Linn Energy files bankruptcy with $9.4 billion in debt on the balance sheet

The total dollar amount of oil and gas bankruptcies grow substantially this week when Linn Energy (Ticker: LINE) announced that it has filed for Chapter 11 on May 11, 2016. The company said previously that current commodity prices, mixed with its weak balance sheet could potentially make bankruptcy “unavoidable,” according to Linn Energy’s CEO Mark Ellis.

Linn went from a $261 million IPO in January 2006, to a top-20 publicly traded E&P, mainly through a number of large acquisitions. The company used the master limited partnership model in order to pay large dividends to investors using a tax pass-through. In order to fuel the continued growth of dividends, LINE grew its production through acquisition, which required the company to take on large amounts of debt.

Linn Energy currently has $9.4 billion in outstanding debt, according to information from Bloomberg. In 2019 alone, LINE has $5.6 billion in debt coming due in the form of $4 billion outstanding on its credit revolver, $0.5 billion in outstanding term loans, and $1.1 billion of its outstanding bonds due. In total, Linn has $4.8 billion in outstanding bonds on its balance sheet.

In the company’s press release, Linn announced that it has come to an agreement with holders of more than 66% of its credit facility under “broad terms” of a debt restructuring plan, but it did not provide further details. The lenders also agreed to let Linn use the money securing their debt, and to help fund a new $2.2 billion term loan.

LINE said it would use the cash to continue normal operations without lining up new bankruptcy financing. The company still requires permission from the U.S. Bankruptcy Court in Victoria, Texas, before it can begin spending that money.

Under the plan with its creditors, Linn will spin off Berry Petroleum, which it acquired in 2013 for $4.3 billion, into a new independent energy producer, reports Reuters.

The company hopes to exit bankruptcy before the end of the year, but it appears that some of the company’s junior creditors are opposed to the restructuring plan. They have put forth their own plan to reorganize the company which would leave them in control of Linn.

The junior creditors can often make the process more difficult to work through as they worry about their unsecured investment being lost in the company. Haynes and Boone Partner Patrick Hughes told Oil & Gas 360® that agreement among the credit holders is key to a swift restructuring.

Southcross Holdings, which completed Chapter 11 restructuring in just two weeks, was able to do so because the unsecured creditors were left unimpaired, explained Hughes, meaning they were paid a value for their debt which they felt was fair.

The downside to MLPs in a bankruptcy

Part of the appeal for investors to put their money into Linn units was the company’s dividend payments. From 2011 to 2014, LINE’s annual distribution averaged $2.84 per unit. This possible thanks to the company’s structure as an MLP, which allowed the company to pass revenue along to unit holders without being taxed at the corporate level. That pass-through, unfortunately, also posed a problem for Linn when it began to consider bankruptcy.

Debt forgiven in a restructuring counts as noncash income, or “cancellation of debt income,” which creates a tax liability for investors without the associated cash distribution.

In an effort to protect investors from that tax hit, Linn Energy completed an exchange in which holders of Linn units were given the opportunity to swap them for stock in LinnCo, LINE’s publicly traded affiliate with a corporate structure, as opposed to the MLP structure of Linn Energy.

Following the initial exchange, Linn launched a second, similar exchange offer that is set to expire May 23. In its bankruptcy announcement, Linn Energy said it is going to ask the bankruptcy court to allow unit holders to continue to swap Linn Energy units for LinnCo shares.

Penn Virginia Corporation files for Chapter 11 shortly after Linn

Penn Virginia Corporation (Ticker: PVA) announced today that it has filed Chapter 11 in the Eastern District of Virginia. The company will enter into a prearranged restructuring that will reduce its long-term debt by more than $1 billion, according to the company.

PVA’s balance sheet shows more than $1.2 billion in debt coming due through 2020, with $147 million due on its revolving credit facility next year. The majority of the company’s debt – $775 million – is in bond payments the company would have to pay in 2020.

Penn Virginia announced that it entered into a restructuring support agreement with holders of 87% of ($1.03 billion) of its debt obligations. Subject to court approval, the company has received a commitment for $25 million in debtor-in-possession (DIP) financing from its reserves based (RBL) lenders, which “combined with the company’s cash reserves and cash from operations, is expected to provide liquidity throughout the Chapter 11 process,” the company said.

The company has also received a commitment for up to $128 million in exit financing from its RBL lenders, led by Wells Fargo as agent, as well as $50 million rights offering that is backstopped and supported by senior unsecured noteholders.

A private producer in Oklahoma files for bankruptcy

In addition to the two large public oil and gas companies to file for protection under Chapter 11 this week, an Oklahoma City-based Chaparral Energy Inc. and 10 related companies filed for restructuring as well to rid themselves of $1.2 billion in debt, reports ABC News.

The company said it continues to negotiate with lenders and bondholders to reduce its debt. Chaparral has filed motions that would permit it to maintain operations as normal throughout the restructuring.

Total oil and gas bankruptcies this week amount to 66% of total 2015 bankruptcies

With the three companies that filed this week reporting total debt of $11.8 billion in their fillings this week, debt being restructured under Chapter 11 this week alone amounted to 66% of the total amount of bankruptcies seen in 2015 on a dollar basis.

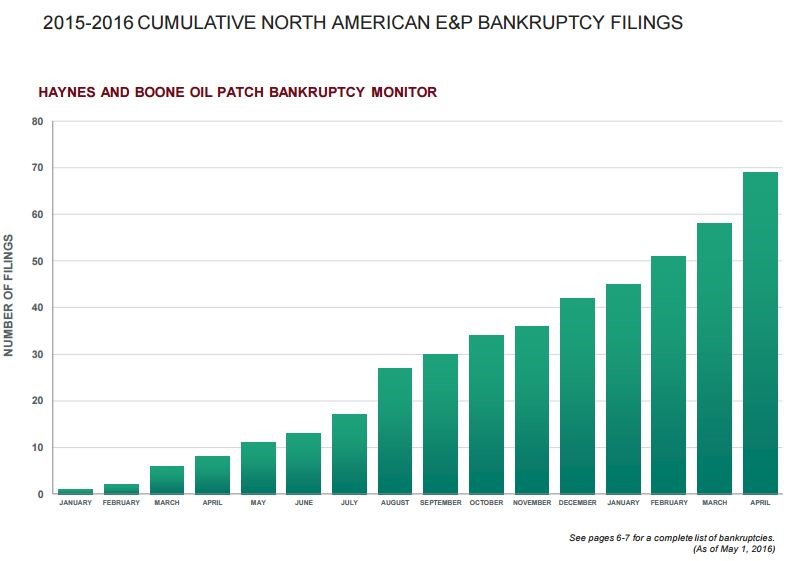

In 2015, 42 companies filed for bankruptcy, with their total debt equaling $17.85 billion.

Energy powerhouse attorneys Haynes and Boone LLC publish an oil and gas industry bankruptcy report several times a year. The newest release of the Haynes and Boone Oil Patch Bankruptcy Monitor, dated May 1, includes a list of all reported 2016 bankruptcies through that date.