Chenier ships its sixth LNG cargo – destination: Europe

The sixth LNG cargo to leave from Chenier Energy’s (ticker: LNG) Sabine Pass project is set to bring U.S. liquefied natural gas to Europe for the first time. The Continent, which will be the third to import U.S. LNG, has predominantly received its natural gas from Russia and Norway in the past. The tanker, Creole Spirit, is destined for Portugal, according to Bloomberg.

The cargo was purchased by Galp Energia, Portugal’s biggest oil company, according to sources familiar with the matter. It is expected to arrive in Europe within the next week.

LNG cargos are being increasingly diverted to Europe, away from markets in Asia as demand falls. Cheniere estimates shipping costs to Europe at $0.50 per MMBtu, compared to $1.50 to transport LNG to Asia, making it a more economical destination for cargos as well.

Portugal relied on LNG imports, mainly from Nigeria, for about one-third of its natural gas last year, according to energy grid operator REN-Redes Energeticas Nacionais. The rest came by pipelines from Algeria through Spain. The southern European nation boosted LNG imports 13% to 1.1 million metric tons last year.

U.S. LNG “heralds the arrival of a global market” for domestic natural gas producers

Cheniere’s LNG project in Louisiana has potentially powerful connotations, both geopolitically, and in terms of natural gas prices. The terminal offers a new source of natural gas for Europe, which has been looking for alternatives to Russian gas, and it has helped soften the blow of a U.S. glut of natural gas by giving U.S. producers a new outlet for their production.

“LNG coming out of the U.S. is probably the single most important thing that will transform the future LNG market,” Melissa Stark, energy managing director and global LNG lead at Accenture, said. “It heralds the arrival of a global market.”

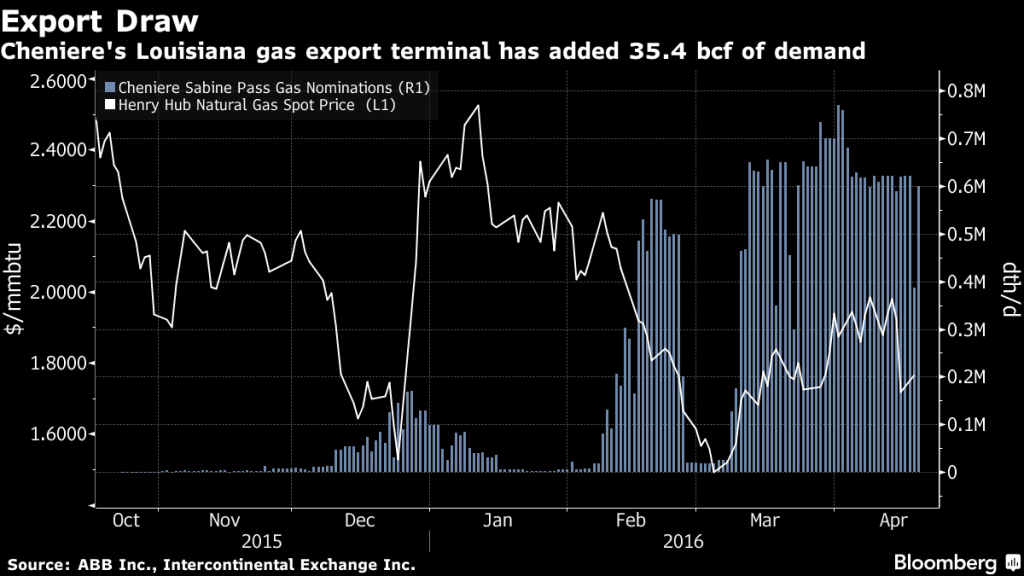

With counter-seasonal builds in natural gas storage this winter expected to continue growing as the traditional injection season starts, more shipments from Sabine Pass offer some support to natural gas prices. The terminal received almost 35.4 billion cubic feet of natural gas since deliveries began on October 23, with most of that volume arriving in the last six weeks, according to Bloomberg.

“There are actually molecules being taken out of the system. That’s supportive,” said Kyle Cooper, director of research with IAF Advisors and Cypress Energy Capital Management in Houston. “Had Cheniere not been able to begin, it would have been a bearish factor for sure.”

Cheniere’s gas demand so far this year has helped support prices by $0.05-$0.10 per MMBtu, said Cooper. While volumes now are relatively small, by this time in 2017, Sabine Pass’s total consumption will reach 200 billion cubic feet or more, he said.

Symbolic value

“U.S. LNG supply to Europe may have strong geopolitical symbolism, but its current volume impact will be negligible, until the big volumes come on stream in 2018-19, and cargoes will probably go to higher value markets in Latin America and elsewhere,” Jonathan Stern, chairman and founder of the natural gas research program at the Oxford Institute for Energy Studies, said.

More than half of U.S. total LNG production may be destined for Europe by 2020, according to Wood Mackenzie Ltd. Cheniere said in January that it can profitably sell LNG despite lower prices, though margins may be as little as $1 per MMBtu to Europe.