Private Equity Cashing In: EnCap Company PayRock Energy Built the STACK Position

Marathon Oil has reached an agreement to purchase privately held PayRock Energy Holdings for $888 million in a cash transaction. PayRock holds approximately 61,000 care acres in the Anadarko Basin STACK play in Oklahoma. “Acquiring PayRock’s STACK position will meaningfully expand the quality and scale of Marathon Oil’s existing portfolio in one of the best unconventional oil plays in the U.S.,” Marathon Oil CEO Lee Tillman said.

Highlights of the transaction include:

- High quality inventory immediately competes for capital allocation within Marathon Oil’s portfolio

- $4.5 – 4.0 million completed well costs offer 60 – 80% before-tax IRRs at $50 WTI

- 330 million BOE 2P resource with 490 gross company operated locations

- 700 million BOE total resource potential from increased well density in Meramec and Woodford, as well as Osage development

- Current production of approximately 9,000 barrels of oil equivalent per day

Oklahoma City-based PayRock is a portfolio company of EnCap Investments focused on Oklahoma and Kansas. The deal is expected to close in the third quarter, and will be entirely funded with cash on hand.

The Growing STACK Becoming Popular Target

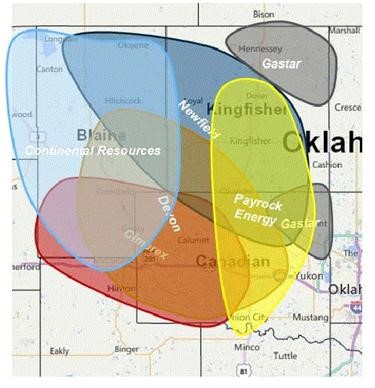

The STACK play has become an increasingly hot play in the last twelve months with several large-cap companies acquiring acreage in the play recently. Continental Resources, Newfield Exploration, Devon Energy, Cimarex Energy, and Gastar Exploration all own acreage positions in the STACK play.

Largest STACK Operators:

- Devon Energy – 430,000 net acres

- Newfield Exploration – 275,000 net acres

- Marathon Oil – 200,000 net acres

- Continental Resources – 170,000 net acres

- Cimarex Energy – 130,000+ net acres

- Chesapeake Energy – 52,000 net acres

- Gastar Exploration – 50,000 net acres

Newfield Exploration announced on May 5, 2016 the company had acquired 42,000 net acres in the STACK play from Chesapeake Energy for $470 million. Production from the field was 3,800 Boepd and approximately $50 million of the transaction was for the PDP property.

Devon Energy acquired assets in the STACK play from Felix Energy for a total consideration of $1.9 billion. Felix Energy held a position of 80,000 net surface acres with up to 10 prospective zones. The acquired properties include production of approximately 9,000 Boepd and estimated risked resource of approximately 400 million Boe.

On the opposite side, Vanguard Natural Resources recently divested their position in the SCOOP/STACK play for $280 million. The position was initially established through the acquisition of Eagle Rock Energy. The position included 5,000 net acres in the STACK play and 20,000 acres in the nearby SCOOP play.

Deal Metrics

On an unadjusted acreage basis, Marathon is paying $14,557 per acre in the STACK play. This is right in the middle of the previous transactions, in which Newfield paid $11,190 per acre, Devon paid $23,750 per acre, and Vanguard sold for $11,200 per acre. Overall, 147,000 acres have been acquired for $2.65 billion at a rate of $18,027 per acre.

While each deal is unique in the mix of core and non-core acreage, and developed and undeveloped acreage, Marathon’s deal sits right in the mix of similar deals in the past few months.