The IEA’s monthly report places demand growth down from its five-year 2015 high

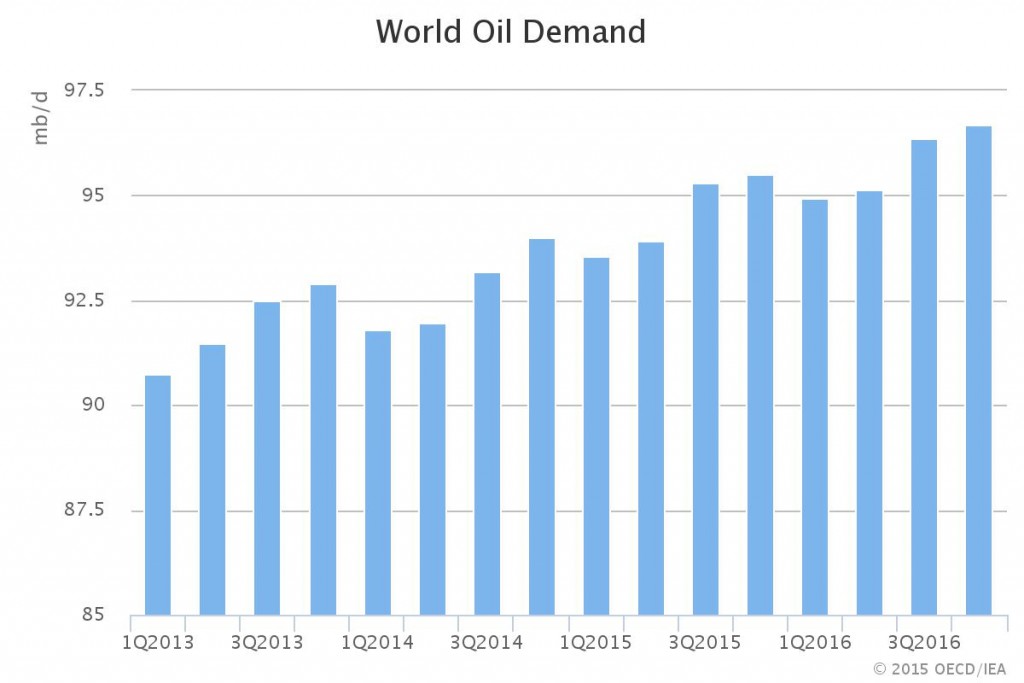

The International Energy Agency (IEA) released its monthly report today, saying it expects global demand growth for oil to slow to 1.2 million barrels of oil per day in 2016. Demand growth in 2015 reached a five-year high of 1.8 MMBOPD, but momentum will ease towards its long-term trend as lower oil prices, colder-than-year-earlier winter weather and post-recessionary bounces in some countries slow demand growth, according to the IEA.

Even with demand at a five-year high, production continued to outpace the quantities of oil that the market could absorb. High global oil output has increased stockpiles of oil to a record three billion barrels, according to the agency.

The stock overhang that first developed in the U.S. on the back of soaring North American crude production, has now spread across the OECD.

Since the second quarter, inventories in Asia Oceania have swollen by more than 20 million barrels. In Europe, record high Russian output and rising deliveries from major Middle East exporters are filling the tanks. Crude oil stocks are also piling up in the non-OECD, with China building inventories at a 0.7 MMBOPD clip during the third quarter and India starting to pour oil into its strategic reserves. This surplus crude provides some relief, with OPEC’s spare production buffer stretched thin as Saudi Arabia – which holds the lion’s share of excess capacity – and its Gulf neighbors pump at near record rates.

Lower prices have continued to push North American rig counts down, with the most recent tally showing another decline this week in total rigs, even as rigs drilling for oil rose.

The IEA also noted that OPEC production remained above its self-imposed 30 MMBOPD production target, despite a slight decline this month, crude oil benchmarks WTI and Brent narrowed due to a strong U.S. dollar, and global refinery runs sank by 1.2 MMBOPD to 78.2 MMBOPD with seasonal maintenance in full swing.