Crude from tight oil now the primary source of oil from the U.S.

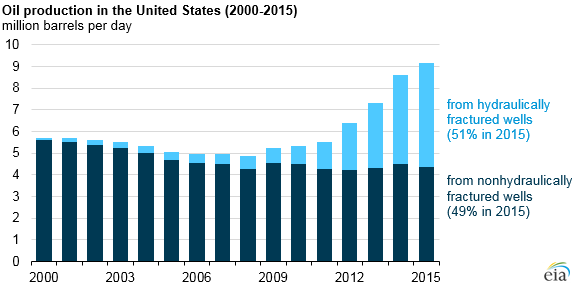

Hydraulically fractured wells now account for the majority of the crude oil produced in the U.S., according to the EIA. Based on the most recent data available, crude oil produced from hydraulic fracturing now makes up 51% of total oil production in the country.

The information compiled by the EIA showed that in 2000, approximately 23,000 hydraulically fractured wells produced 102 MBOPD in the U.S., making up less than 2% of the national total. By 2015, the number of hydraulically fractured wells grew to an estimated 300,000, and production from those wells had grown to more than 4.3 MMBOPD, 42-times more than at the turn of the century.

The oil produced from hydraulically fractured wells comes primarily from tight oil formations including the Eagle Ford and Permian Basin in Texas, and the Bakken and Three Forks formation of Montana and North Dakota.

Hydraulic fracturing is not limited to just tight oil formation, or to horizontal drilling. Fracing has been successfully used in directional and vertical wells, in tight formations and reservoirs, and in offshore crude oil production.

It is ironic, given the importance of fracing to overall U.S. production, that presidential hopefuls advertise their hopes of putting a stop to the industry.

“By the time we get through all of my conditions, I do not think there will be many places in America where fracing will continue to take place,” said Hillary Clinton.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.