Sanctions lifted on Iran

Iran has officially carried out all measures required to start the Joint Comprehensive Plan of Action (JCPOA) and begin the implementation of sanctions relief, according to a statement from the International Atomic Energy Agency (IAEA). Saturday, called Implementation Day under the JCPOA, marked the beginning of the end of sanctions against Iran regarding its nuclear program.

The lifting of sanctions offers Iran a chance to reenter the global community, with increased access to international banking, the release of previously frozen assets, and the ability to sell its crude oil in international markets. U.S. sanctions regarding Iran’s support for terrorism, human rights abuses, and missile activities will remain in effect and continue to be enforced, according to The White House.

Adding to the global glut

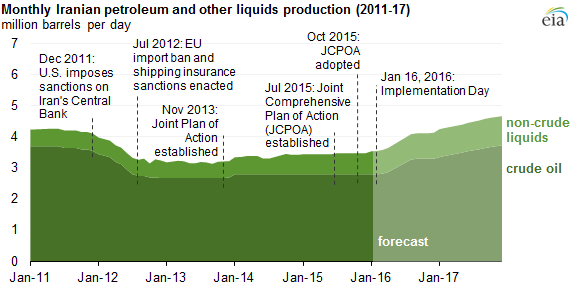

Estimates for how much crude oil Iran could bring back online immediately following the lifting of sanctions typically fall in the range of 300-500 MBOPD. The Islamic Republic’s production has remained relatively flat over the last three years, averaging 2.8 MMBOPD, or 9% of total OPEC output, according to the Energy Information Administration (EIA). Iran’s production is projected to increase to 3.1 MMBOPD this year, and then to 3.6 MMBOPD in 2017, the EIA said.

Most of Iran’s forecast production growth comes from Iran’s preexisting crude oil production capacity that is currently shut in, while the remainder comes from newly developed fields. Fields developed in conjunction with Chinese companies in the past several years have the potential to add 100-200 MBOPD of production capacity by 2017.

The rate at which those increases might happen is still uncertain, however. Iran has 30-50 million barrels stored offshore in tankers, most of which is condensate, and crude oil stored at onshore facilities. Most of the additional exports from Iran are expected to come from storage initially, with meaningful production increases taking place after a draw down on storage.

These additions could push oil prices down by $10 per barrel next year, according to The World Bank. Despite another leg lower in oil prices, The World Bank expects that Iran’s reintegration into world markets will cause economic growth “to surge to about 5% in 2016 from 3% [in 2015].”

Access to new capital

In addition to allowing Iran back into global markets, the end of sanctions also means that billions of dollars in frozen assets will become available to Iran. Estimates range from $55 billion to over $100 billion, but problems surround how that total is calculated according to Morningstar senior fellow and director of research at the Washington Institute for Near East Policy Patrick Clawson.

Reports evaluating Iran’s frozen assets do not include tangible property, while other funds, like those held in Iran’s Central Bank, have been committed already despite being frozen.

“Iranians are learning how to use these funds to purchase items in the countries where they are being held; that is, most of the restrictions only prevent use of the money to buy goods from third countries. Both Treasury Secretary Jacob Lew and Central Bank of Iran (CBI) governor Valiollah Seif have stated that $20 billion or more of these restricted funds are already committed for future Iranian purchases, arguing that this money should not be included in any calculation of assets that will become available to Iran once the nuclear deal is implemented,” wrote Clawson.

“Anyone who is introducing more supply … is going to make it worse” – U.A.E. energy minister

Iran’s partners in OPEC defended the country’s right to increase production, but cautioned that it would make the market situation worse for everyone.

“Anyone who is introducing more supply into the market in the current situation is going to make it worse. That’s obvious; I don’t think we need a scientist to tell you that … that’s the bad news,” said U.A.E. Energy Minister Suhail bin Mohammed al-Mazrouei, reports The Wall Street Journal.

“Does Iran have the right to do so? Yes, of course. They are a member of [the Organization of the Petroleum Exporting Countries] and they are entitled, all of the rights, to produce whatever they want, whether it’s 100,000 or 200,000 or 500,000 [barrels per day] … but is this going to help the situation? No.”

The U.A.E. and other Persian Gulf members of OPEC like Saudi Arabia have led the continued policy of producing near capacity in order to protect market share. By keeping markets oversupplied and prices low, OPEC hopes to push higher-cost competitors like U.S. shale out of the market.

“You need to let the market balance itself,” said al-Mazrouei. “Yes the prices are not the right prices for anyone, but why do we concentrate only on the Gulf States? Non-OPEC [nations] are responsible for 60-70% of the production. Most of those are commercially not viable in my view … Let’s not just put the concentration on OPEC, that is not fair.”

Oman ready to cut production by 5%-10%

During the same energy conference in which al-Mazrouei expressed his concerns over the increased supply from Iran, Oman, the largest non-OPEC producer in the Middle East, said that it would be willing to cut up to 10% of production if done in conjunction with other nations.

“Oman is ready to do anything that would stabilize the oil market,” said Oman Oil Minister Mohammad bin Hamad al-Rumhy. “5% or 10% is what I think we need to cut and everyone has to do the same.”