Update:

Jordan wants to wait until anti-trust decision is made before proceeding with Noble deal

Jordan suspended talks to import natural gas from Israel from Noble Energy (ticker: NBL) and will instead sign an agreement with BG Group (ticker: BG) to buy Gaza Strip gas.

The kingdom halted negotiations after news that the Israeli anti-trust regulator might recommend breaking up Noble’s interest in the Leviathan offshore field with its partners Delek Group, according to Jamal Qammouh, head of Jordan’s Lower House energy committee, reports Bloomberg.

“We were informed that there are differences between Israel and Noble Energy and we cannot proceed with talks until we know which side will develop the gas field in Israel,” Qammouh said.

Noble and its partners signed a preliminary deal on September 3 to sell gas to Jordan’s National Electric Power Co. for more than 15 years. Noble had signed a $771 million agreement in February to supply gas to Jordan-based Arab Potash Co. starting in 2016.

U.S. supports Noble Energy Deal

A State Department spokesman said Tuesday that the U.S. supports moving forward with the natural gas deals involving Noble, reports Reuters.

U.S. Secretary of state John Kerry has also discussed the issue with Israeli Prime Minister Benjamin Netanyahu, State Department spokesman Jeff Rathke said.

“We continue to engage and we support all parties to move forward with the natural gas deal signed between Noble Energy and entities in Jordan and Egypt,” Rathke told reporters.

Rathke said the debate was a legal one that did not involve the U.S., but said “It is important for all countries to have a strong investment climate, including a consistent and predictable regulatory framework.”

To read more about Israel’s anti-trust regulator’s concerns in the Leviathan field, please see our article below:

Israel’s anti-trust regulator has said that Noble Energy and its partners, Delek Drilling and Avner Oil Exploration, have a monopoly over the country’s natural gas resources. The regulator recommended last Tuesday, December 23, that the companies’ interest in the offshore Leviathan field should be broken up, reports Reuters.

Noble owns 39.66% of Leviathan, with Delek Drilling and Avner, both units of Delek Group, holding 22.67% each, representing 85% interest in the offshore project.

The announcement damaged share prices of all the companies involved in the Leviathan field, and has cast some doubt over the future of gas investment in the region. Noble fell 4.4%, while Delek Group lost about 16.5%, according to the New York Times.

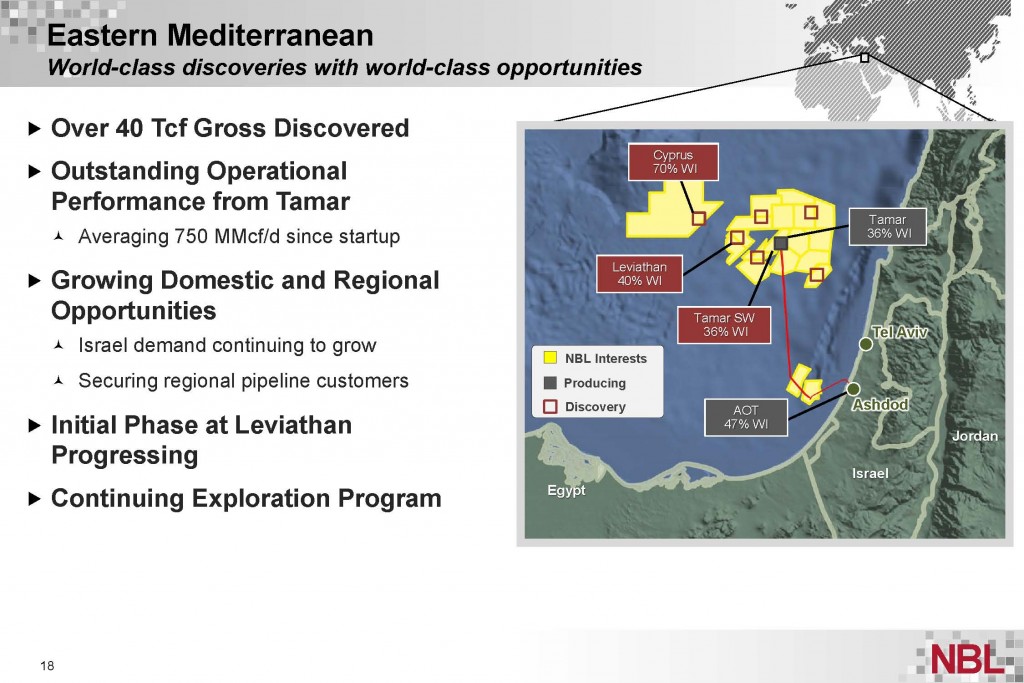

Noble and its partners produce nearly all of Israel’s gas from an offshore field called Tamar, which generates about half of the country’s electric power. Offshore development for Israel is relatively new – production of the Tamar Field began in March 2013. Including the Leviathan field, NBL and its partners have access to more than 800 billion cubic meters of gas, enough to meet current Israeli demand for about a century. Assessments by the Energy Information Administration indicate the fields have as much as 19 Tcf of recoverable resources in place. Given significant reliance on the gas in Israel, the anti-trust regulator, headed by Commissioner David Gilo, is objecting to the group’s hold over the significant supplies in the two fields. “The entry of Delek and Noble into Leviathan has created a situation in which these groups control all the gas reserves on the coast of the state of Israel,” Gilo said in a statement.

In a statement released by Noble, Charles D. Davidson, NBL’s Chairman said: “This is a matter we believed was resolved some time ago and follows on recent assurances from the Anti-trust Authority that approval was forthcoming. We believe this is a harmful precedent for Israel to set and we will vigorously defend our rights relating to our assets.”

In its Q3’14 release, NBL reported net sales volumes of 265 MMcf/d in Israel, representing a quarter-over-quarter increase of 21%. Infrastructure buildout in the region is progressing, and the company is addressing bottlenecking issues by adding compression terminals that will increase deliverability to 1.2 Bcf/d. A Plan of Development for the Leviathan Field was also submitted to the government and originally targeted sales to begin in early 2018.

Delek Group and Noble already had an agreement with Israel’s antitrust regulator to sell two smaller fields, called Tanin and Karish, to address monopoly concerns, according to the New York Times. Mr. Gilo said he was reconsidering this earlier decision because it “did not create a real competitive solution to solve the problem of a monopoly in the market.”

Leviathan decision could be damaging to Israel

Some analyst worry that the anti-trust regulator’s plan may harm the Israeli economy. Noam Pincu, an analyst at the Psagot brokerage said, “instead of creating competition, it will delay competition.” Pincu told Reuters that this decision might hurt investment in the oil and gas sector as the working interest of other companies may be targeted.

Binyamin Zommer, Noble’s manager in Israel, said the decision “will cast a shadow over the future of the oil and gas industry in Israel and will impact Noble Energy’s continued investment there.” Noble and its partners have already invested $6 billion in Israel’s oil and gas sector and saythey remain committed to developing Leviathan, as soon as regulatory, commercial and financial conditions allow.

Pincu said one possible outcome could be that Noble and Delek are allowed to hold onto a share of Leviathan’s gas earmarked for export, but not the 60% that is destined for Israel’s own use.

The current plan for the Leviathan field, which is supported by the U.S. government, is to sell the gas to Jordan and Egypt through long-term arrangements that could help improve relations between Israel and the two Arab nations. The Palestinian Authority has already committed to buying gas, agreeing to a 20-year deal worth $1.2 billion.

In an interview with Israel Radio, Gideon Tadmor, the chairman of Delek Drilling and chief executive of Avner, said these deals represent a geopolitically important asset for Israel. One of the many concerns with the anti-trust group trying to break up the current partnership in Leviathan is that changing owners could put these deals at risk.

In addition to being strategically important, the Leviathan field also represents a substantial economic boost to Israel. Nati Birendoim, a former adviser to the Israeli minister of energy and water, said he thought that a decision to force Noble and its partners to sell their stakes in Leviathan could set the project back by at least two or three years. Mr. Birendoim also said that the shortfall in tax income “is going to cost billions,” reports the New York Times.

In his statement, Mr. Gilo said he was aware that his “determination could have consequences for the economy.” Gilo will hold a hearing for the companies before making a final decision on the matter.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

NBL Update

$41.52, EQUALWEIGHT, $52.00 Target

Cutting NAV est to $52 from $57 on reduced valuation for Leviathan. Uncertainty surrounding the project has increased significantly since Dec 23 when the Israel Anti-trust Authority surprisingly withheld the consent decree to the Anti-trust Tribunal for final approval of the project. Most had assumed final approval was a foregone conclusion given a March 2014 agreement that included the divestiture of two gas fields by NBL and its partners. We now ascribe a bigger risk factor to NBL’s 40% stake in the project, valuing it at $2.4B (~$7/sh) vs $4.4B (~$12/sh) previously. Meanwhile, NBL plans to issue 2015 guidance when it reports 4Q results on Feb 19. NBL targets scaling its budget down to levels near expected CF. Based on our $60/bbl price deck for 2015, we estimate ~$2.8B of CF. We assume ~$3.2B in CAPEX, down ~35% y/y from ~$4.8B last year. This implies a modest ~$400MM outspend. NBL mentioned it may pursue some small asset sales and may look to MLP some or all of its DJ Basin midstream assets, so CAPEX may be higher than our forecast. NBL noted the most obvious area to cut given the recent developments would be Eastern Med. Spending will also likely be cut on exploration and some long lead time development projects (Katmai, Diega). In the DJ Basin, NBL wants to maintain operational efficiencies but acknowledged it may cut activity. Based on our CAPEX forecast, we expect production to average 335 Mboe/d, +12% y/y (or +2% from 4Q14 to 4Q15). Our estimate is 1% below the Street’s 338 Mboe/d est. For 2016, we expect growth to be flat y/y at 334 Mboe/d, which is 10% below the Street’s 386 Mboe/d est. On our current 2015/2016 estimates (which assume $60/bbl WTI in both years), NBL trades at EV/EBITDA multiples of 6.5x/8.0x. Excluding hedging gains in both years, these multiples expand to 8.4x/8.8x. More below. (Johnston)

Leviathan Update: Uncertainty surrounding the 22 Tcf gas development project offshore Israel has increased significantly since Dec 23 when the Israel Anti-trust Authority surprisingly withheld the consent decree to the Anti-trust Tribunal for final approval of the project. Most had assumed final approval was a foregone conclusion given that NBL and its partners reached a written agreement with the Anti-trust Authority in March 2014 that included the divestiture of the Tanin and Karish gas fields. NBL and its partners need antitrust clearance (as well as a number of other approvals from Israel including export approvals, inter-country contract agreements, etc) before Leviathan can be FID’ed. In response, NBL called the actions “another disturbing example of the uncertain regulatory environment in Israel” and noted that final resolution, as well as a number of other regulatory matters, is required before any further investment in Israel.

Subsequent to this development, NBL suspended negotiations with Israel shipyards regarding a 7-yr extension of NBL's lease on the offshore base until there is more clarity on the issue. Furthermore, Bloomberg reported that Jordan suspended negotiations w/ NBL to import gas from Leviathan due to the uncertainty. Recall that NBL signed a non-binding LOI w/ Jordan’s NEPCO in Sept 2014 for 300 MMcf/d over a 15-year period. If the antitrust issue is ultimately resolved, we think that talks w/ Jordan could resume. Next up is a hearing w/ the Anti-Trust Authority, which should occur in the next few weeks. NBL acknowledged that the hearing may not lead to a complete resolution on the issue and that movement may slow heading into the mid-March elections, but the company is hopeful that there is opportunity to resolve the matter between now and YE15.