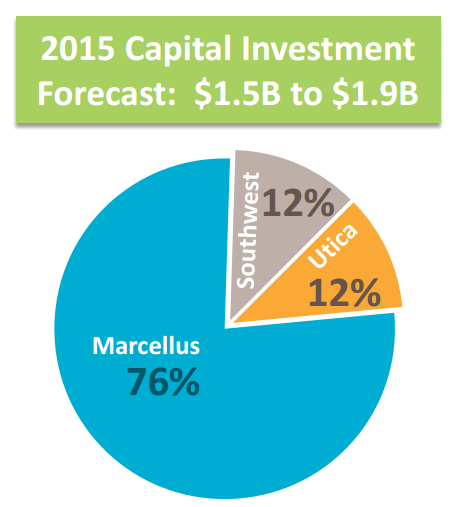

$1.5 to $1.9 billion in 2015 growth capital

Denver based MarkWest Energy Partners LP (ticker: MWE) remains focused on growth, even as oil prices remain low. A recent presentation from the company says the company currently has 20 major projects under construction, and forecasts $1.5 to $1.9 billion in capital investment for 2015.

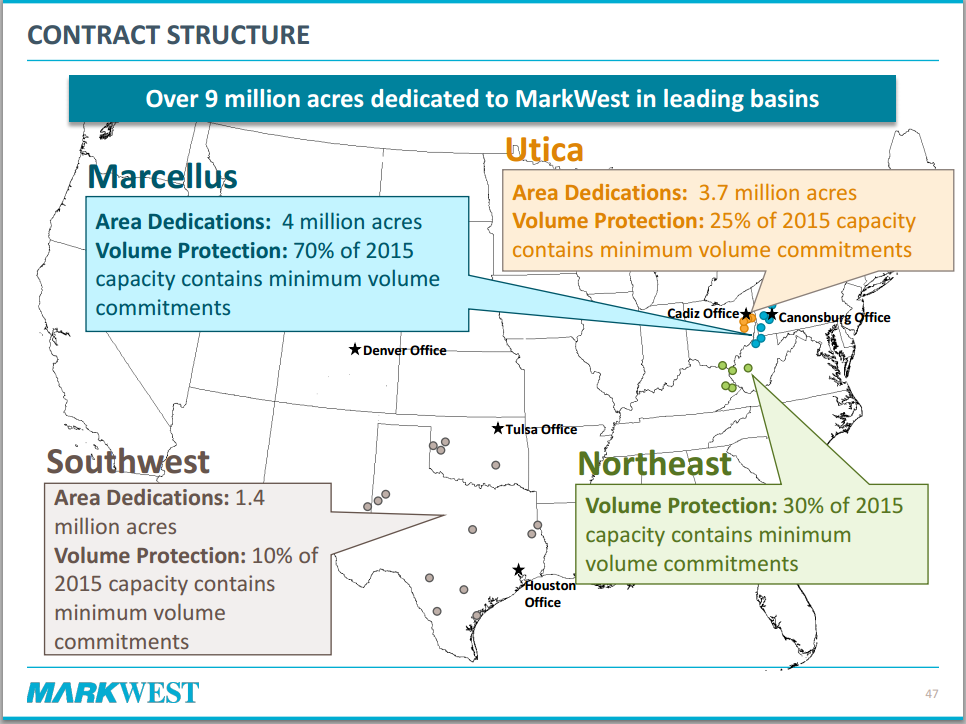

The company’s focus on pipelines and associated assets has helped to keep it more insulated from the oil price decline than most E&P companies. The company has nearly 4,700 miles of pipelines, 6.0 Bcf/d of gas processing capacity and 379 MBOPD of fractionation capacity. 90% of the company’s 2015 net operating margin is fee based, and the company has long-term agreements with over 160 producers.

MarkWest still sees opportunity in Ohio despite current prices. The company is finalizing three major plant expansions in the state and a fourth plant with 200 million cubic feet of extra capacity that will be added to its Seneca processing complex in Noble County, reports the Denver Business Journal.

“Given the market conditions currently, this will give us plenty of capacity to meet all the immediate needs,” said David Ledonne, vice president of MWE’s Utica and Appalachia operations.

The company currently has $1.1 billion in liquidity according to its corporate presentation. MWE’s debt to market cap is well below its peers in EnerCom’s MLP Weekly at 37% compared to the group’s median of 57%.

Focus on the Marcellus

Of the company’s projected $1.5 to $1.9 billion of 2015 capital investment, 76% ($1.1 to $1.4 billion) is earmarked for use in the MarkWest’s Marcellus segment. MWE anticipates 67% of its 2015 forecasted operating income coming from the Marcellus where the company’s operating margins are 94% fee based.

Currently the company has 1.0 Bcf/d of gathering capacity in the Marcellus along with over 3.1 Bcf/d of cryogenic processing capacity, 106 MBODP of C2+ fractionation and 180 MBOPD of C3+ fractionation capacity, 140,000 barrels of natural gas liquids storage capacity and access to over 900,000 barrels of shared third-party propane storage. MarkWest has an additional 1.8 Bcf/d of cryogenic processing capacity, 141 MBOPD of C2+ fractionation and 60 MBOPD of shared C3+ fractionation capacity currently under construction.