Flaring volumes remain steady as production rises; flaring less than 22% of NatGas may not happen anytime soon

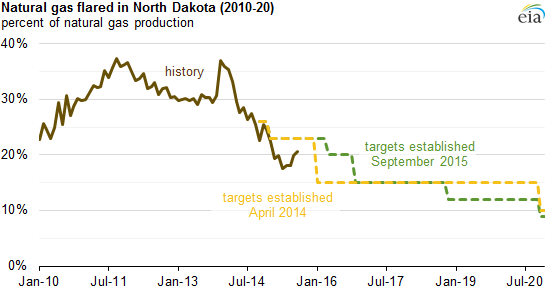

North Dakota has been working to lower the percentage of the natural gas flared inside the state, with a goal set to lower the percentage of flared natural gas to just 15% by the end of first-quarter 2016. Historically, North Dakota flared more than 35% of its natural gas production, according to information from the Energy Information Administration (EIA).

Increases in crude oil production have resulted in increased associated natural gas production from oil reservoirs, especially in the Bakken. Because of insufficient infrastructure to collect, gather, process and transport the natural gas that comes along with the state’s vast oil production, about one-fifth of North Dakota’s natural gas production is flared rather than marketed.

North Dakota’s Industrial Commission (NDIC) has established natural gas capture targets in an effort to reduce the amount of flared gas, and the NDIC recently issued a revision to the flaring targets in response to faster-than-expected gas production growth in the Bakken region.

North Dakota’s current target is to capture and sell at least 78% of total natural gas gross withdrawals, or flare just 22% of the state’s natural gas output. Based on the targets established in April 2014, the percentage of flared gas was set to fall to 15% in January 2016 and to remain at that level until 2021. However, on September 24, 2015 the NDIC slightly loosened the restrictions in the near term, allowing 22% to be flared through the first quarter of 2016, with the targeted decline to 15% taking place in November 2016.

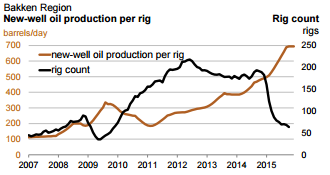

Even as the rig count in the Bakken falls to five-year lows, production efficiency on new rigs continues to climb. While the overall production coming out of the Bakken has tapered off as the overall rig count in the region continues to fall, the high level of produced gas associated with the wells currently on line has left overall volumes of flared gas at similar levels even as production climbs.

The NDIC’s targets are based on percentages rather than volumes due to the difficulty in anticipating volumes of flared gas, but the EIA reports that while the percentage of natural gas flared is down in North Dakota, the volume has remained relatively unchanged due to higher production. In 2014, flared volumes in the state reached 0.35 billion cubic feet (Bcf) per day, according to the EIA.

The NDIC’s targets are based on percentages rather than volumes due to the difficulty in anticipating volumes of flared gas, but the EIA reports that while the percentage of natural gas flared is down in North Dakota, the volume has remained relatively unchanged due to higher production. In 2014, flared volumes in the state reached 0.35 billion cubic feet (Bcf) per day, according to the EIA.

Since the beginning of 2014, growth in natural gas processing infrastructure has kept pace with overall natural gas production growth. However, existing infrastructure still faces a number of challenges. Although new infrastructure and limits on producing from wells not connected to gathering lines have reduced the amount of flaring at unconnected wells, wells that are connected to gathering lines have flared about 15% of total gross withdrawals over the past two years. Even these wells may require compression and capacity additions to handle the region’s rapid gas production growth.

Natural gas has fewer large scale transportation options than oil – it must be moved by pipeline. Once gas leaves the wellhead, a pipeline gathering system transports much of the gas to a processing plant that dehydrates the gas, extracts contaminants, and separates NGLs, then sends the gas to the mainline transmission system. As Bakken gas is typically “wet,” with a high NGL ratio, it also needs to be compressed at a compressor station before being sent to a gas processing plant, reports the U.S. Department of Energy.

The amount of flared gas in North Dakota was down to 19%, according to a release from North Dakota’s Department of Mineral Resources released today. But the department told Oil & Gas 360® that hitting the 15% target by the second quarter of next year would be dependent upon the completion of gas plants in the coming months.

Who’s building infrastructure to gather and transport ND’s gas to market?

The Williston’s location and infrastructure buildout has historically made the product more difficult to get to market, and its frigid winters are capable of literally freezing operations. North Dakota’s revenue estimations take a 15% discount to West Texas Intermediate into consideration, which has stayed consistent since 2012. The lack of infrastructure is also the direct reason gas is flared off as companies were previously trying to get as much oil as fast as they could.

Companies with interests in the Williston have been looking for ways to correct this problem. Midstream companies have invested billions into North Dakota infrastructure to handle the surging hydrocarbon volumes. ONEOK, Inc. (ticker: OKE) is the largest gas processor in the Bakken and has increased its pipeline mileage to 673,000 miles in September 2014 compared to 350,000 miles in April 2012. In that time, OKE’s anticipated expenditures ballooned to as much as $8.2 billion through 2016, compared to estimates of $1.8 billion in investment from 2012 to 2014. Eight new natural gas plants operated solely by OKE have either been completed or are in the process of completion since 2010, allowing the midstream provider to have 11 times the processing capacity by 2016.

In an interview with Oil & Gas 360®, Director of North Dakota DMR Lynn Helms said that he expects midstream capacity to continue expanding next year as well.

“We’ve had meetings with the midstream, gathering and gas processing guys, and they’ve indicated that they’re going to continue their investments at the same pace as last year,” said Helms.