The EIA released a report showing its expectations for the refining sector based on U.S. oil production and whether or not crude oil export laws are reversed

How increased production and U.S. export laws might affect refiners has been a topic of considerable debate, so much so in fact that the Energy Information Administration (EIA) decided that not only would it do its own analysis of possible outcomes, but it even retained Turner, Mason & Company (TM) to help paint the most accurate picture. The EIA said that retaining TM would allow for much greater detail in its model than could be achieved purely though the administration’s resources.

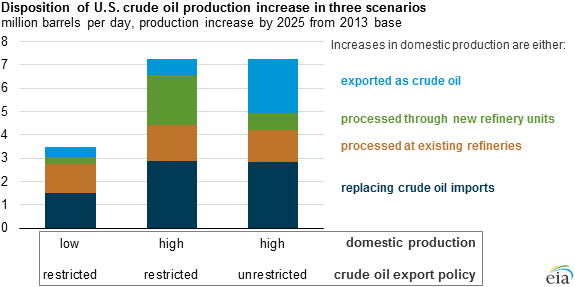

The analysis considered operational changes and investments in capacity expansion that domestic refiners would likely make to process increasing volumes of light oil. The analysis covers the period from 2014 to 2025, using 2013 as a base year, and looks at high and low domestic production, as well as crude oil export policy, to create different scenario pairings.

One pairing, combining low crude oil production and unrestricted crude oil exports, was considered, but ultimately not included in the analysis. This scenario was not materially different from the low crude oil production under current crude oil export restrictions, according to the EIA.

The results

In all cases considered, higher domestic crude oil production leads to a decline in crude oil imports, an increase in refinery runs, new investments to expand processing capacity and higher crude oil and petroleum product exports, according to the report. However, the magnitude of the changes and the complexity of the new processing units added vary across scenarios.

In the “High Production/Crude Exports Restricted” scenario, overall crude production is expected to increase by 7.2 MMBOPD by 2025, the same amount as in the “High Production/Crude Exports Unrestricted” scenario, but new refinery unit runs are expected to increase by 2.1 MMBOPD, three times as much as in the unrestricted exports model. New refinery investment would reach $11 billion in the restricted export model, reflecting the greater need for refiners to process the increased production. The Brent-WTI price spread would average $13.78 per barrel from 2015 to 2025, according to the report.

In the High Production/Crude Exports Unrestricted model, new refinery unit runs would only reach 0.7 MMBOPD as much of the new production is exported, rather than refined domestically. New refinery unit investment would also be substantially lower, totaling just $2.3 billion by 2025. Crude exports would reach 2.4 MMBOPD by 2025, three times more than the 0.8 MMBOPD of exports expected in the High Production/Crude Exports Restricted model, with WTI receiving a much more favorable price against Brent, with the Brent-WTI price spread averaging just $6.64 per barrel.

It is worth noting that while crude exports are understandably much higher in the unrestricted export model, the export of refined products is substantially lower. In the restricted model, net refined product exports are expected to total 4.5 MMBOPD by 2025, while only reaching 2.9 MMBOPD in the unrestricted crude export model.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.