Since 2009, Israel has been on a hot streak of discovery. Sitting 15 miles off the Mediterranean coast of Israel lies a vast resource of natural gas fields. Beginning with the Tamar natural gas field in 2009 and continuing with the Leviathon field in 2011, the Tanin field in 2012, the Karish field in 2013, and the most recent Daniel filed in 2016. A country that once reported natural gas reserves equivalent to the number of glaciers in Kenya, now finds themselves with an abundance of reserves.

The Tamar field is now averaging production in the realm of 1.2 billion cubic feet per day (Bcf/day). The Leviathon filed is expected to come online in 2019, pending any hiccups in development. However, the Leviathon field will require an estimated $6 billion to develop.

Israel’s Government Develops Investing Framework

This week, the Israeli government announced the approval of a general framework that would encourage foreign investors to participate in the development of the fields.

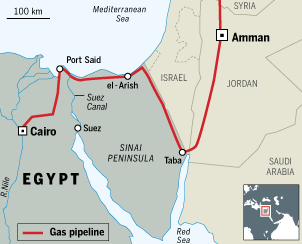

In the past, Israel imported most of its natural gas from Egypt through the Arab gas pipeline. This pipeline has been repeatedly bombed in Sinai by the Bedouin group since the summer of 2012, and the tables could soon be turning. Natural gas could begin flowing the other direction into Egypt as demand is growing in that country.

Currently, the Tamar field and its 1.2 billion cubic feet per day feeds 40% of Israel’s power generation. The Leviathon field is expected to produce 2 billion cubic feet per day when it clears regulatory hurdles.

The result: energy independence for Israel, with extra natgas to export to neighbors like Turkey, Cyprus, Greece, or Jordan.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.