As oil prices continue to drop, Iran looks for a way to minimize the damage being done to its economy, but are its plans in OPEC’s best interest?

OPEC member, Iran, is heavily reliant on petroleum exports and adopted a budget for the current fiscal year based on a projected price of $100 per barrel of oil, reports Yahoo News. With Brent prices down to $78.11 a barrel on London’s ICE Futures Europe exchange today, and WTI at $75, Iran is far from reaching its fiscal expectations. The IMF has estimated Iran needs an oil price above $130 a barrel to balance its budget according to Reuters, while Bloomberg estimates Iran would need a sales price of $143 a barrel to break-even.

Iran will draw on its sovereign wealth fund to cope with the plunging price of oil, according to Reuters. Iranian Oil Minister Bijan Zanganeh was quoted by the ministry’s news agency Shana, as saying, “By drawing upon its National Development Fund to reimburse contractors active in upstream projects, Iran will make up for the impact of the oil revenue decline on these projects.”

Iran’s National Development Fund is worth about $62 billion, according to the Sovereign Wealth Fund Institute, which track the industry. Some of its assets may be frozen by international sanctions imposed over Iran’s disputed nuclear program.

Zangeneh also said Iran would raise tax revenues to compensate for the impact of the oil price slide, but Shana gave no details. Iran will adopt “a contractionary monetary policy” for the next year, Zanganeh said. He did not elaborate, but his statement appeared to indicate the central bank would not loosen policy in an effort to offset the drop in oil revenues.

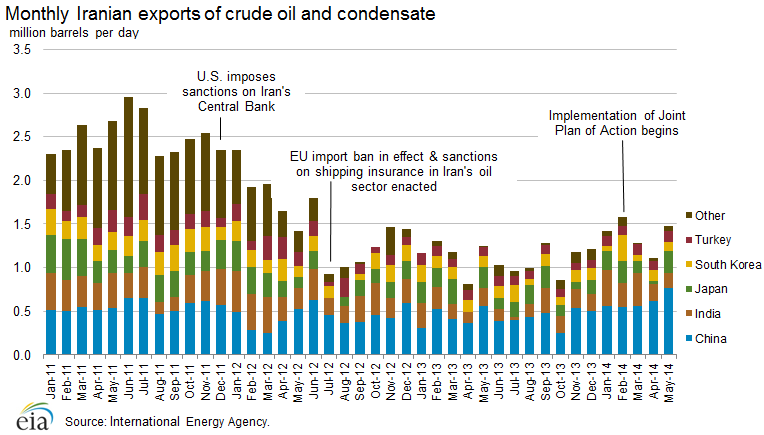

Iran is hoping to ramp up its oil and gas output if it can win a “lifting of the sanctions” at talks on the nuclear program with world powers this month. To increase output, however, Iran needs to invest heavily in ageing production facilities and infrastructure, but as oil prices fall, Iran will have to look to continuing the stricter monetary policies started by President Hassan Rouhani, which tightened central bank policies to fund reconstruction of their oil infrastructure.

Disagreement within OPEC about Increasing Production

As Iran looks for ways to increase its production, other members of OPEC are voicing their concern about oversaturating the market, which will further pressure oil prices.

As the next OPEC meeting on November 27 approaches, many members are talking about cutting production. OPEC nations, particularly larger output countries like Saudi Arabia, Iraq, Iran and Kuwait, lifted output as Brent crude dropped to a four-year low amid ample global supplies and sluggish demand, Other OPEC members are beginning to question the wisdom in this approach, however. Libya, Venezuela and Ecuador have called for action to stabilize crude prices, reports Bloomberg.

Libya’s OPEC Governor Samir Kamal said Oct. 22 that the group must cut daily output by 500,000 barrels as the market is oversupplied by about 1 million barrels a day. This reflected his personal view, he said at the time, reported Bloomberg.

The Saudis, in particular, seem unwilling to cut production. “The Saudis seem to be more concerned about their volumes than about falling prices,” John Kilduff, a partner at Again Capital LLC, a New York based hedge fund that focuses on energy, told Bloomberg during a phone interview. “There’s a lot of dissension in the cartel,” Kilduff said. “It appears that most members want the Saudis to make the cuts needed to support prices and they’re not inclined to oblige. The Nov. 27 meeting could easily end without agreement, which would send the market another leg lower.”

As oil prices continue their downturn worldwide, it remains unclear how OPEC will react. Smaller producers would like to see production cuts to stabilize prices, but larger producers, like Saudi Arabia and Iran, continue to “play chicken with the market,” as John Kilduff summarized.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.