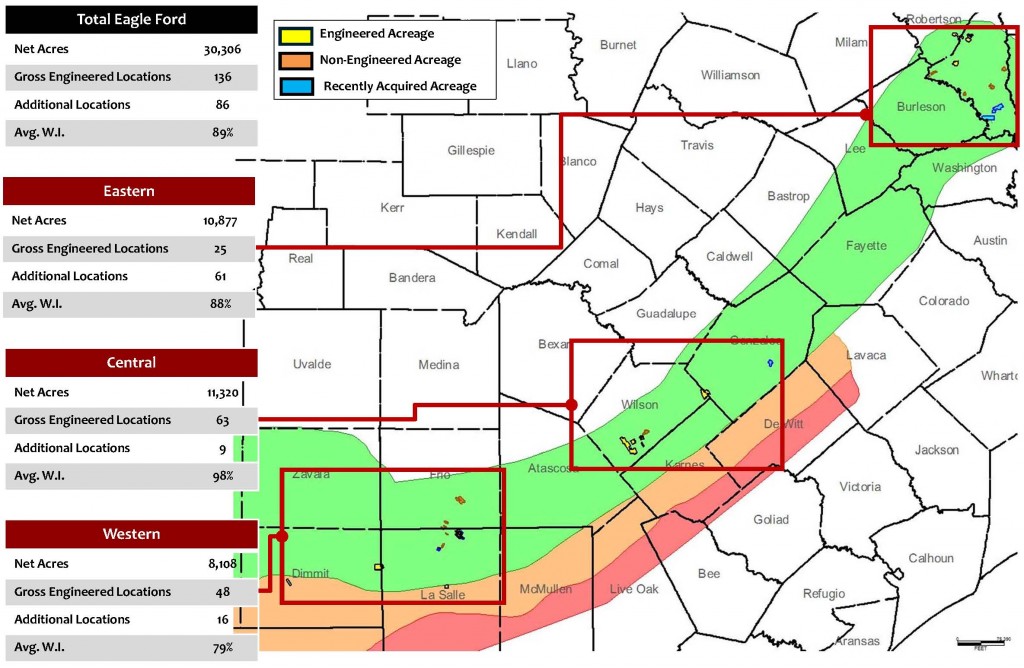

Lonestar Resources (OTCQX: LNREF, ASX: LNR) is an oil and gas company in Fort Worth, Texas, focused on acquiring and exploiting the Eagle Ford Shale. The company has doubled its acreage on a compounded year-over-year basis since 2012 and is listed on both the Australian Stock Exchange (following a January 2013 merger with Amadeus Energy) and the U.S. based OTCQX since June 2014. The latest listing provided access for American stockholders to trade shares in American dollars.

Growth Rising in a Constrained Market

Lonestar Resources revised its 2015 capital expenditures program in a news release on December 9, 2014. Its new budget will be in the range of $85 to $101 million, down approximately 35% from its original guidance of $135 to $150 million in its Q3’14 quarterly results. Lonestar expects to complete 15 to 17 gross wells in 2015, based on a range of $65 to $80 in West Texas Intermediate (WTI) prices. Original plans had called for the drilling of 20 to 25 gross wells in the upcoming fiscal year.

Lonestar still expects to increase production by 30% to 55% on a year over year basis in 2015, even with the reduced capital plan. EBITDA is forecasted to reach $100 to $125 million – up 19% at its midpoint from the company’s projected year-end exit rate of $92 to $97 million in EBITDA. Management said an official capital budget for 2015 will likely be announced in January, once “more clarity” is gained regarding the current market environment.

“Our capital budget will always be driven by maximizing returns for shareholders, which in an era of lower oil prices means we will slow down the pace of drilling on our existing properties to preserve liquidity to position Lonestar to be opportunistic in acquiring additional properties in the Eagle Ford shale trend,” said Frank Bracken III, Chief Executive Officer of Lonestar Resources, in the release.

Source: LNR December 2014 Presentation

Drilling Slows, but the Value Does Not

In the latest update, Lonestar says its decision to moderate its near term drilling activity will still generate rates of return in excess of 35%, even with the lower commodity prices. The expected returns will cover drilling costs through the use operating cash flow. The company aims to maintain more than $100 million in liquidity to navigate through the current market environment and possibly “take advantage selectively of accretive acquisition opportunities in the oil window of the Eagle Ford Shale.” The company had $142 million in liquidity as of September 30, 2014.

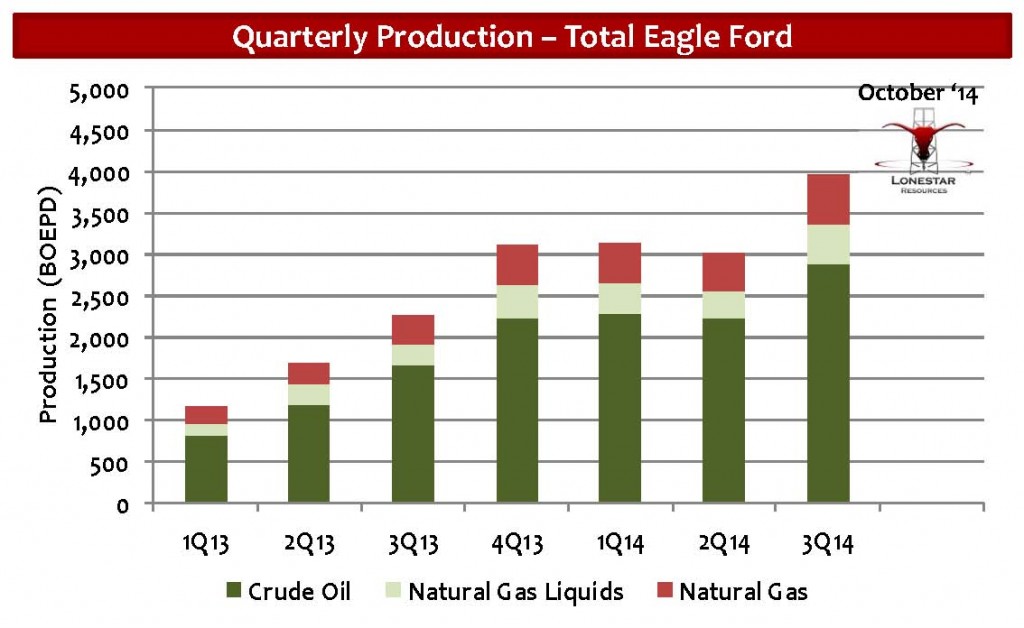

Growth in 2014 has still been dramatic. Production in Q3’14 averaged 4,669 BOEPD – 29% higher than volume from the prior quarter. Rates in October, the first month of Q4’14, averaged 5,600 BOEPD, and year-end exit rates are projected to reach 6,500 to 7,000 BOEPD. At its midpoint, 2014’s year-end volumes would be 79% higher than Q4’13’s average of 3,762 BOEPD.

Source: LNR December 2014 Presentation

Eagle Ford Returns

Lonestar says its 2015 drilling obligations are “extremely limited,” allowing the company to choose projects based on the best IRR. The company believes such rates could reach 35% to 45%.

Traits that provide security to Lonestar’s cash flow include hedging 2,500 BOEPD at $88/barrel. Total cash costs, including lease operating expenses, taxes, interest and G&A were $25/barrel in October 2014. The company said it will aim to generate greater savings in the upcoming year by implementing new cost-sensitive initiatives.

Operational Review

Lonestar has broken up its Eagle Ford position into the Western, Central and Eastern region. At $70 oil prices and 8,000 foot laterals, the rates of return for those respective regions are 32%, 21% and 35%. Well costs range from $7.4 to $8.0 million.

The Western region provides the majority of Eagle Ford production. Three wells were completed in Q3’14 and test rates ranged from 351 to 521 BOEPD.

The Central began development in Q4’13 and has increased rates to more than 700 BOEPD. The Pirate #K1H well is producing 338 BOEPD after 105 days online with 25% of its frac load recovered. Three more wells in Southern Gonzales County (37.5% net revenue interest) began flowback in late November.

Two wells in Brazos County of the Eastern section were placed online in the recent quarter and tested at rates of 778 and 698 BOEPD, respectively. Three more wells were completed but their results have not yet been disclosed. A well completed by a competitor in the region produced 48,515 BOE in its first four months of production. A total of 61 drilling locations have been identified, while the other two regions hold 25 total locations.

The company also holds a position of 52,559 gross acres in the Bakken/Three Forks trend in Montana and determined the area has a total of 420 unconventional and conventional drilling locations. An application for development has been filed with the Bureau of Land Management and Lonestar expects to receive approval in the near future.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.