Reports Quarterly Records for Upstream and Midstream Segments

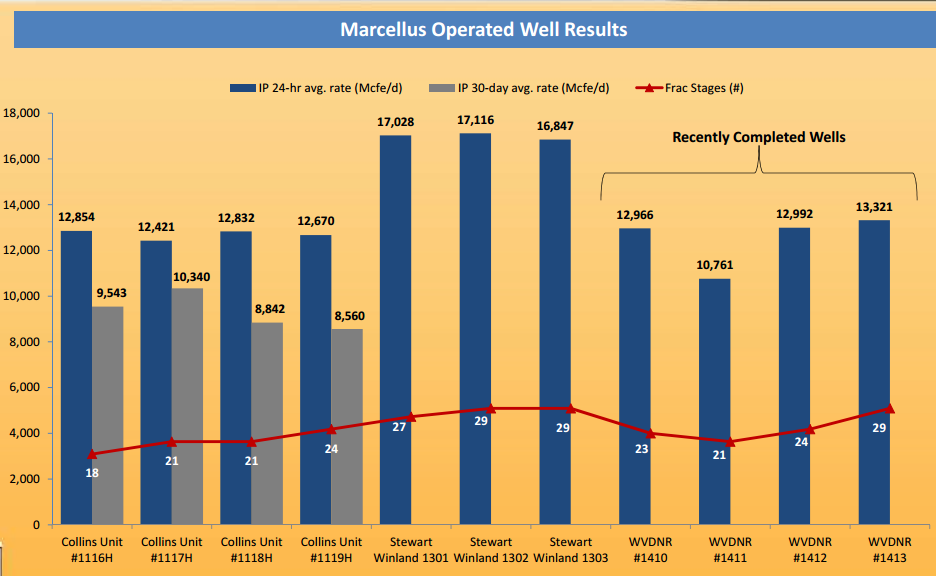

Magnum Hunter Resources (ticker: MHR), a Houston-based E&P with operations focused largely on the Appalachia region, reported new quarterly records for production and throughput volumes in a press release on April 15, 2015. The company says the production increase was “attributable primarily to the Company’s expanded 2014 drilling program in its core areas of operations and production results from the Marcellus and Utica Shale plays.”

Production volumes for Q1’15 averaged 27,261 BOEPD, representing a 58% increase compared to Q4’14 (17,178 BOEPD). Natural gas accounted for 74% of the mix. Volumes continued the upward climb through each month, with production in March reaching an average of 30,832 BOEPD – 35% higher than production from January.

“These operating results for the month of March 2015 alone reflect how quickly we continue to grow our overall volumes due to the prolific nature of the reservoirs within our core operating regions,” said Gary C. Evans, Chairman of the Board and Chief Executive Officer of Magnum Hunter.

Eureka Hunter, MHR’s pipeline segment, increased its network to nine pipeline interconnects (up from its previous count of five) and boosted its throughput to an average of 514.2 MMBtu/d in March (including hitting a single day record of 623.7 MMBtu/d). Its most recent volumes are three times greater than its volume flow in March 2014. In a January conference call, Evans called the interconnects a “huge pain and a huge expense,” but stressed their importance to growth and development. “It strained our financials but we knew that we were spending money very, very wisely and it would pay off in spades down the road,” he said. “And it’s proving to be the case.”

The company spent $359 million on the interconnects in 2014 but will not have to repeat the investment in 2015.

The company plans on bringing online 11 gross wells in the current year and has approximately 20% of estimated production is hedged at $4.09/MMBtu. In a January conference call, Evans said the company would like to lock in a greater amount of its production, but volumes grew so rapidly that the lenders prevented MHR from doing so. In the meantime, MHR is exercising patience in the market and plans on taking advantage of lower oilservice fees and no obligations to meet leasing requirements in the near future. Its 2015 capital budget of $100 million and Evans said the likelihood of a joint venture in its Utica operations is “almost 100%.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.