2+ TCF of gas to be supplied to China per year for 30 years

With economic sanctions taking an ever greater toll on the Russian economy, it appears Russia is increasingly turning its focus towards strengthening its trade ties with China. China is already Russia’s largest trading partner, with bilateral trade flows at $90 billion in 2013, but both countries are looking to more than double that number to $200 billion in the next 10 years, according to BBC. During a meeting between Russia’s President Vladimir Putin and Chinese President Xi Jinping, the two agreed on the second monumental natural gas deal between the two countries this year.

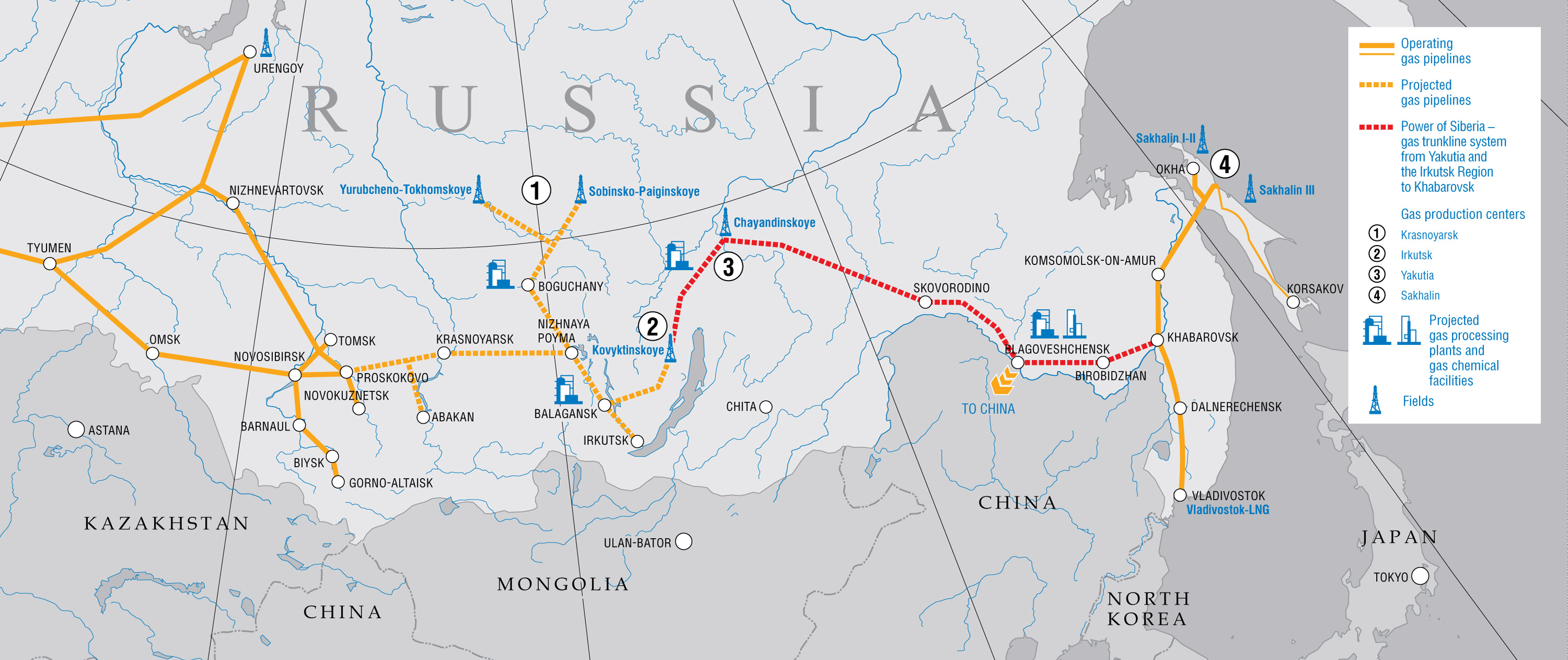

Back in May of this year, Russia’s Gazprom and the China National Petroleum Corp. (CNPC) signed their first deal, which secured the transit of 38 billion cubic meters (1.34 trillion cubic feet) a year, over the course of 30 years, starting in 2018. The gas will be transported through an eastern route, using a pipeline called the “Power of Siberia,” which runs east-west from Kovyktinskoye to Khabarovsk, and into China at Blagoveshchensk. Gazprom CEO Alexei Miller was quoted by the BBC as saying, “ [this deal is] the biggest contract in the entire history of the USSR and Gazprom – over 1 trillion cubic meters (35.3 trillion cubic feet) will be supplied during the whole contractual period.”

Earlier today, Russia and China deepened their economic ties even further by expanding on the deal struck in May with a second, slightly smaller deal. The new deal, being referred to as the western route, will use the Altai Pipeline to supply an additional 30 billion cubic meters (1.06 trillion cubic feet) a year, over the next 30 years, reports Bloomberg. The Altai pipeline runs north-south from Urengoy to Gorno-Altaisk, and into China.

Russia Times reported that the estimated price for the now 68 billion cubic meters (2.4 trillion cubic feet) of gas supplied per year to China will be $350-$400 per 1,000 cubic meters ($9.92-$11.33 per Mcf). Interestingly, Presidents Putin and Jinping are also seeking to conduct these deals increasingly in Russian rubles and Chinese yuan. President Putin was quoted in The Moscow Times saying, “The initial deals for ruble and yuan are taking place. I want to note that we are ready to expand these opportunities in [our] energy resources trade.”

This move could curtail the importance of the U.S. dollar in the Chinese economy, and help to strengthen the ruble, which has dropped in value 30% against the dollar this year. In addition to strengthening the two currencies on the international market, this move would also strengthen economic bonds between the two countries. A separate report from The Moscow Times mentions Gazprom’s interest in becoming listed on the Hong Kong stock market, further indicating Russia’s shift away from the West towards China.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.