Midland Basin E&Ps Set to Benefit From Play’s Massive Resources

It’s no secret the Permian Basin has enough oil to produce for many years ahead. On November 15, USGS estimated that the Wolfcamp Shale of the Midland Basin alone held an estimated mean 20 billion barrels of oil, 16 trillion feet of associated natural gas, and 1.6 billion barrels of NGLs. This is the largest estimation of continuous, or non-conventional, oil USGS has ever assessed in the U.S.

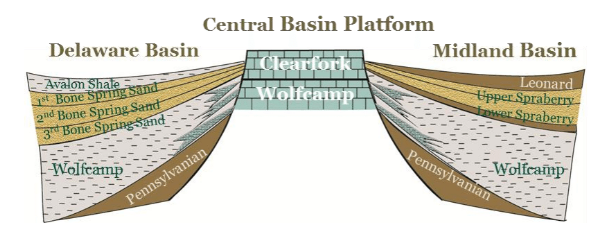

This is all the more amazing considering the several other layers of oil and gas packed shale in the Midland, Delaware, and Central Basin Platform shown below. The study split the Midland Wolfcamp shale into A, B Upper, B Lower, C, D, and Northern segments.

With huge resources and stacked pay, acreage prices in the basin are reaching upwards of $60,000/acre, as seen in QEP’s June 2016 acquisition in Martin County. Operators holding onto acreage in the basin can just plant and drill for years.

Oil & Gas 360® decided to take a look at current production growth, economics, and proved reserves among oil and gas companies with major operations in the Midland.

Finding, development, operating, and G&A costs together constitute an all-in sustaining cost, or the average price to produce a barrel of oil equivalent for each company. F&D costs are on a trailing three-year basis. OPEX and G&A are consistent in the range of $11 to $13 per BOE. Approach currently shows the lowest F&D costs at less than $10 per BOE, with the remaining companies at around $20 per BOE.

EBITDA is a measure of a company’s gross profit before interest, taxes, depreciation, and amortization expenses are removed. Gross cash margin measures cash flow from operations available to spend on development by deducting OPEX, G&A, and interest expenses and excluding realized derivative effects. Both metrics are on a trailing twelve month basis.

Diamondback and RSP Permian are currently leading the group in terms of gross cash margin. Parsley and EOG show a strong ability to convert their EBITDA into cash flow, indicating low non-operating expenses and derivative effects at the moment.

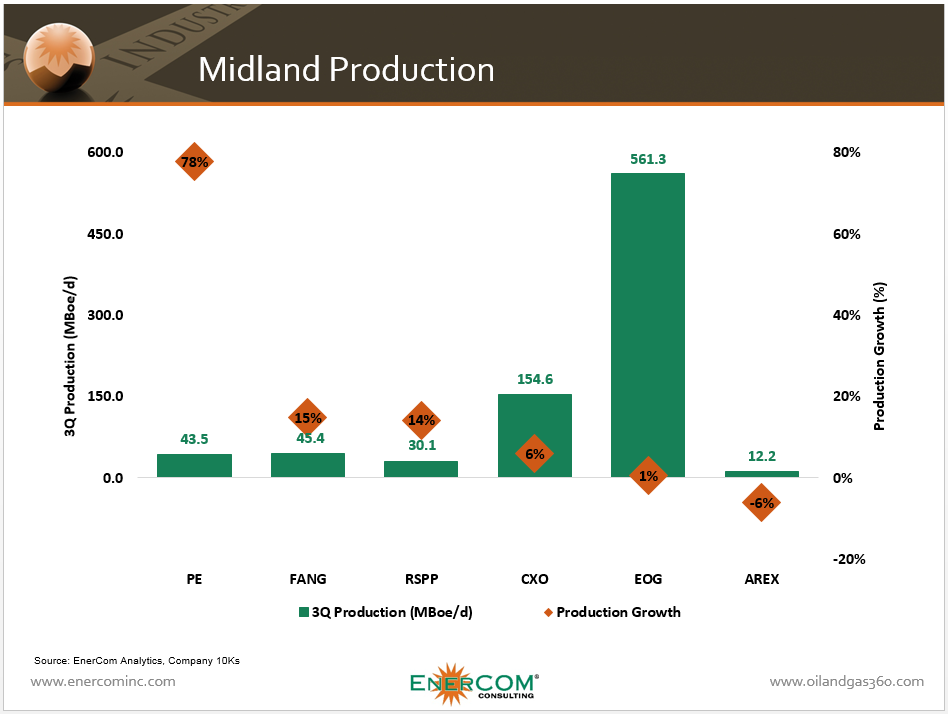

Parsley Energy has ramped its 3Q production 78% above their trailing twelve month average to 43,500 BOEPD. Diamondback and RSP Permian have also seen sizable increases of 15% above their TTM averages.

EOG, the largest producer examined, is not a pure play operator. 97% of the company’s operations are located in the U.S., with acreage in the Williston, Rockies, Marcellus, Eagle Ford, Woodford, and Haynesville as well as British Columbia, China, Trinidad and Tobago, and the East Irish Sea.

Concho’s operations cover both the Delaware and Midland Basins of the Permian, RSP is a pure-Midland player, and Approach’s acreage is located entirely in the South Midland. Previously a Midland-focused player, Diamondback greatly expanded its Delaware footprint two days ago with its acquisition from Brigham Resources of 76,319 net acres in Pecos and Reeves Counties.

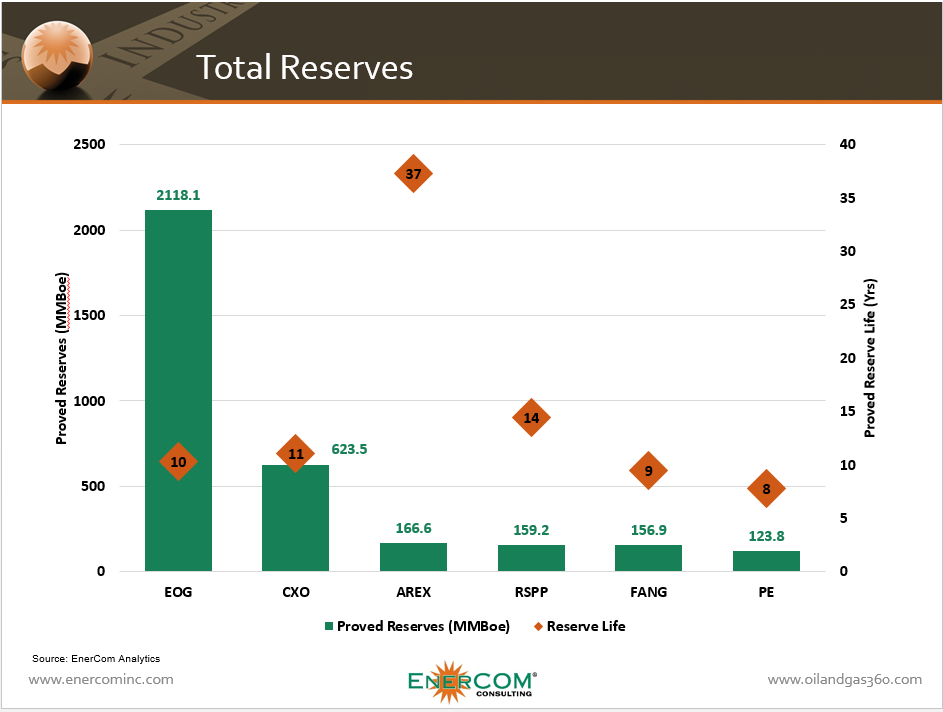

At current production levels, all of these companies have about a decade of proved reserves available. This doesn’t count probable and possible reserves or resources. As drilling continues in a given area, the likelihood of oil recovery increases. Improving technologies and favorable economics allow proved resources continue to further expand.

Despite the massive decrease in oil and gas prices, total Permian reserves have increased both in Texas Railroad Commission District 8 (Core Midland and Southern Delaware) and in Eastern New Mexico (Northern Delaware), according to EIA. RRC District 8 proved reserves for 2015 have increased 15% year over year while Eastern New Mexico proved reserves increased 1%.