We all know the emergence of hydraulic fracturing has spurred an energy revolution in North America, but that doesn’t mean there isn’t room for improvement. Operators and service companies alike are constantly evaluating different options and adjusting techniques to fully utilize all wellheads. That includes GASFRAC Energy Services (ticker: GFS.TO), a Calgary-based company who believes its “waterless” formula is a key element for future fracing operations.

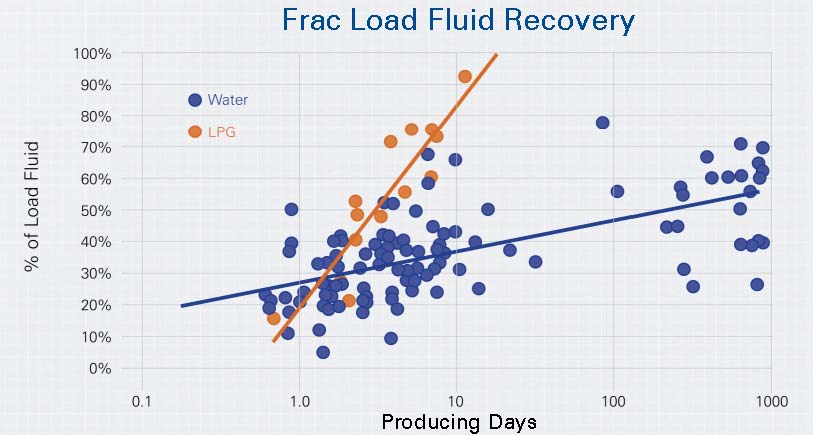

“Water is inherently damaging, so when you frac with water you may recover only a fraction of what you’ve actually pumped at the well,” said Jason Munro, President of GASFRAC, in an interview with Oil & Gas 360®. “When you consider the water that remains in the reservoir, you’re actually blocking production. Liquid petroleum gas (LPG) is better for the formation and the results are incrementally better than just using water.”

GASFRAC’s LPG technology consists primarily of propane (C3H8) in a gelled form, rather than conventional fracing fluids. The gel, in addition to increasing production rates and pay zones, is a naturally occurring hydrocarbon and regains permeability as operations commence. Not only is the majority of the gel recovered within days of stimulation, but the fluid can actually be reused in new downhole operations.

“When you use LPG or a hydrocarbon with LPG, you’re more than likely to get most of that fluid back,” Munro said. “It’s a tremendous value proposition when you consider you’re really just borrowing the fluid.”

LPG in Action

The method is getting a test run in the Utica Shale this week. The region has intrigued geologists and analysts alike as companies continue to find both the “code” and “sweet spot” of the water-sensitive formation. “We know a lot of companies have tried to frac with various forms of water treatment (such as slick water) and it just hasn’t worked,” said Munro. “We believe LPG is the magic bullet in that formation at this place in time.”

GASFRAC is also utilizing its LPG technology in the Cardium formation in Alberta and the Eagle Ford of south Texas. Its primary target in south Texas is the San Miguel Basin – one of the Eagle Ford’s shallower oil windows. The company has a total of four different LPG sets and use them accordingly for each well.

LPG’s Role in the Current Commodity Environment

Several E&Ps are adjusting to the new $75 per barrel (WTI) world by slimming down capital expenditures and focusing on assets with the highest return. The oil rig count in Baker Hughes’ (ticker: BHI) most recent report was 1,578 – 31 less than in the beginning of October. WTRG Economics told Bloomberg the oil rig count will likely drop below 1,500 by the end of the year, while Genscape Inc. believes current commodity prices will reduce the count to 1,325 by the middle of 2015.

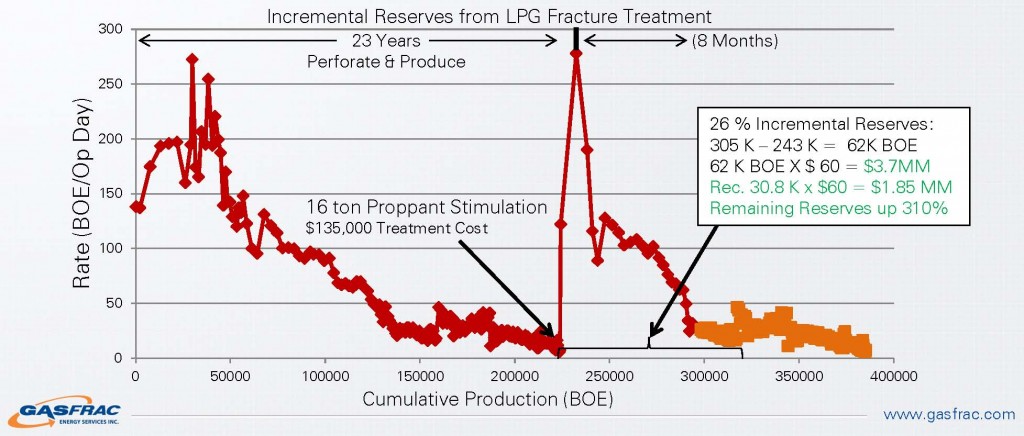

LPG may be an important tool for generating the most volume in a suddenly economic-intensive environment. The method is best utilized on low pressure, water-sensitive formations targeting oil. GASFRAC estimates one-third of the current market fits that category. Additionally, the ability to reuse the product reduces the need for the transporting and disposing of fracing water.

LPG may also prove to be beneficial in idle areas, which may become more common in the current commodity environment. Munro said: ““If you look at its downhole application, we’ve actually pumped wells with LPG and left it shut in for several months. We’ve found it can actually benefit the well because LPG is miscible with in the oil or hydrocarbon, resulting in better flow characteristics coming back. It makes a lot of sense, even if you’re thinking about shutting in a well for a period of time.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.