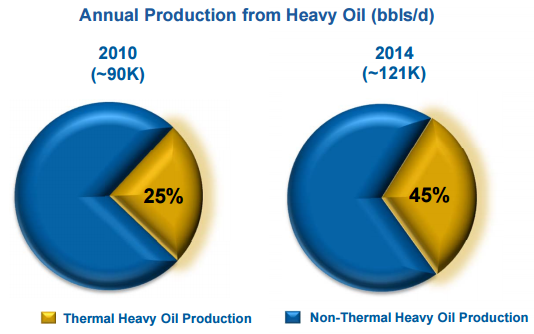

According to a company news release, the proven EOR method and repeatable construction templates provide “Low operating costs, good netbacks and low execution risk, these projects offer good returns even in a low price environment.” Husky’s current production from thermal projects is approximately 44.0 MBOPD, and the incoming projects will boost output to a combined total of 78.5 MBOPD. In 2014, the unconventional method provided more than one-third of HSE’s heavy oil volumes.

An article by Reuters places the breakeven cost of thermal projects at around $45 per barrel. “Most of the (thermal) projects are going to have positive netbacks at that price,” said Michael Dunn, an analyst with FirstEnergy Capital. Husky holds a competitive advantage due to its midstream and downstream segments, allowing an integrated refining process. In its Q1’15 conference call, management said additional infrastructure and 600 MBO of storage was added to handle the anticipated production increases.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.