Kurdistan set to pay $75-$100 million to oil exporters next month

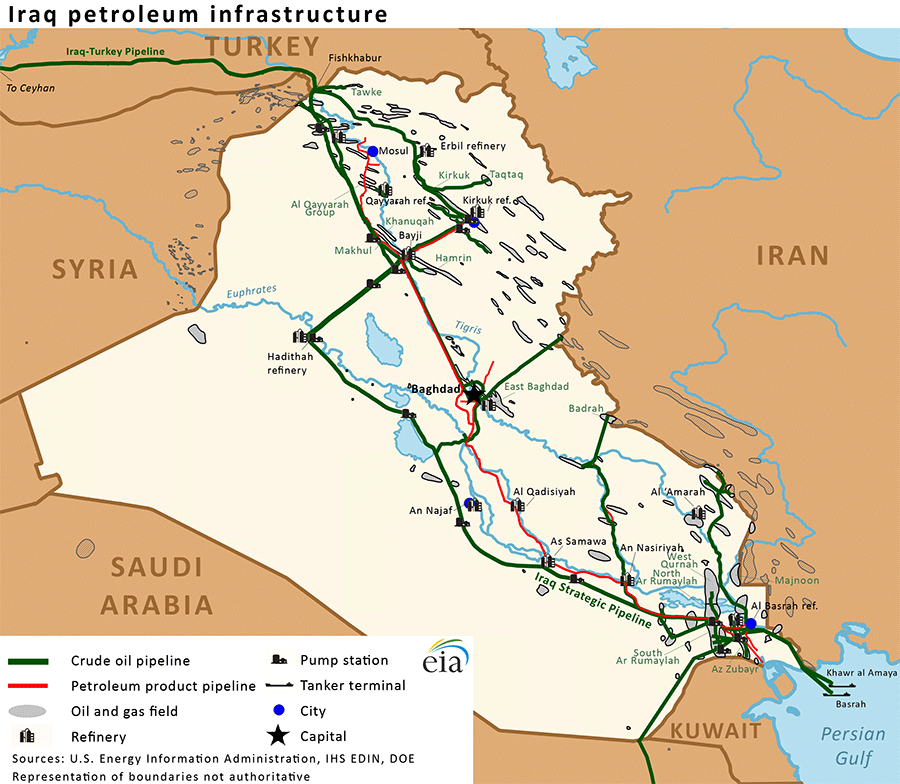

Iraq’s northern Kurdish region announced that it will start making regular payments for crude exports to producers starting in the first-half of September. Exporters will receive $75-$100 million in total next month, according to a release from the Kurdistan Regional Government’s (KRG) Ministry of Natural Resources Thursday, with additional export revenue to be paid as Kurdish shipments rise in 2016, reports Bloomberg.

The payment would be the first stable compensation for companies in the region that have been caught in the crossfire of a dispute over revenue sharing between Iraq’s federal government and the semi-autonomous Kurdish region. The news sent shares of Genel Energy (ticker: GENL) up 18%, the largest gain the company has seen since it began trading in 2011.

“With the steep fall in the price of oil, it is difficult for the international oil companies to sustain oil exports at current levels without receiving some of their financial dues on a predictable basis,” the statement from the Kurdistan Regional Government said. The will “be distributed in broad proportion to the companies’ past and present contributions to export.”

Even after reaching a deal in December of last year to allow increased shipments, payments to international oil companies operating in Iraq have remained a problem after the collapse in oil prices put pressure on the local government’s budget.

“Crude oil export is the principal revenue earner for the Kurdistan region and helps to pay civil service salaries, maintain vital government services and defend the region against Islamic State terrorism,” according to the KRG statement.

An unusual model

Unrest in the Middle East has been an ongoing problem faced by international companies operating in the region for some time, but recent instability has presented a new set of challenges. Oil & Gas 360® spoke with Ambassador Christopher Hill, former U.S. Ambassador to Iraq, about his views on the situation, and what could be done.

Ambassador Hill recently spoke at EnerCom’s The Oil & Gas Conference 20® in Denver, Colorado, about the implications of the Iranian nuclear deal.

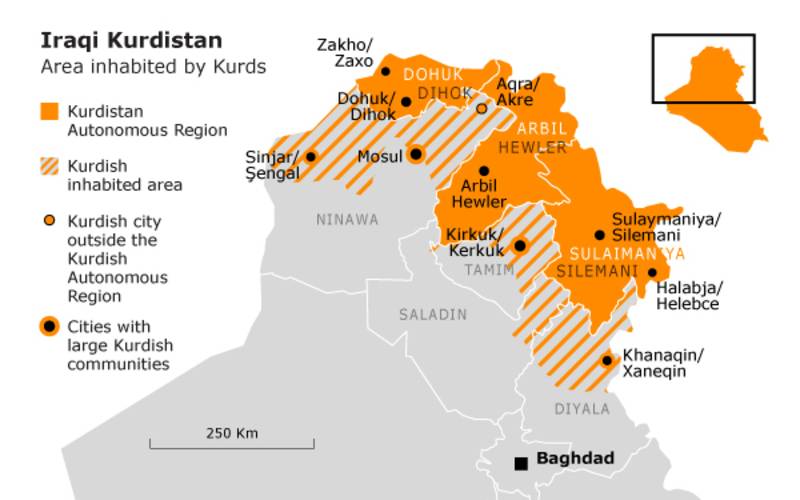

Oil and gas represent unique problems in Iraq, which is the only Shia-led state, aside from Syria, in the entire Middle East, and most of the hydrocarbon wealth is beneath their feet. “Any successful Iraq needs to be able to distribute the fruits of those resources throughout the country, including with the Kurdish and the Sunni areas,” said Hill. “A good distribution of the proceeds from oil and gas will provide the glue to keep Iraq together.”

“Iraq has had a very difficult time distributing the hydrocarbon wealth, and I believe the sticking point has been Sunni Iraqis who, in many cases, feel they would be better off outside of Iraq. If that happens, they also won’t be able to receive anything from the Shia areas [like hydrocarbon wealth]. It will be a major challenge, but a very necessary challenge, to make sure they have proper distribution.”

The main point of contention between groups like the KRG and Iraq’s central government is the distribution of wealth, explains Hill. Trying to use the central authority in Iraq as the main vehicle of wealth distribution is ineffective, he said. “I think a successful policy there would not empower the central organs, but rather empower more of the local governments.”

The semi-autonomous Kurdish region is an example of decentralized power in the Middle East, but it may have strayed too far. “The decentralization, for the Kurds, has led to almost a separate state, so I think it would be difficult to rein that in,” said Hill. “I think Baghdad needs to do a better job of giving broad autonomy to the Sunnis.”

“Iraq is exceptional in the Middle East,” said Hill. “People thought that it could be an inspiration for the rest of the region, but people forgot that it is also the only Shia-led state in the Middle East, putting aside Syria.” Because of its unique makeup, Iraq has never been a good example for the rest of the Sunni Arab world, according to Hill.

“I think we need to be realistic to what extent we think Iran can be a model for the Middle East,” he said, but “that said, if Iraq can manage the centrifugal force of sectarianism, I think that it would be a good sign for the region.”