Tellurian+Magellan merger is expected to close Q4

On October 11, Magellan Petroleum (ticker: MPET) filed an S-3 Registration Statement with the SEC paving the way to sell up to $500 million in common stock, warrants and units, the proceeds to be used for general corporate purposes for the company which is moving toward LNG development.

Magellan’s previously announced reverse merger with privately held Tellurian Investments, the Charif Souki (former Cheniere Energy CEO) and Martin Houston (former BG COO) LNG development venture, is scheduled to close in Q4 of 2016. When it’s final, Souki will be chairman and Houston will be president, according to the company announcement.

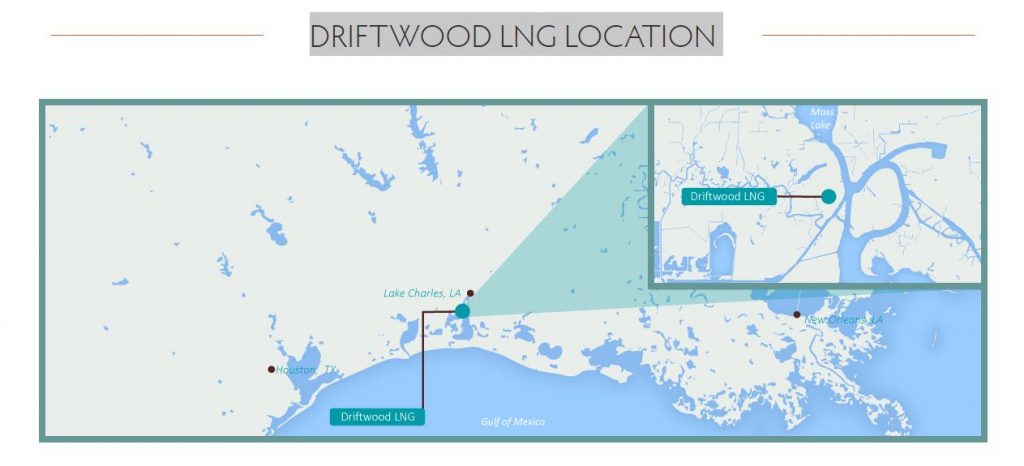

Tellurian, which has attracted other Cheniere executives, is focused on the development of a mid-scale liquefied natural gas (LNG) facility on the U.S. Gulf Coast. The project, currently in permitting and planning phase, is called Driftwood LNG.

In the August 3 press release announcing the Tellurian merger with Magellan, Houston referred to Driftwood as having the potential to become “one of the most cost-competitive LNG projects globally. … With this transaction, we will be able to access more attractive financing in order to develop Driftwood LNG, which should come on stream in 2022, just as the markets for new LNG open up.”

According to the Driftwood LNG website, the LNG project entered the FERC Pre-Filing review process in May 2016 and expects to file NGA Section 3 and 7 applications in Q1 of 2017. The company has targeted the start of construction in 2018, and projects the first LNG plant in-service in 2022 and construction complete with all plants in-service in 2025. Houston said Tellurian will partner with Bechtel and its sub-contractors, GE and Chart Industries, on the project.

Driftwood LNG Pipeline LLC, a subsidiary of Tellurian Investments Inc., is currently investigating the development of a pipeline to deliver gas to the Driftwood LNG facility. The proposed 96-mile feed gas pipeline would supply the facility with an annual average of 4 Bcf/d of natural gas via sections of 36-inch and 42-inch single pipeline, 42-inch dual pipeline and 48-inch single pipeline, three compressor stations and up to 15 meter stations and associated tie-ins at up to 13 sites, according to the company.

The shelf prospectus filed yesterday summarizes Magellan’s capitalization:

“Our common stock is traded on the NASDAQ Capital Market under the symbol “MPET.” On October 10, 2016, the closing price of our common stock as reported on the NASDAQ Capital Market was $6.21 per share. None of the other securities offered under this prospectus are publicly traded.

“As of October 10, 2016, the aggregate market value of our outstanding voting and non-voting common equity held by non-affiliates was approximately $29.5 million, based on an aggregate of 5,879,610 shares of common stock outstanding, of which 4,746,127 shares were held by non-affiliates, and a per share price of $6.21, the closing price of our common stock on October 10, 2016, as reported on the NASDAQ Capital Market.”