Manitok Energy produced 4,825 BOEPD even with production down time at Stolberg

Manitok Energy (ticker: MEI) announced Monday that the company’s production averaged 4,825 BOEPD from September 1, 2016 to September 19, 2016 (40% light crude and NGLs), the highest production rate achieved by the company in the last two years. Production through September 19th represents a 35% increase in average daily production from the second quarter of this year, Manitok said in a press release.

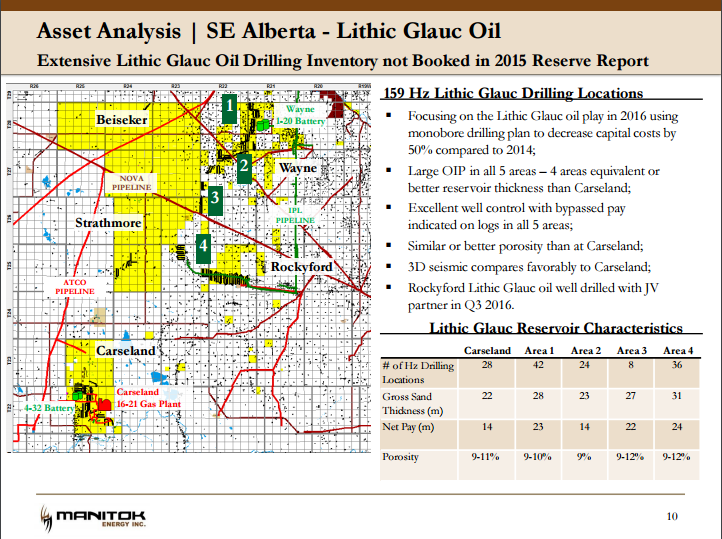

The increased daily production volumes are the result of shut-in volumes being placed back on production at Stolberg and Wayne, the removal of temporary pipeline restrictions experienced in Stolberg over the summer, and increased production volumes in Carseland due to gas plant improvements and removing restrictions on certain wells. In addition to the production increases at Carseland, Stolberg and Wayne, Manitok has added incremental production volumes at Rockyford as a result of participating at a 50% working interest level on a successful Lithic Glauc (LG) discovery well and on a carried working interest of 5% on several of the initial Basal Quartz (BQ) wells drilled by its farm-out partner on lands under a farm-out agreement.

Manitok expects production to continue growing in the future as shut-in wells come back online, and the company drills new wells. The company reported production down time at Stolberg which equated to about 300 BOEPD (90% gas), and currently has two shut-in BQ wells in Carseland that it intends to tie-in early in 2017. Manitok expects that the Carseland BQ wells will come on-stream at an initial rate of approximately 500 BOEPD.

Manitok is currently drilling a horizontal LG well at Carseland, which will be followed by a second Carseland horizontal LG well, and the first horizontal LG well drilled in the Wayne area. Manitok anticipates it will participate in at least one horizontal LG well (50% net) in Rockyford with its farm-out partner in October. These four (3.5 net) wells will be tied in and add incremental production volumes during the fourth quarter.

Leveraging the advantages of monobore technology

All of the horizontal LG wells are anticipated to be drilled using a monobore drilling plan which will significantly reduce drilling costs per well and increase the anticipated return on capital. The monobore drilling plan has been used by industry in progressively deeper zones since Manitok last drilled in 2014.

Drilling and completion costs in the company’s LG Rockyford well, which used monobore technology, were approximately $1.3 million, down 52% from the $2.7 million Manitok spent on similar wells in 2014.

“While drilling and completions costs have been lower across the industry regardless of technology, monobore reduces drilling times 25 to 30%, allowing wells to be completed in a shorter time frame,” Manitok CEO Massimo Geremia told Oil & Gas 360®. “If we can bring it up to scale, we feel that this is a stair step change for us in terms of well economics and reserves, which will greatly enhance our SE Alberta land values.”

In the company’s press release Monday, Manitok said that it will continue to “maintain a balanced approach towards production, and drilling opportunities.” As the value of crude oil and natural gas recovers from multi-year lows, MEI believes it is now in a position to benefit from the combination of increased volumes and prices.