Takeaway Record for Eureka Hunter Follows

Magnum Hunter Resources (ticker: MHR) is betting big in the Marcellus/Utica, and a company announcement on September 24, 2014, supports its assessment. The Stewart Winland 1300U well in Tyler County, West Virginia, returned an initial production rate of 46.5 MMcf after being drilled to a true vertical depth of 10,825 feet (including a 5,289 foot horizontal lateral) and fraced with 22 stages.

Oil plays are among the hottest acreage spots right now, as evidenced by Encana’s (ticker: ECA) $7.1 billion acquisition of Permian-focused Athlon (ticker: ATHL), announced on September 29, 2014. Magnum Hunter has gone a different route, selling off its assets in Canada and a portion of the Bakken within the last year to narrow its focus on the Appalachian. Management expects the company to be a pure-play Marcellus/Utica company in the near future.

Did the Utica just get Bigger?

The Stewart Winland 1300U accomplished three milestones:

- The timing of the IP was not disclosed, but MHR believes it is the highest rate for any Utica/Marcellus well to date. Rice Energy (ticker: RICE) drilled a well earlier in the year that tested at 41.7 MMcf over a 24 hour period.

- It is the first Utica well to be drilled in West Virginia. Chevron (ticker: CVX) is completing the only other Utica well and management said it expects to release results within the fiscal year.

- It is the southernmost Utica well drilled to date. MHR has built up its acreage in the southern region, which has returned greater rates than wells to the north.

“[The 1300U] is one of the highest flow rate gas wells ever reported in any shale play located in the U.S.,” said Gary Evans, Chairman and Chief Executive Officer of Magnum Hunter, in the company release.

“The initial shut-in casing pressure of this monster well was 9,050 psi. Even at a gas flow rate of 46.5 MMCF and choke size of 32/64 inches, flowing casing pressure was maintained at 7,810 psi. We look forward to further extending this play to the south with our existing lease acreage position.”

Source: MHR September 2014

Management had previously told investors at EnerCom’s The Oil and Gas Conference® 19 about the high pressure involved with Utica wells due to its organic content. “It’s not really a shale, it’s more of a carbonate reservoir,” Evans said. “It’s got porosity, permeability and resistivity – all the things you look for. I think this play will turn out to be one of the largest gas fields in the world, and it’s already being compared to some of the fields in Saudi Arabia.”

Midstream Takeaway Sets Company Record

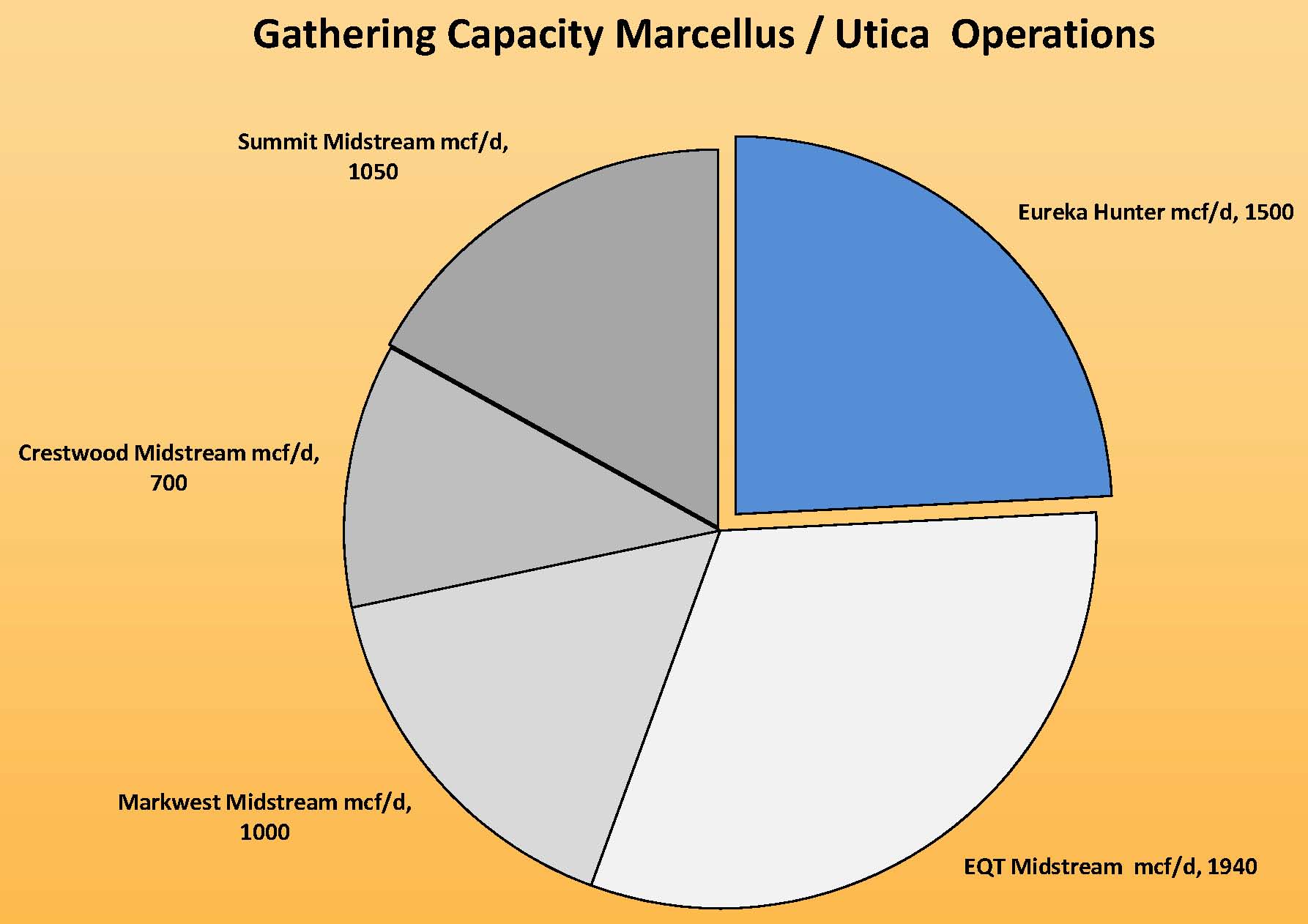

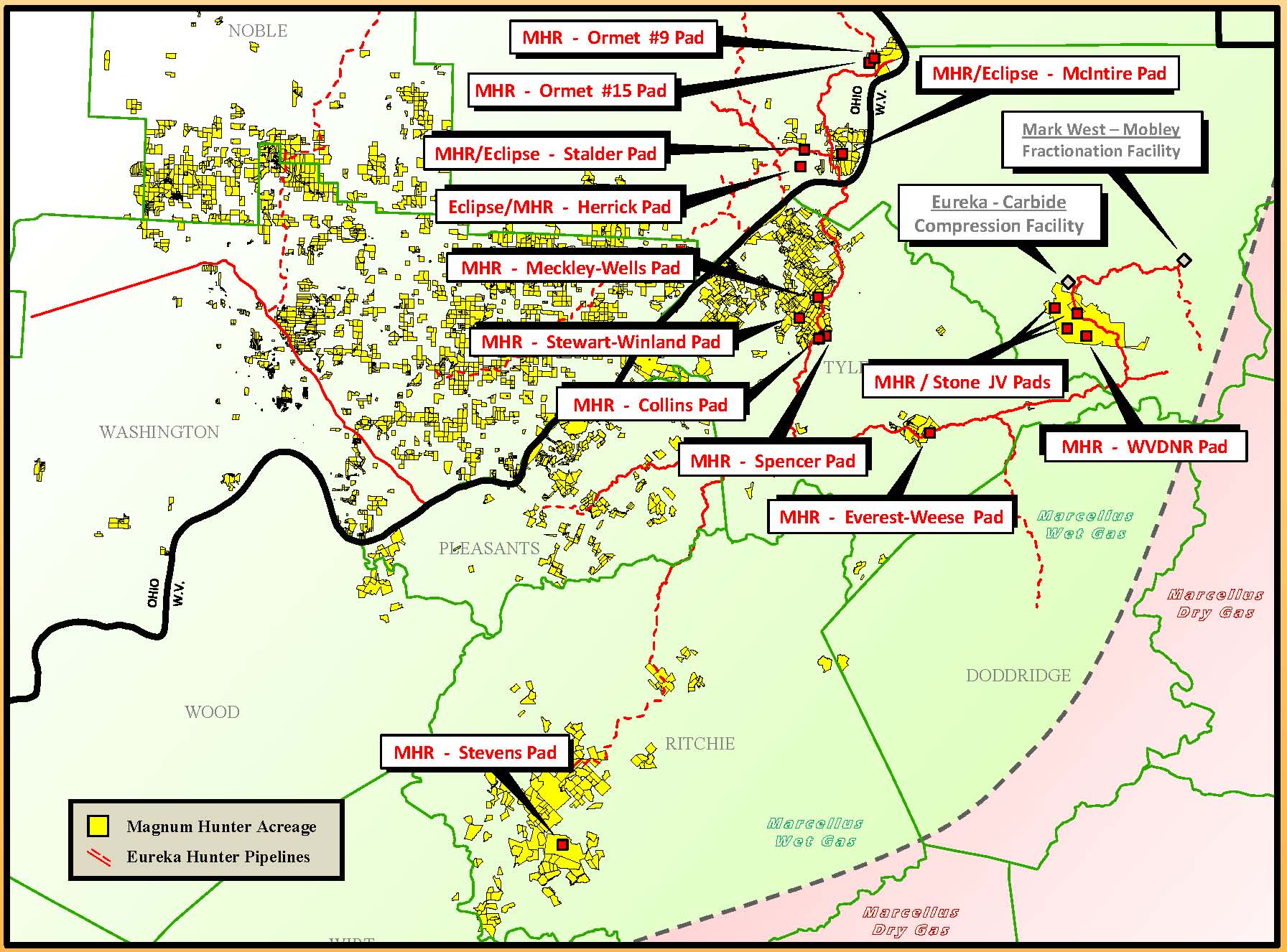

Pipeline access can be difficult in the Marcellus/Utica, where gas output has increased by more than 700% since 2010. Magnum Hunter’s entry into the southern Appalachia was conjoined by the purchase and construction of pipeline systems. Today, MHR has direct takeaway ability through Eureka Hunter, its midstream subsidiary consisting of 105 miles of pipe and 1.5 Bcf/d of capacity.

Eureka Hunter announced a company takeaway record of 316,500 MMBtu/d one day after MHR released results from the Stewart Winland 1300U. The company expects to set more records soon –construction crews will expand the network to 170 miles by year-end 2014, while takeaway is expected to reach 400,000 MMBtu/d. MHR expects the network to exceed the 200-mile mark by 2015.

The midstream access is an invaluable asset to bring down costs, says Evans. “Even today with sub-$4 gas price, you’re talking 60% to 70% IRRs,” he explains.

Source: MHR September Presentation

What’s next for Magnum Hunter Resources?

Magnum Hunter is one of the few companies exploiting both the Marcellus and Utica shales from single pads. Even the record-setting Stewart Winland 1300 pad is in the process of drilling and completing three Marcellus wells with true vertical depth of roughly 6,150 feet (average lateral length of 5,733 feet) and between 27 to 29 frac stages.

The company holds more than 200,000 net acres in the region, and believes roughly 43,000 net acres overlap the Marcellus/Utica. “The economics of pad drilling with two very distinct plays going on is quite unique and also has lots of challenges with respect to how you lay dual pipelines and how you complete these wells,” said Evans. “But, it’s very exciting and an area that we think is quite unique and it’s going to have some tremendous returns.”

Production is expected to ramp up considerably, with a 2014 year-end target of 32.5 BOEPD. That’s more than double Q2’14’s production of 15.9 BOEPD. Management is confident in reaching the goal due to incoming production from its new wells, which include operations on a total of four pads in the Marcellus/Utica. The forecasted rise in production has allowed management to publicly declare plans to take Eureka Hunter public in 2015 as a Master Limited Partnership.

MHR Has roughly 50 wells drilled to date in the Appalachia but believe it holds more than 1,400 gross drilling locations with 64.1 MMBOE of proved reserves. Moving forward, the company believes it can expand its knowledge of the Marcellus into the Utica formation. “We think we have the Marcellus code down,” said Evans, noting well costs average $6.5 million apiece with up to 12 Bcfe of returns. “And, we know for a fact we are in a very good place.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom, Inc. has a long-only position in Magnum Hunter Resources.