Occidental, Canadian Natural Resources Working to Preserve Employment

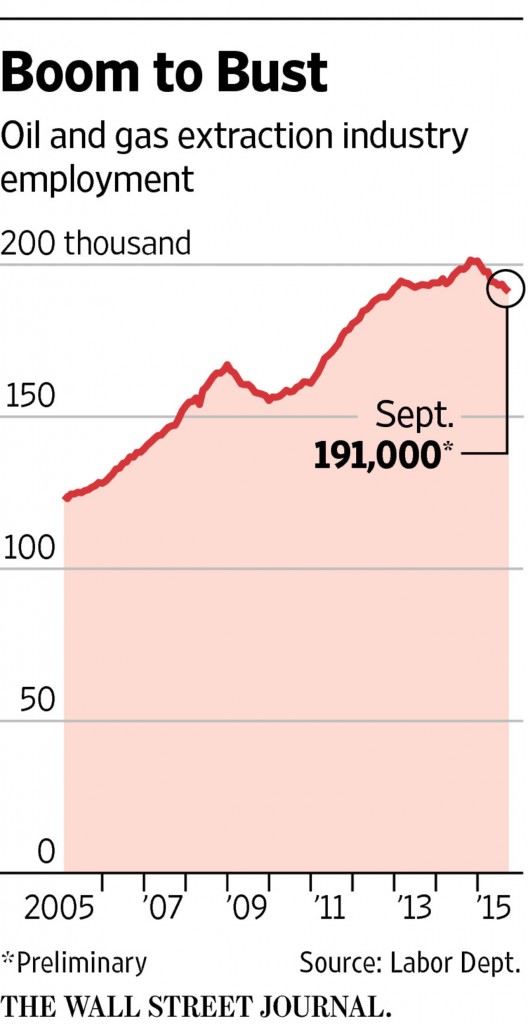

The rash of layoffs seem to make weekly headlines in the oil industry, but companies are employing measures in an attempt to keep the dreaded “L” word away from their doors.

The Wall Street Journal reports large-scale exploration and production companies like Occidental Petroleum (ticker: OXY) and Canadian Natural Resources (ticker: CNQ) are freezing or reducing salaries to avoid trimming their workforce. Bonuses are being capped. Several executives in many companies are also taking voluntary cuts to free up some much-needed cash for their respective organizations.

Continental Resources (ticker: CLR) in Oklahoma City has vowed to neither downsize nor reduce pay in the current environment, even though the E&P is as exposed to the commodity slump as any of its peers. CLR monetized its oil hedges last year but says it can be cash flow neutral at $50/barrel prices. Occidental also has no oil hedges in the near term.

Need for Skilled Labor is Still High

Although recent job prospects can appear to be discouraging, at face value, the technological and geological expertise spurred by the shale revolution has companies in constant search for high-end talent. And although the majority of companies (particularly on the oilservice side) are scaling back operations, the closed-door side of the industry still has plenty of dry powder.

“Private equity is currently looking into the market, and they have about $80 billion of unlevered capital,” said David Preng, President and Chief Executive Officer of Preng & Associates, in an interview at The Oil & Gas Conference® 20. Preng & Associates is an executive search firm, and its hands-on experience provides an accurate pulse of the oil and gas industry. In more than 35 years of operations, the Houston-based firm has conducted more than 3,300 engagements for nearly 700 companies worldwide.

Regardless of company goals, the tightened margins place tremendous pressure on executives to navigate the troubled waters of the new commodity environment. Preng & Associates is actively conducting both public and private searches for company board members in the pursuit of finding the right person for the job. “Companies are wondering if they have the right people on the board to guide this company through the downturn,” said Preng, adding that retirements also factor into the strategy.

A red hot industry can occasionally lead to overstaffing in an attempt to meet project demands and deadlines, as the management of Hornbeck Offshore explained in June. With such significant staffing cuts over the past year, some executives are worried that discouraged oil and gas employees may leave the industry for good.

A red hot industry can occasionally lead to overstaffing in an attempt to meet project demands and deadlines, as the management of Hornbeck Offshore explained in June. With such significant staffing cuts over the past year, some executives are worried that discouraged oil and gas employees may leave the industry for good.

“From 1980 to 1984, the numbers of undergraduate petroleum engineers from the University of Texas varied from 110 to 125,” said Preng, referencing a historical bright spot of the industry, leading up to the oil market crash of the late 1980s. “In 1989 to 1991, the average class was just nine… then in 2008, the total number of undergraduate petroleum engineers in all universities was 600.”

The new wave of faces to the industry are waiting in the wings to replace those nearing retirement. A Reuters article in May said about 7,000 members of the Society of Petroleum Engineers are over the age of 65. Estimates from an industry survey say about half of the workforce will retire in the next five to seven years, while 90% of oil and gas executives believe talent shortage is an issue.

Universities Still Receiving Plenty of Interest

No matter the shape of the commodity environment, companies continuously remain active in tapping the nation’s top universities for the next generation of oil and gas workers. In September, Colorado School of Mines (CSM) celebrated the largest career fair in its 140-year history, hosting 240 companies from around the globe.

About 50 oil, gas and energy companies participated in CSM’s 2015 fair – down from about 80 in 2014, but the market is still seeking new, skilled additions to their work force. “We’ve seen a slight decline in hiring numbers, but students and graduates are still getting jobs,” said Jean Manning-Clark, Career Center Director at Colorado School of Mines, in an interview with Oil & Gas 360®. She also mentioned more and more companies are employing large pools of interns to allow job-seekers to develop within the organization.

Although company participants from the oil and gas industry declined on a year-over-year basis, Manning-Clark said CSM continues to keep in close contact with numerous companies across the energy sphere. “You have to keep your name out there,” she said in reference to the E&P and oilservice participants. “When prices go back up (and they will go back up) you can’t be trying to outbid your peers for the top talent.”

The only setback is the cyclical nature of the industry – a topic discussed by legendary oil man Bill Barrett as part of OAG360®’s “Top Minds in the Business” series. “It’s a great industry to be involved in, but you have to have some staying power and not get too spooked in the tough times,” he said, adding that “There’s still going to be development for the next 40 years.”

Manning-Clark offered a similar sentiment, touting the resiliency of the industry. “Yes, you may have to put more effort into job seeking as opposed to a couple years ago, but if you keep after it, those positions will come.”