Opinions vary widely on how much Iranian crude will hit the market and when we can expect to see it

The much anticipated deal between Iran and the five permanent members of the U.N. Security Council, plus Germany (P5+1), was finalized today, fleshing out the details of the preliminary agreement reached on April 2, 2015.

Under the terms of the agreement, Iran will reduce its enriched uranium stockpile by 98% and export all waste for 15 years, reduce the number of centrifuges used to enrich uranium by two thirds, allow inspector access at nuclear sites (including military sites), and redesign the Arak reactor, according to a note released by UBS Global Research.

In exchange for meeting these requirements, the United States, European Union and United Nations agreed to lift oil, financial and economic sanctions against Iran, along with the U.N. arms embargo after five years and a ballistic missile embargo after eight years.

Many analysts worried that this deal would mean opening the taps on Iran’s crude oil production, adding substantially to the already over-supplied market, but the actual amount of production that could come back online varies greatly depending on who you ask.

A Credit Suisse conference call that was held with Iranian expert Dr. Fereidun Fesharaki forecast about 500 MBOPD coming back online by year-end 2015; analysts at Raymond James expect more than 500 MBOPD in the next 12-18 months; SVB Energy International predicts as much as 800 MBOPD (400-600 MBOPD in crude and an additional 200 MBOPD in condensate) in the next 6-12 months; Wood Mackenzie expects that exports will not reach 600 MBOPD until year-end 2017; and the IEA anticipates 800 MBOPD “within months of lifting sanctions.”

Crude oil sanctions will remain in place until nuclear compliance is verified

Regardless of how much crude Iran might be capable of producing and selling on world markets now that an agreement has been reached, the market should not expect to see it until after Iran has complied with the nuclear side of the deal, says William Featherston, an analyst for UBS.

“Implementation of the deal also requires the International Atomic Energy Agency (IAEA) to inspect Iranian nuclear sites and draft a report about possible previous nuclear research for military use before sanctions can be lifted; target date is 12/15/15,” he said. Because there is no set timetable for the IAEA verification, however, there is no set date when sanctions might be lifted.

The agreement also maintains the “snapback” capability that was included in the preliminary deal in April. Under the terms of the agreement, sanctions can be re-imposed after 65 days in the event of non-compliance. U.N. sanctions will automatically snapback for a decade, with the option for another five years if necessary, while U.S. and E.U. sanctions can be put back in place for as long as is deemed appropriate, according to a release from the White House.

End of supply shocks

While few are excited about the prospect of more oil joining the global glut, the agreement may actually be good news for markets, says a note from Roger Read, senior analyst at Wells Fargo Equity Research. “This agreement signals the end of oil supply shocks, in our view,” he said.

“With the exception of Libya’s 0.5 MMBOPD of offline oil, there are no other significant non-producing easily available barrels globally,” said Read. “With the easy oil now accounted for and reasonable global demand growth entrenched, we believe it is easier to take a more bullish direction towards oil prices.”

Other analysts were less optimistic about the effects Iran’s oil production could have on markets, with most expecting the deal to delay any meaningful recovery in oil prices, with additions of any magnitude keeping prices depressed.

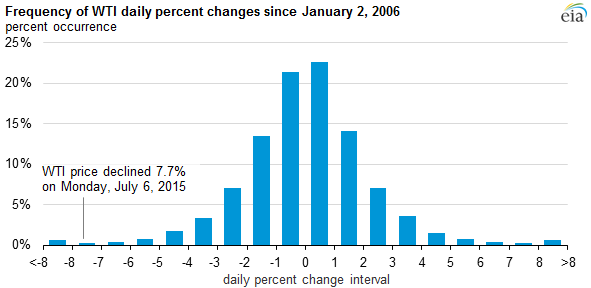

Last Monday saw the largest drop in oil prices in four months, largely on the back of concerns of increased Iranian oil exports, the Greek debt crisis and weakness in the Chinese stock market. While the Energy Information Administration (EIA) calculated that the 7.7% single-day drop in WTI prices was a one-in-two thousand event, many are worried about what more oil coming out of Iran may mean for oil prices.

Iran deal still faces Congress

While the P5+1 and Iran have come to an agreement for the nuclear deal that will lift sanctions, it still requires a review from a Republican-led Congress that is opposed to many of the deal’s parameters. Some have expressed that the terms of the deal ensure Iran having a nuclear weapon within the decade.

The U.S. Congress has 60 days to approve or amend the deal, but President Obama has promised to use his power as executive to veto Congress if it tries to block the deal. In order for Congress to overcome a presidential veto, a two thirds majority is required to override, meaning bipartisan support will be necessary.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

Roger Read, Wells Fargo 07.14.2015

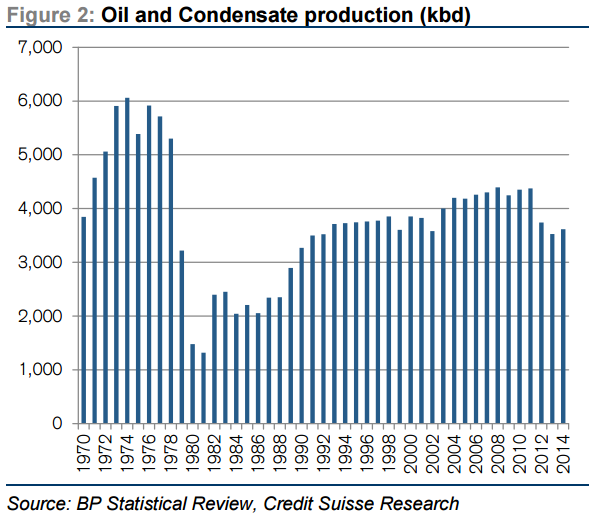

Iran and the Power 5 plus 1 countries have reached agreement on Iran's nuclear ambitions. Following the tie off of some end of deal items, Iran should be free to fully reenter the global crude oil market. Prior to sanctions and the 2008 global financial crisis Iran annually produced 3.7-3.9 mmbopd. Under the full weight of sanctions, Iran has only produced 2.7-2.8 mmbopd. Our forecast presumed an agreement would be reached and that Iran would benefit from leakage ahead of a full lifting of sanctions. Thus we expect Iran to exit 2015 producing approximately 3.3 mmbopd, 0.5 mmbopd above sanctions limited production. We expect that level of production to persist throughout 2016 before moving 0.2-0.3 mmbopd higher in 2017.

John Freeman, Raymond James 07.14.2015

As far as lifting of the oil-related sanctions – which is what the oil market cares about – today’s text simply confirms what we’ve known since April 2. That is to say: there will be no immediate increase in Iranian oil exports. The European Union’s sanctions against “import and transport of Iranian oil, petroleum products, gas and petrochemical products” will be lifted “simultaneously with the IAEA-verified implementation of agreed nuclear-related measures by Iran.” Until Iranian compliance is certified, the sanctions will remain in place. Because there is no fixed timetable for this certification, there is no set date for when Iran will be able to ramp up oil exports. Thus, vis-à-vis the oil market there is fundamentally nothing new.

William Featherston, UBS 07.14.2015

We assume last week's sharp selloff in crude was driven by a combination of Greek uncertainty, concerns the Chinese equity market decrease would have on demand, and the growing likelihood of an Iranian accord. Nonetheless, with the IEA and OPEC estimating a 2016E 'call on OPEC' of 30.3 mb/d and 30.1 mb/d, the market is already oversupplied by over 1 mb/d with June OPEC production of 31.4 mb/d likely to increase assuming Iranian sanctions are lifted next year. We do not forecast a return to "midcycle prices" for $90/$85 Brent/WTI until 2018.