Rice Energy (ticker: RICE) is an independent natural gas and oil company engaged in the acquisition, exploration and development of hydrocarbons in the Appalachian Basin. The company filed its initial public offering in January 2014. Approximately 33% of the company’s shares are owned by management following the closing of $900 million in unsecured senior notes in April 2014. Proceeds from the offering are being used to de-risk Rice’s 2014 capital expenditures plan.

Rice announced the acquisition of approximately 22,000 net acres in the Marcellus region from Chesapeake Appalachia, LLC on July 7, 2014. Total acquisition price is $336 million and includes 12 developed Marcellus wells (seven currently producing) in western Green County, Pennsylvania, with total production of 20 MMcf/d. The transaction has an effective date of February 2, 2014 and is expected to close in August 2014. In the press release, Toby Rice, President and Chief Operating Officer, said: “The acquired assets provide us with a foothold to pursue additional leasehold opportunities and further grow our inventory of low-risk, high-return projects.”

The acreage addition increases Rice’s footprint by 24% in comparison to its Q1’14 totals on March 31, 2014, and increases its Marcellus net risked locations to 325 from 152 – a 47% rise. According to a note from Neal Dingmann of SunTrust Robinson Humphrey, the metrics of the deal are in line with recent deals in “highly developed” Marcellus areas and amount to $15,273/acre, or $11,485/acre assuming $4,167 per flowing Mcf.

Source: RICE June 2014 Presentation

In its Q1’14 earnings release, Rice listed $910.6 million in total debt and roughly $1.1 billion in total liquidity, with $704.4 million in cash on hand and $278.7 million available on its credit facility. The totals were all used to take into account the $110 million Momentum acquisition, which comprised of midstream and gathering assets in the Marcellus region. The company anticipates funding its latest purchase from borrowings, cash on hand and the possibility of equity capital markets.

Rice Energy – Upsizing

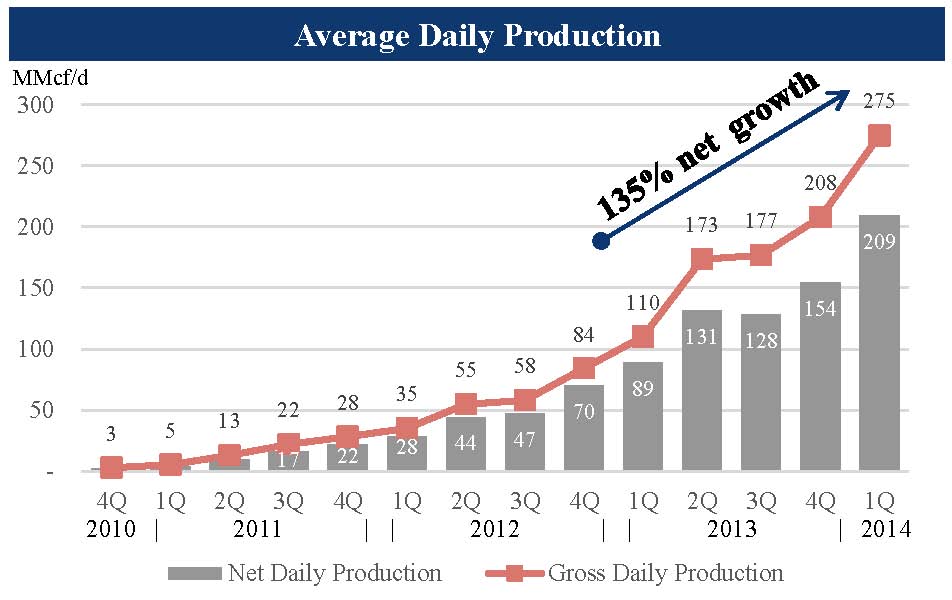

Rice is still on track to achieve its goal of adding 30,000 to 40,000 net leasehold acres within calendar 2014. Pro forma for its recent purchase, the company has roughly 112,000 net acres in the Marcellus/Utica and has a total of 57 producing wells. An additional 50 wells are currently in the process of completion.

Total production in regards to its Q1’14 numbers are now 229 MMcfe/d, and the company plans on reaching 260 MMcfe/d to 310 MMcfe/d by the end of 2014 – all of which is dry gas. The numbers would be respective increases of 157% and 220% (midpoint) compared to Q1’13’s total of 89 MMcfe/d. In its Q1’14 conference call on May 13, 2014, Rice management said its midstream team was ahead of schedule on infrastructure buildout in the region, which is a notable achievement due to historical capacity constraints in the region.

Chesapeake – Right-sizing

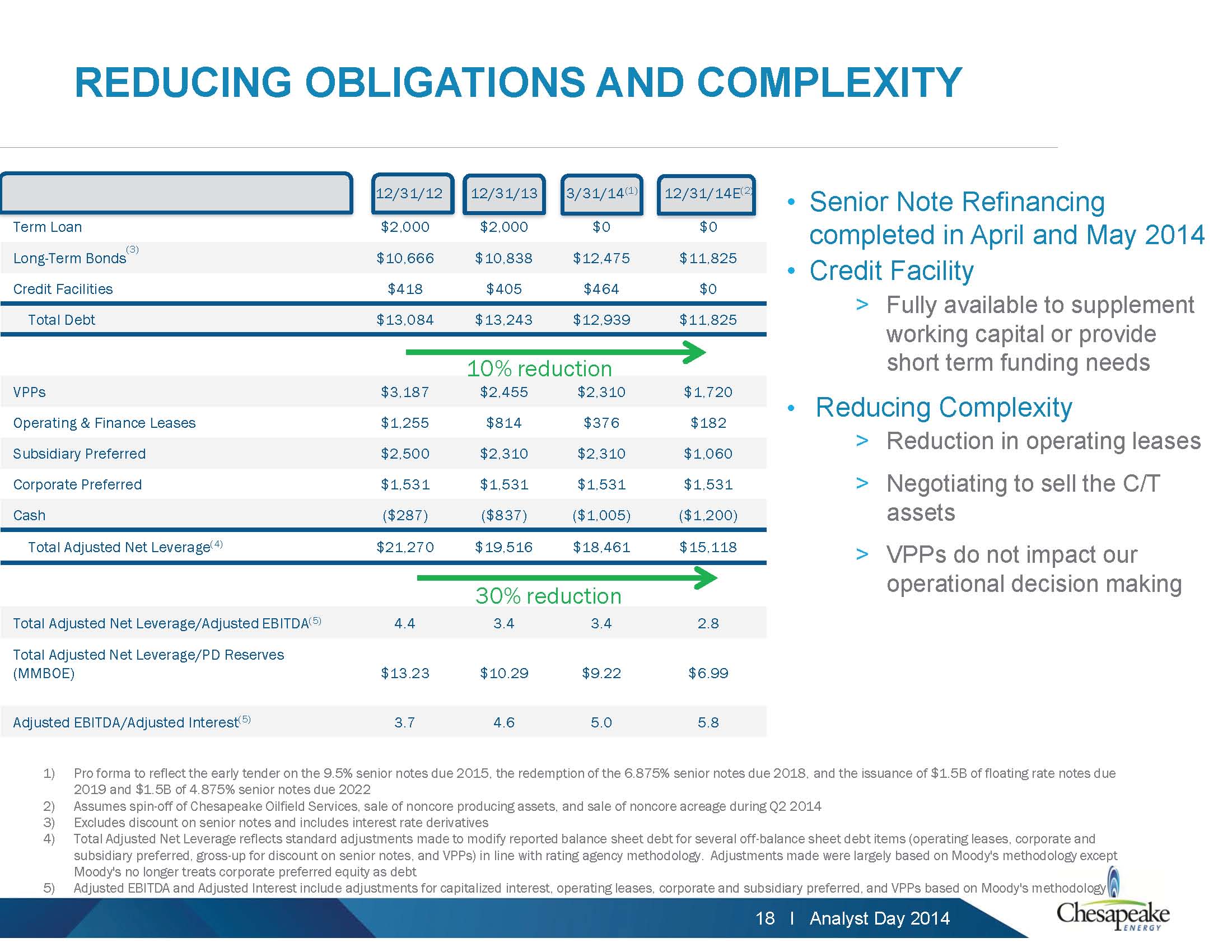

Chesapeake Appalachia’s parent company, Chesapeake Energy Corporation (ticker: CHK), plans on selling $4 billion of its assets in 2014 and spun off its oil services company to its own entity, known as Seventy Seven Energy (ticker: SSE), on July 1, 2014. CHK divested an additional $4 billion in assets in 2013 as an ongoing effort to right-size the company. While the divestments sales are large, Chesapeake is attempting to keep its production stable. At an analyst day on May 17, 2014, Doug Lawler, Chairman and Chief Executive Officer of Chesapeake Energy, said: “You see a lot of companies out there that are increasing CapEx and increasing production. You see some that are increasing CapEx and decreasing production. Chesapeake is increasing production and maintaining flat CapEx. As we look at the current outlook today, the work has taken place in the Company to continue to improve our balance sheet.”

According to a company presentation on June 25, 2014, Chesapeake has reduced $6.2 billion of leverage since 2013 but anticipates a compounded annual growth rate (adjusted for divestures) of 7% to 10% through 2019.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.

Analyst Commentary

Capital One Securities - (7.7.14)

Rice Energy will spend $336MM on 22K net acres in western Greene County, Pennsylvania, in a deal scheduled to close in August. The properties include 7 producing wells (~20 MMcf/d) with 5 additional wells in progress. Backing out the current production at $5,000 per flowing Mcf of daily production implies a value of roughly $11K/acre. These 22K net acres will be incremental to the company's already anticipated 30K net acres of organic leasing to be added in 2014. The $336MM will also be incremental to the current CAPEX total, which was previously guided to $1,340MM and is now raised to $1,691MM. Well performance on the new acreage is similar to what we model for RICE's existing Marcellus acreage, and the addition of the ~190 unrisked locations (we model an increase of 165 net locations to inventory) takes our target price higher by $2 to $32. The additional spending will be financed by the company through an equity offering (also announced this morning) along with some combination of cash on hand and borrowings under the revolver. In a separate release this morning, RICE announced that a total of ~20.5MM shares will be offered to the public. Of that total, 7.5MM will be newly issued shares with proceeds of about $220MM net to RICE. The remaining 13MM shares are being sold by existing holders with no proceeds net to RICE. We see the acquisition as accretive and view it as a positive long-term move for RICE that extends its Marcellus drilling inventory to nearly 500 net locations in our model.