Hawaii has a long list of issues whirling around its expensive energy situation.

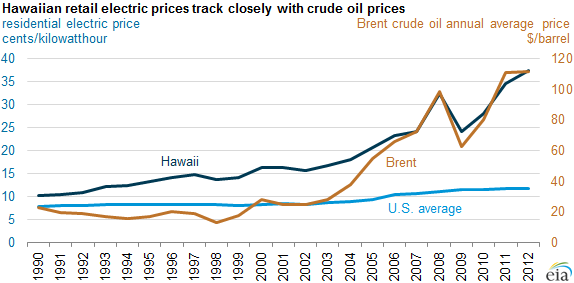

It stems from the fact that Hawaii is home to the U.S.’s most expensive electricity. Since the island state has no reserves of native fossil fuels that it can extract in order to fuel its electricity generation or to refine into ground transportation and jet fuel, it imported 93% of its energy supplies in 2011. Since more than 70% of the state’s electricity comes from oil-fired generation, the cost of retail electricity in Hawaii has closely tracked the price of Brent crude since 2007. The EIA reports Hawaii residents pay an average retail price of $0.34/kilowatt hour, which is more than three times greater than the average price in the United States of less than $0.10/kilowatt hour. New York comes in second on the list at $0.15/kilowatt hour.

Hawaii gets electricity from a smorgasbord of sources. According to the EIA, it has the world’s largest commercial electricity generator fueled exclusively with biofuels, and the state’s energy plan has targeted an agricultural biofuels industry to provide 350 million gallons of biofuels by 2025.

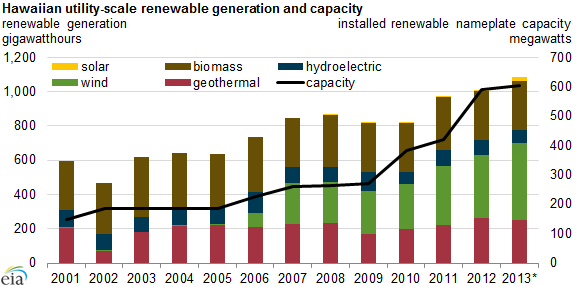

Hawaii is one of eight states with installed geothermal capacity; In 2013, 23% of its renewable net electricity generation came from geothermal energy, the EIA reported.

In late April, Hawaii’s governor and its public utilities commission (PUC) embarked on a path to accelerate the “transformation” of the state’s energy mix in order to lower its cost of energy. The initiative was spearheaded by a set of directives issued by the PUC that require the Hawaiian Electric Companies (HECO) to “develop and implement major improvement action plans to aggressively pursue energy cost reductions, proactively respond to emerging renewable energy integration challenges, improve the interconnection process for customer-sited photovoltaic systems, and embrace customer demand response programs,” according to a news release from the Hawaii PUC.

According to an EIA Feb. 20 report, “As recently as 2008, oil and coal accounted for more than 90% of Hawaii’s annual electric generation. The petroleum share of electric generation has been declining, from a high of 81% in 2002 to 72% in 2013 (through November). Meanwhile, generation from renewable sources has climbed from a 4% share in 2002 to more than 12% in 2013. Generation from coal comes from a single 180-megawatt (MW) facility on Oahu and has been relatively steady at 13%-15% of total generation each year. Total utility-scale electric generation has declined six years in a row from 2007 through 2012. This reduction is attributable to distributed generation and net metering policies that encourage electric generation from homes and businesses, mostly from solar photovoltaic installations, and increased energy efficiency measures.”

“Hawaii has produced renewable electricity from biomass, geothermal, and run-of-river hydroelectric sources for many years, although recent wind and solar capacity additions have resulted in large increases in renewable electricity production. In 2012, wind accounted for 36% of total utility-scale renewable generation in Hawaii, a contribution that rose to 42% in 2013 (through November). This increase followed the completion of three large wind projects in mid- to late-2012 (Kaheawa Phase II-21 MW, Kawailoa Wind-69 MW, and Auwahi Wind-21 MW). Utility-scale solar generation has increased more than fivefold from full-year 2012 to 2013 but still accounts for less than 2% of utility-scale renewable generation in Hawaii. Utility-scale data understate total solar generation in Hawaii because totals do not include the much larger output from small-scale solar power installations,” the EIA report said.

But renewables alone and distributed generation, in lieu of power transmission lines strung between the islands, are not able to supply the state’s energy demand, so HECO recently experimented with importing LNG.

“We’ve begun deactivating older fossil fuel plants, such as Honolulu Power Plant and others on Maui and Hawaii Island. And we’re taking other steps to lower costs to customers, such as use of low-cost liquefied natural gas as a transition fuel,” Dick Rosenblum, HECO president and chief executive officer, told the Honolulu Star Advertiser.

Hawaii Sticks a Toe into the LNG Waters

In early April, Clean Energy Fuels (ticker: CLNE) of Newport Beach, Calif., supplied Hawaii Gas with its first shipment of liquefied natural gas (LNG).

According to an article in the Pacific Business News,“The initial shipment totaled about 7,000 LNG gallons, shipped in a 40-foot container to the Hawaii Gas facility at Pier 38, where it was regasified using a mobile vaporizer and injected into the company’s synthetic natural gas distribution system. The LNG was loaded into the container at the company’s plant in Boron, Calif., then transported to Los Angeles before being shipped to Hawaii. Hawaii Gas President and CEO Alicia Moy, said: ‘Bringing LNG in ISO containers allows us to diversify our existing fuel supply. As we bring in larger quantities of LNG, we believe we can meet the needs of the people and businesses of Hawaii by lowering their cost of energy with a lower-carbon fuel’.”

According to the EIA report, “In 2008, the state began the Hawaii Clean Energy Initiative (HCEI) with the U.S. Department of Energy. The partnership’s objective is for Hawaii to produce 70% of its electricity from clean energy by 2030 through a combination of increased renewable energy production (40% of total generation) and energy efficiency (30%, or a reduction in electricity demand of 4,300 GWh). In addition to electricity-generating technologies, other technologies such as solar water heating and sea-water district cooling systems can be used to meet the reduction targets. A study conducted in 2008-09 by Booz Allen Hamilton concluded that the 70% goal was achievable and that Hawaiians would save money if the average price of crude oil stayed above $65-$85 per barrel from 2008 through 2030.”

However, for Hawaii to become a significant importer of LNG to replace its oil-fired and coal-fired power generation, a regasification plant and related infrastructure would need to be available to convert the LNG back to the gaseous state for distribution to natural gas-fired power generation plants. One option that is emerging is floating LNG platforms such as the floating storage and regasification unit for being built for use at GNL del Plata in Uruguay.

The GNL del Plata terminal gains a 263,000 cubic meter long-term storage capacity and a regasification capacity of 10 Msm3/day, expandable to 15 Msm3/day. The floating LNG regasification plant is being constructed by Daewoo Shipbuilding and Marine Engineering of South Korea, according to a report by PennEnergy.

According to the report, 15 floating regasification units have been built worldwide, to date.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.